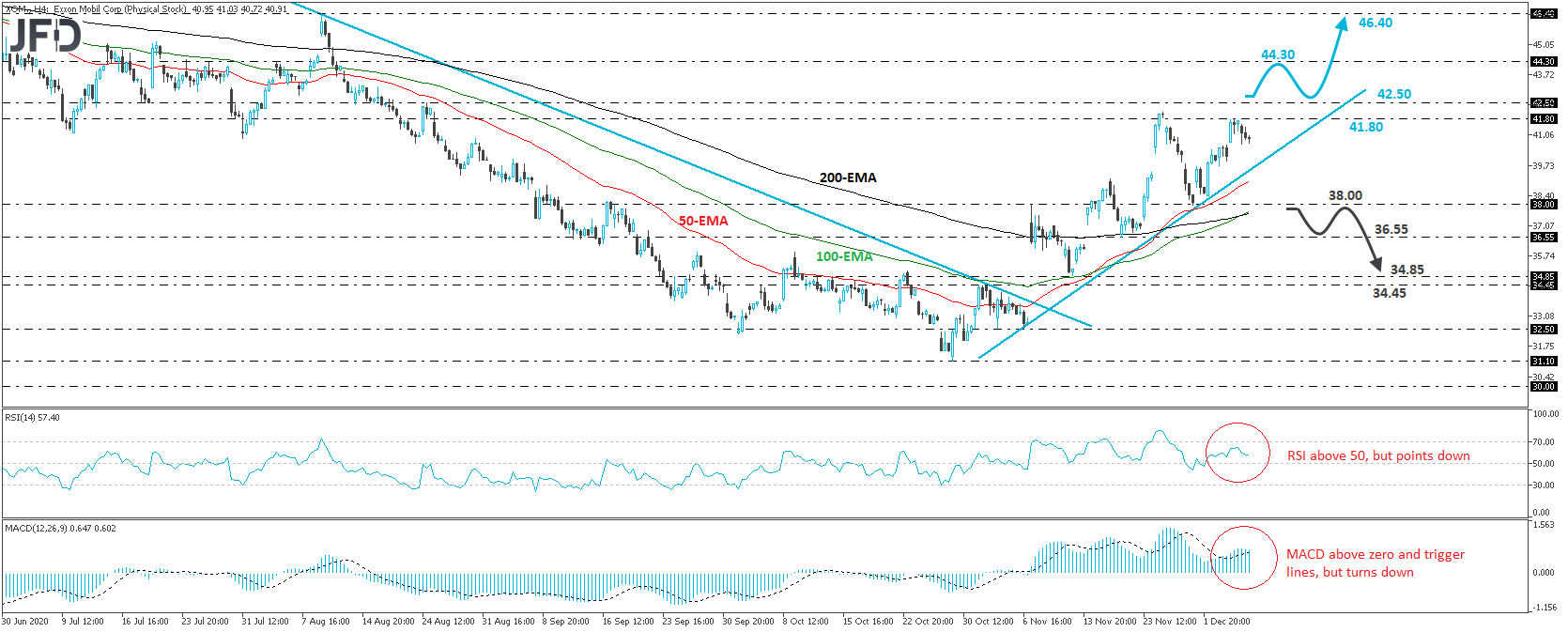

The Exxon Mobil Corporation stock (NYSE:XOM) traded lower yesterday, after hitting resistance at 41.80 on Friday. Overall, although it struggles to go for a higher high, the stock continues to print higher lows above a short-term tentative upside support line drawn from the low of November 6th, and thus, we will adopt a cautiously-bullish approach for now.

If, eventually, the stock manages the break above 41.80, or even better above the peak of August 24th, at 42.50, a forthcoming higher high would be confirmed and market participants may get encouraged to push the action towards the 44.30 zone, which provided strong resistance between July 22nd and August 7th. That said, if that territory is not able to stop the advance this time around, we may see extensions towards the peak of August 11th, at 46.40.

Looking at our short-term oscillators, we see that the RSI lies above 50, but points down, while the MACD, although above both its zero and trigger lines, has turned south as well. Both indicators detect slowing upside speed and suggest that some further retreat may be in the works before the next positive leg, perhaps for the stock to test once again the aforementioned upside line.

In order to abandon the bullish case and start examining deeper declines, we would like to see a decisive break below 38.00, a support marked by the low of November 30th. The price would be already below the pre-mentioned upside line, while the dip below 38.00 would confirm a forthcoming lower low. We may experience initial declines towards the 36.55 barrier, marked by the low of November 19th, the break of which could set the stage for the low of November 12th, at 34.85, or the inside swing high of November 3rd, at 34.45.

Exxon Mobil 4-hour chart technical analysisOriginal Article

Exxon Mobil 4-hour chart technical analysisOriginal Article