The year is still young, but not too young to see trends that could define 2021 for leaders and laggards in U.S. and world equity markets. Reviewing a set of exchange traded funds as proxies highlights three key trends that deserve monitoring: leadership in energy shares, small-cap stocks and markets in Asia ex-Japan.

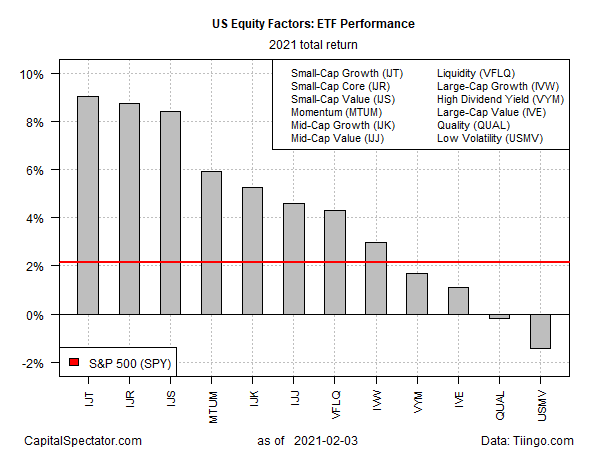

Let’s start with U.S. small caps. Year to date, various flavors of the small-cap factor are leading the field in the equity-risk-factor space. Posting roughly 8%-to-9% gains so far in 2021, small-cap growth (iShares S&P Small-Cap 600 Growth ETF (NASDAQ:IJT)), core (iShares Core S&P Small-Cap ETF (NYSE:IJR)) and value (iShares S&P Small-Cap 600 Value ETF (NYSE:IJS)) are enjoying sizable premiums over their factor counterparts, based on data through Feb. 3.

Raymond James strategist Tavis McCourt sees a rotation unfolding that favors small caps and cyclicals, fuelled by several sources, including a “wall of cash” via consumer savings. This rotation is still in its early stages, he predicts via Barron’s. Adding to the allure: relatively low or at least reasonably priced valuations. “This spread between P/Es based on market cap is about as extreme as 2001 and continues to argue for far better risk/reward in smaller caps if earnings estimates prove accurate,” he explains in a research note.

IJR Daily Chart.

IJR Daily Chart.

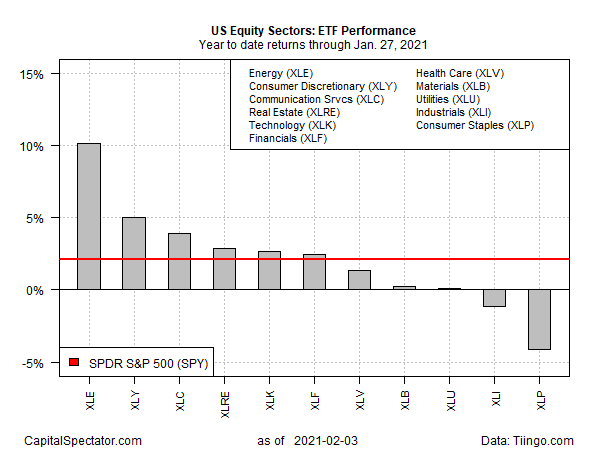

Carving up the U.S. equity market by way of sectors points to strong leadership in energy stocks. Energy Select Sector SPDR (Energy Select Sector SPDR® Fund (NYSE:XLE)) is the upside outlier in 2021. Through Wednesday’s close, XLE is higher by 10.1% — double the gain for its nearest competitor, Consumer Discretionary SPDR (Consumer Discretionary Select Sector SPDR® Fund (NYSE:XLY)).

ETF Performance.

ETF Performance.

Energy’s rally is impressive, but keep in mind that XLE is driven by big oil shares such as Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX). The outlook for these companies is sketchy, analysts advise. “The uncertainties associated with the pandemic are going to continue largely unabated at least through the first half of this year as vaccinations continue to roll-out, but the uncertainties that are arriving from the long-term disconnect between [big oil’s] business model and climate realities, those are only growing — and they are not going to abate,” says Carroll Muffett at the non-profit Center for International Environmental Law.

XLE Daily Chart.

XLE Daily Chart.

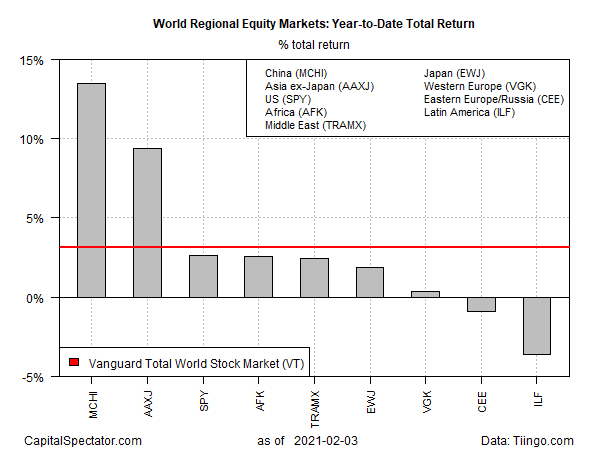

Looking at the world’s equity markets on a regional basis highlights the strong leadership in Asia ex-Japan so far in 2021. Within this bucket, China stocks are sizzling this year, rising nearly 14%, based on iShares MSCI China (iShares MSCI China ETF (NASDAQ:MCHI)). In second place: iShares MSCI All Country Asia ex Japan (iShares MSCI All Country Asia ex Japan ETF (NASDAQ:AAXJ)), which is higher by 9.5% in 2021.

World Markets Y-to-D Returns.

World Markets Y-to-D Returns.

Investors are considering if the runup in Asia shares is vulnerable to the potential for tightening liquidity in China. “Given China’s influence within the emerging markets, pre-mature or pre-emptive tightening of monetary policy poses a risk to financial stability in China, Asia and the broader emerging markets spectrum,” wrote Brendan McKenna, an international economist at Wells Fargo (NYSE:WFC), in a research note earlier this week.

AAXJ Daily Chart.

AAXJ Daily Chart.

That’s a risk factor that’s receiving more attention these days, reports MarketsWatch.com: “Analysts have pointed out that some Chinese credit growth metrics have rolled over at the turn of the year. Those brought up haunting memories for traders who watched global markets crumble at the end of 2015 around when credit growth stalled.”

Leave a comment