It is well known that supply chain disruptions in Taiwan, and other leading countries which produce semi-chips for computers/Electric Vehicles, have been struggling to keep up with demand.

Therefore, if the EV space is looking to extend higher, it will need semiconductor supply companies to step up its game.

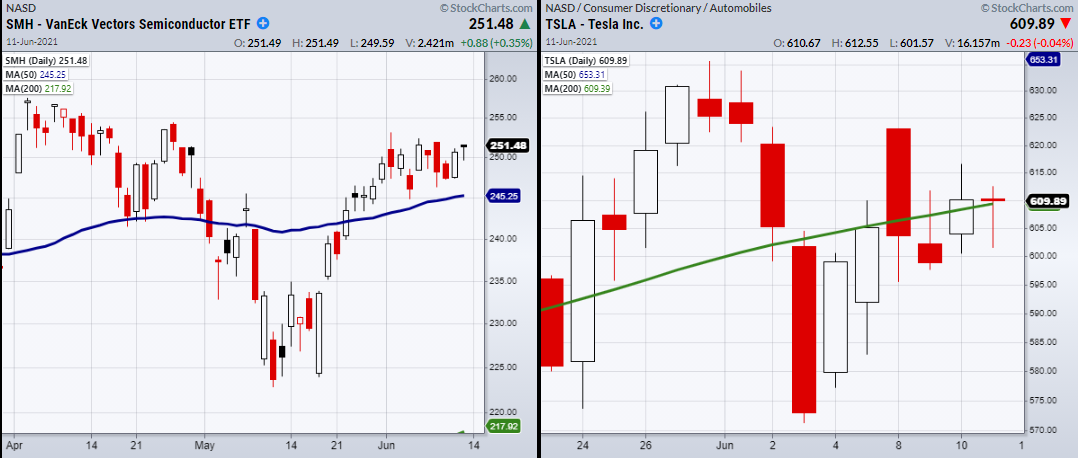

Knowing how intertwined chips are to the EV space, we can keep a close watch on VanEck Vectors Semiconductor ETF (NASDAQ:) to gauge underlying support in the EV industry.

From a charting standpoint, SMH has been hovering over its 50-Day moving average and is not far from new all-time highs last seen in February.

If we expect SMH to pick up the pace, we can also watch for sentiment to improve in EV stocks such as Tesla (NASDAQ:), Nio (NYSE:), and Lucid Motors.

Specifically, TSLA is the most interesting of the three as the others have begun to move up while TSLA has been consolidating around its 200-DMA.

Additionally, if TSLA can grasp a consistent hold over its 200-DMA and SMH heads towards or clears its high of $258.59, this could be a great setup in a company known to make large moves once it gets started.

ETF Summary

- () 422.82 support to hold.

- () 234.53 high to clear.

- () 351 resistance. 342.43 support.

- () 338.19 resistance area.

- (Regional Banks) Doji day. 67.49 next support.

- SMH (Semiconductors) 245.25 support. 258.59 resistance.

- (Transportation) Watching to clear the 50-DMA at 268.85.

- (Biotechnology) 159.37 new support to hold.

- (Retail) Needs to hold over 96.27.

- Volatility Index () Needs to find support.

- Junk Bonds () 109.35 needs to hold as new support.

- (Utilities) Confirmed bullish phase change over the 50-DMA at 65.72.

- (Silver) 25.47 support.

- (Small Cap Growth ETF) 278.02 support.

- (US Gas Fund) Needs to hold over 34.68 area.

- (iShares 20+ Year Treasuries) Inside day.

- (Dollar) 89.54 support. Resistance 90.75.

- (Alternative Harvest ETF) Needs to hold 21.09.

- (Lithium) Watching to hold 70.00.

- (Oil and Gas Exploration) 95 support.

- (Agriculture) Holding 18.94 the 10-DMA.

- (Gold Trust) 175.83 pivotal area. 174.66 next low to hold.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.