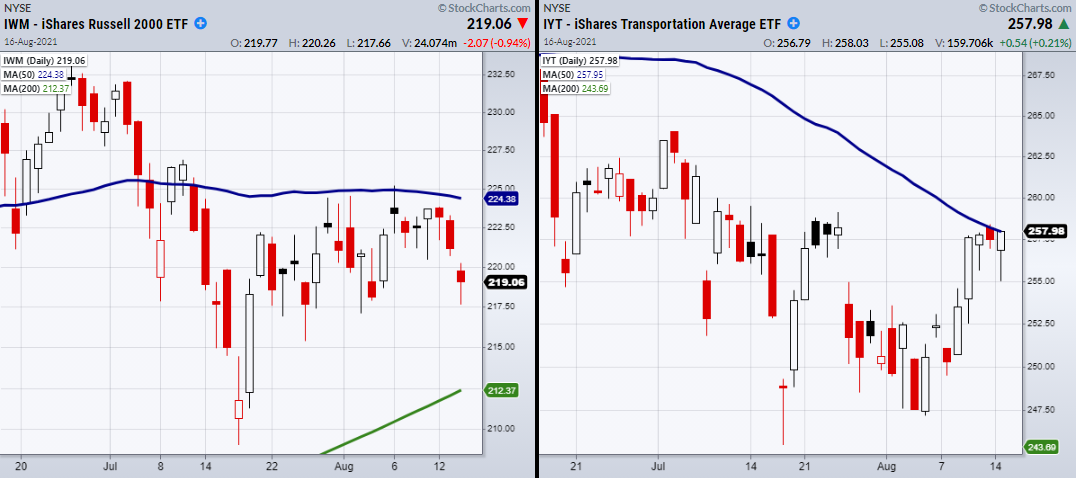

Since mid-May, the Transportation sector, via iShares Transportation Average ETF (NYSE:), has been trending lower. Currently, IYT sits just under resistance from its 50-Day moving average at $257.98.

Additionally, the small-cap index iShares Russell 2000 ETF (NYSE:) has traded sideways for over a month and continues to have trouble clearing its pivotal $225 resistance level.

Because IWM represents a large section of the economy, and IYT can be correlated to the movement of goods within the economy, both are key symbols to watch for market strength or weakness.

Mish returned from vacation Monday and noted that has also traded sideways, the Russells lower, while the and the were a smidge higher. And that is after 3 weeks.

In general, the market was still reacting more to the continued hopes of Fed stimulus along with the ongoing low interest rates.

and have soared.

So, if SPDR® S&P 500 (NYSE:) and SPDR® Dow Jones Industrial Average ETF Trust (NYSE:) are so happy, why can’t the Modern Family show us more enthusiasm?

With that said, what other symbols are we watching that could help IYT and IWM clear nearby resistance?

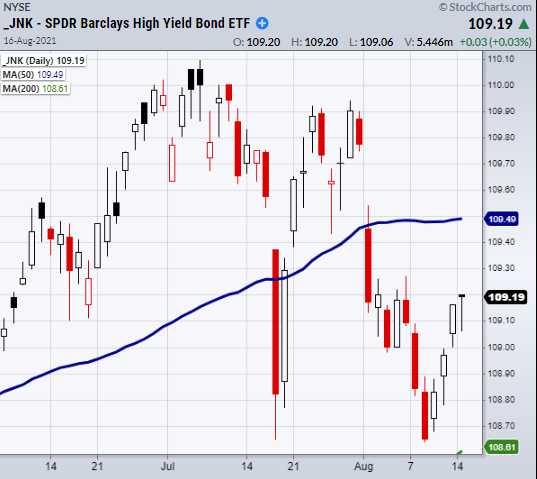

Since the beginning of the pandemic, the Fed has played a major role in supporting the market and economy. One of their main programs has been the 120-billion monthly bond-buying program. Therefore, to keep track of how effective the Feds’ spending has been, we can look at the SPDR® Bloomberg Barclays High Yield Bond ETF (NYSE:).

JNK-Daily Chart

Currently, JNK sits underneath its 50-DMA at $109.49. In order to show that investors are still very bullish, JNK will need to clear back over its 50-DMA. Therefore, along with watching IWM and IYT to clear nearby resistance, we should watch JNK as it can be used to indicate how well the Fed’s money is helping prop the market up.

ETF Summary

- S&P 500 (SPY) New highs.

- Russell 2000 (IWM) Needs to clear resistance at 225.

- Dow (DIA) 351 support.

- () 362 support.

- (Regional Banks) Holding over its 50-DMA at 64.99.

- (Semiconductors) Next support area 256.94 the 50-DMA.

- IYT (Transportation) Watching for 2 daily closes over the 50-DMA at 257.97.

- (Biotechnology) Support area the 50-DMA at 164.05

- (Retail) 93.51 support. 98 resistance.

- Junk Bonds (JNK) Holding over the 10-DMA at 109.01. Next resistance level 109.49.

- (Real Estate) 108 resistance.

- XLP (Consumer Staples) New highs.

- (Trust) Gap to fill at 168.20.

- () 21.32 support area.

- (S&P Metals and Mining) Like this to hold over the 10-DMA at 44.57.

- (US Fund) 45.85 support.

- (iShares 20+ Year Treasuries) 145.43 support.

- USD () 93.19 resistance to clear.

- (Agriculture) Sitting in resistance.