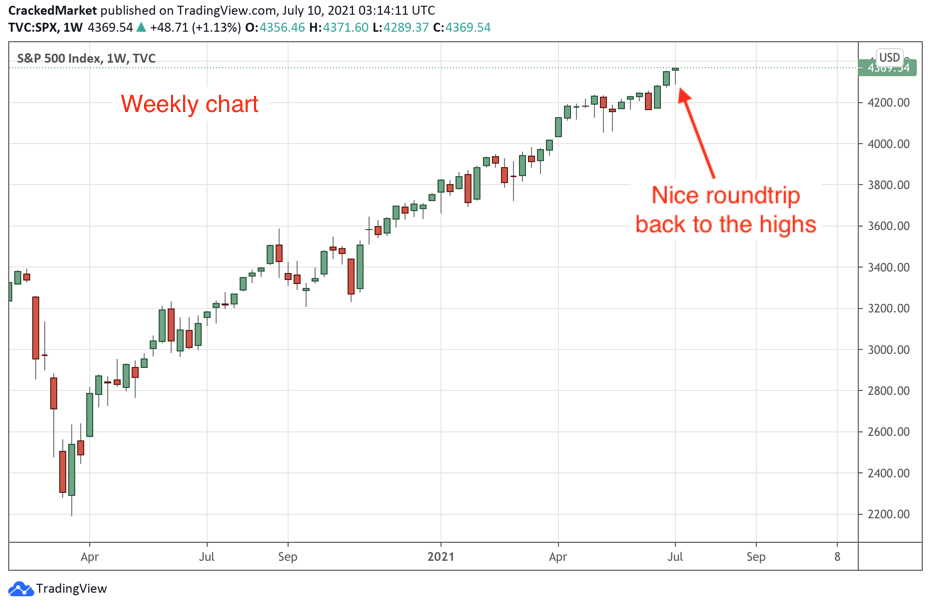

The finished the past week up 0.4%, setting yet another record closing high. That said, the index took the long way to get there after Thursday morning devolved into the biggest down day in nearly a month.

Two steps forward, one step back. That’s the way this game works; always has, always will. The index racked up seven consecutive record closes leading into the week and obviously, a down day or two were coming. And that’s exactly what the market gave us this past week.

More important than a down day or two is how most stock owners reacted to those bouts of weakness. For the most part, investors shrugged and kept holding. Which, coincidentally enough, is the same exact thing they’ve been doing all year.

While bears have been begging and pleading for a breakdown, anyone who’s been paying attention knew this selling didn’t stand much of a chance. No doubt this bull market will die like all of the other bulls that came before it, but this will bounce dozens and dozens of times before that happens.

Do smart traders go all-in on the thing that happens only once every year or two? Or do they stick with the thing that happens 50+ times in between?

Weak markets don’t keep setting record highs, so this most definitely is not a weak market. Keep following this strength higher and see where it takes us. Next up is 4,400. After that, we might be setting up for another sideways grind into the fall season.

After a slow start to 2021, the FAANG stocks are finally getting their mojo back. All of them are at record highs, with the exception of Netflix (NASDAQ:) and even that laggard is doing a solid job bouncing off of $500 support.

We are coming into earnings season and barring anything shocking, we should expect this nice glide higher to continue. These stocks have reclaimed their leadership role and that is good for the entire market.