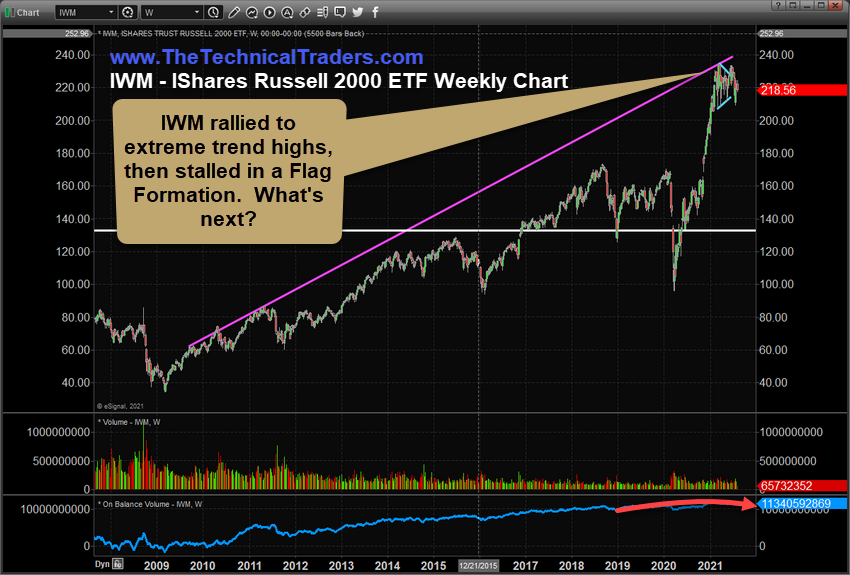

Early 2021 surprised investors with a very strong bullish price rally in the major U.S. indexes and the . Then, in March, the Russell 2000 peaked near $234.53 and entered a sideways pennant/flag formation/rotation. In June and July 2021, a moderate breakout/breakdown of that pennant/flag formation took place – resulting in price reentering the pennant/flag range near the Apex level. What does this mean for investors/traders?

IWM Rallies To Incredible Highs After November 2020 Elections

First, we want to highlight something very unusual related to the strength of the rally that took place after the November 2020 elections and into early 2021. There has only really been one example of any major U.S. index reentering a bullish price phase that rallies so strong it reaches an early (post bottom) recovery trend strength – the peak in the markets in 1929. Take a look at the MAGENTA line on this IWM weekly chart, below, to see what we are suggesting. The post-November 2020 rally in IWM was so strong, that price rallied over a 90 day period in excess of +64% – setting up an incredible excess phase rally/peak.

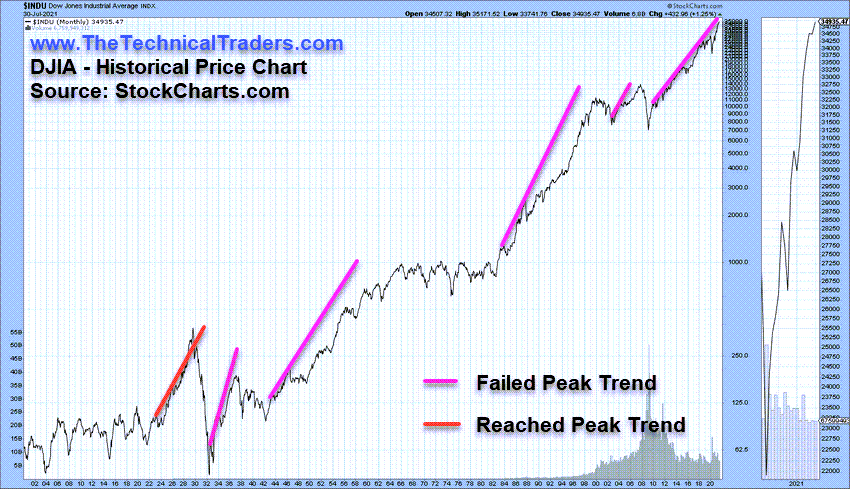

1929 DJIA Shows Similar Excess Phase Peak Setup

This long-term chart highlights one very interesting fact that we saw on the Russell 2000 chart above. Throughout history, the only time a rally phase has rallied above the initial bottom phase trend channel has been in 1929 – representing a major excess phase peak setup. This rally in 1929 continued to extend well beyond the upper trend-line level and eventually peaked after a series of two impressive price advances above the trend-line.

If the current IWM rally continues in this manner, we may expect to see one or two more attempts at a continued market rally. Each pushing the price of IWM ever higher in an attempt to identify a true peak value. Conversely, the IWM pennant/flag formation suggests some type of breakout or breakdown event is very likely over the next few weeks.

IWM Showing Signs Of Increased Volatility Near Flag Apex

This last chart shows how the current pennant/flag formation in IWM has reconfirmed with recent price action. The June/July price rotation, beyond the flag ranges, suggests that increased volatility exists in the U.S. markets as traders/investors digest the Q2:2021 earnings data/expectations and as the world continues to attempt to understand what the future of global economic normalcy will look like.

The fact that the Russell 2000 has moved back into the pennant/flag formation ranges recently and is very close to the apex of this setup, suggests that the U.S./Global markets are no more than 2 to 4+ weeks away from a big breakout or breakdown event. My research team suggests key levels to watch on IWM are $234 (for a potential upside price breakout) and $208 (for a potential downside breakdown).

US Market Will Likely Cycle Into MoM/YoY Declines Through The Rest Of 2021 & Into 2022

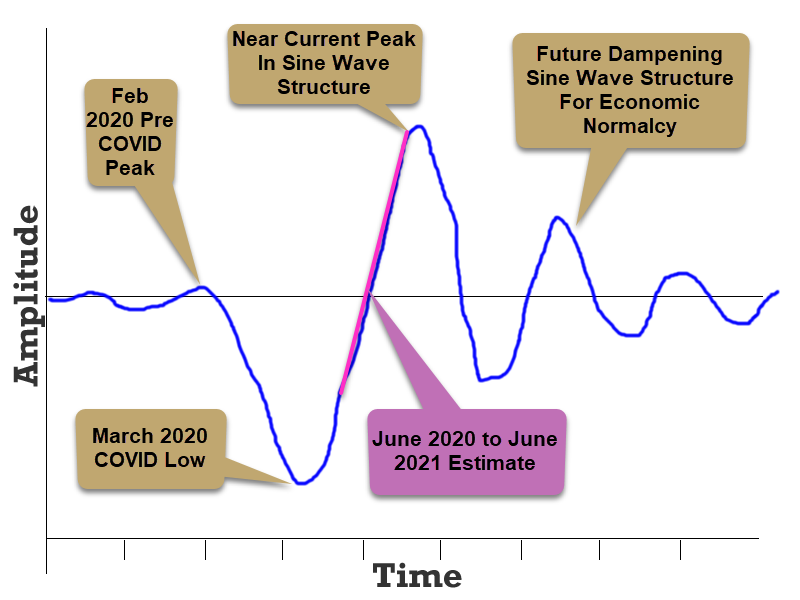

It is our opinion that a broader market reversion event is very likely over the next 6+ months related to the post-COVID reflation trade recovery. The process of the markets, and economic indicators, reacting to the deep COVID market collapse acts in a “Dampening Sine Wave” pattern. Initially, after the deep COVID-19 market collapse, the recovery of the markets will prompt seemingly extreme bullish monthly and quarterly expectations/results. This is because the month-over-month and year-over-year results are factoring in the extremely deeply depressed COVID-19 collapse event.

Over time, possibly more than 24 to 36 months, these levels will rotate upward and downward toward a more normal type of result. I’ve included an example of a Dampening Sine Wave similar to what I expect to happen post-COVID below.

Stay prepared for big market trends and a shift in how economic data is reported over the next 14+ months. If the markets shift, as we are expecting, a broad market stagnation or decline is likely over the next 8 to 12+ months. The extreme cycle phases that have been prompted since the COVID-19 market collapse are likely to result in a continued “Dampening Sine Wave” cycle that will eventually result in more normal types of market activity.

If another COVID event takes place before the end of 2021, resulting in any new type of lockdown or economic restrictions, the current down-wave cycle of the Dampening Sine Wave (above) will be amplified in scope. Thus, a potential deeper subsequent secondary down-wave cycle may take place – setting up another big upside recovery wave in the future.

We live in interesting times and it is important for traders/investors to learn to recognize the mechanics of what we are living through. There will come a time where the markets move in a more normalized manner – but that time is likely 5 to 6+ years away.

More than ever, right now, traders need to move away from risk functions and start using common sense. There will still be endless opportunities for profits from these extended price rotations, but the volatility and leverage factors will increase risk levels for traders that are not prepared or don’t have solid strategies. Don’t let yourself get caught in these next cycle phases unprepared.