S&P 500 earnings update

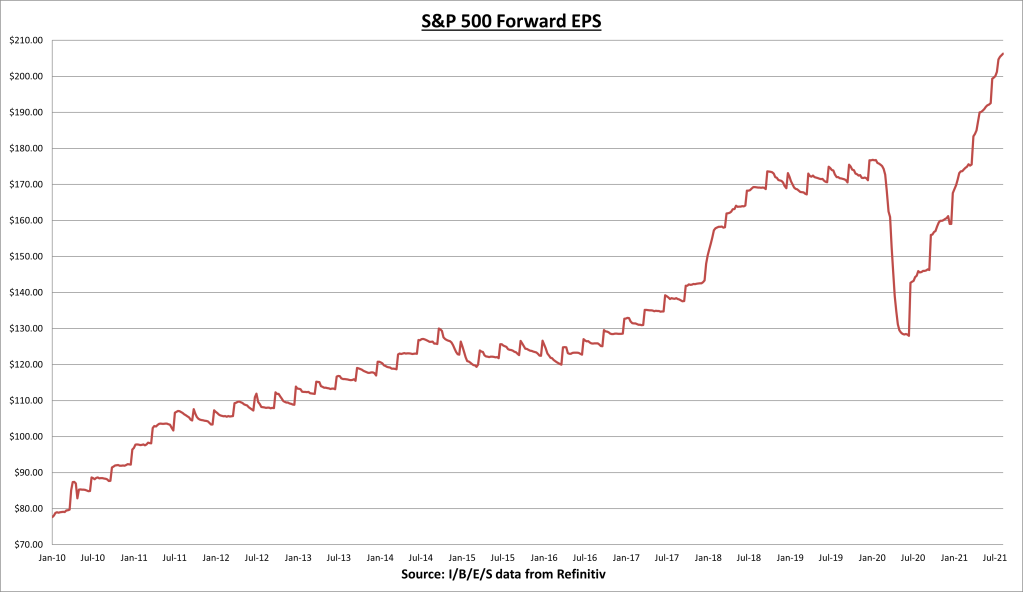

S&P 500 earnings per share (EPS) increased to $206.32 last week. The forward EPS was +30% year-to-date.

95% of companies have now reported Q2 results, 87% have beaten estimates and results have come in a combined +15.8% above expectations. The Q2 earnings growth rate is now +94.7%. (I/B/E/S data from Refintiv)

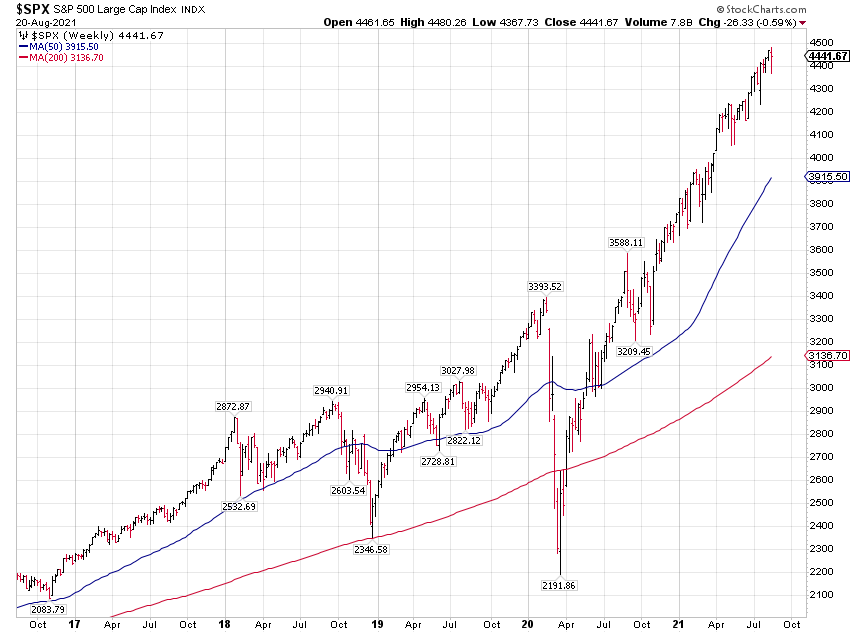

The S&P 500 index declined 0.59% for the week.

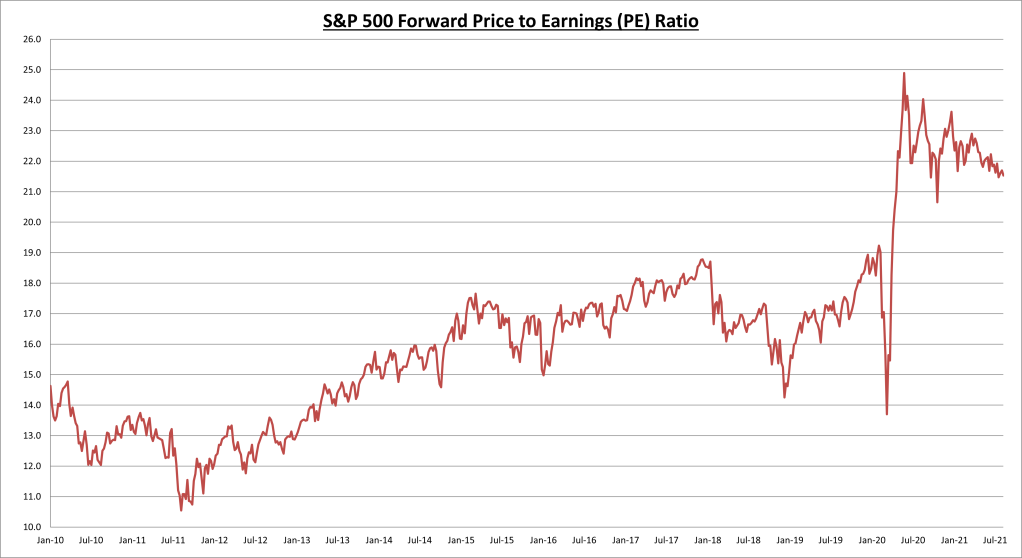

S&P 500 price to earnings (PE) ratio reached 21.5, down from 21.7 the previous week due to an increase in earnings and decrease in price.

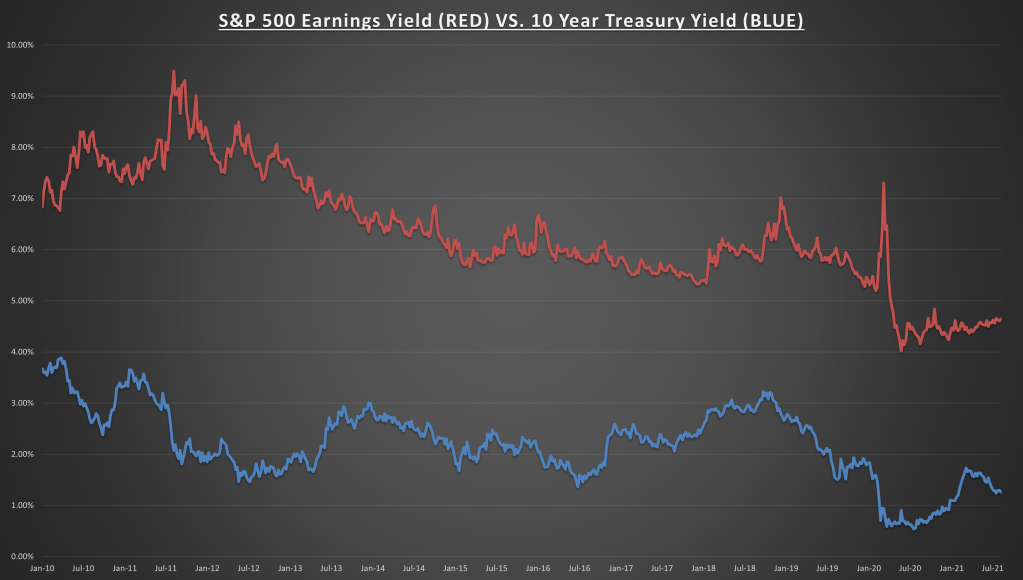

S&P 500 earnings yield is now 4.65%, compared to the treasury bond rate of 1.26%. Fixed income still offers no competition to stocks in terms of valuation. There are still those that focus only on the PE. If stocks are expensive, then bonds are ridiculously expensive. It’s all relative.

Economic data review

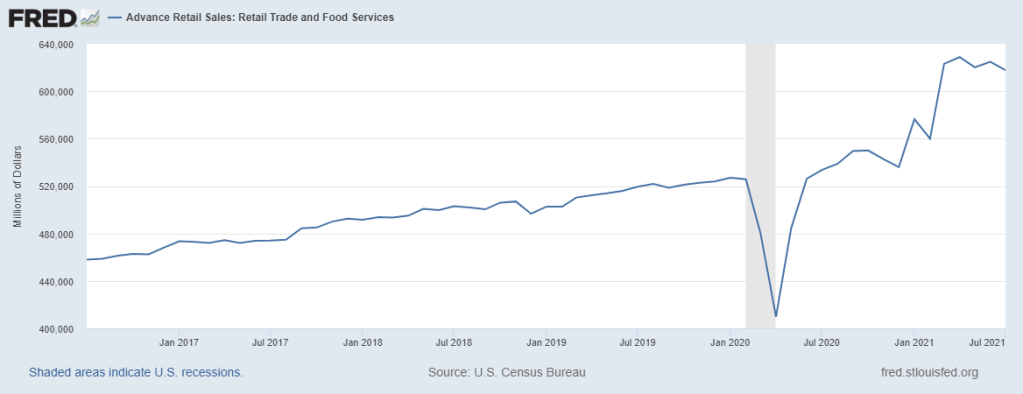

Total retail sales for July came in at $617.7 billion, a decrease of for the month, but still up +15.8% over the last 12 months and +17.5% above the pre-COVID high. June was revised higher, to +0.7%.

The monthly decrease was led by motor vehicle & parts dealers (-4.1%), non-store retail-ecommerce (-3.1% month), and clothing (-2.7% month). The biggest gains came in the miscellaneous store retailers (+3.4%), gasoline (+2.3%), and food service and drinking (+1.7%).

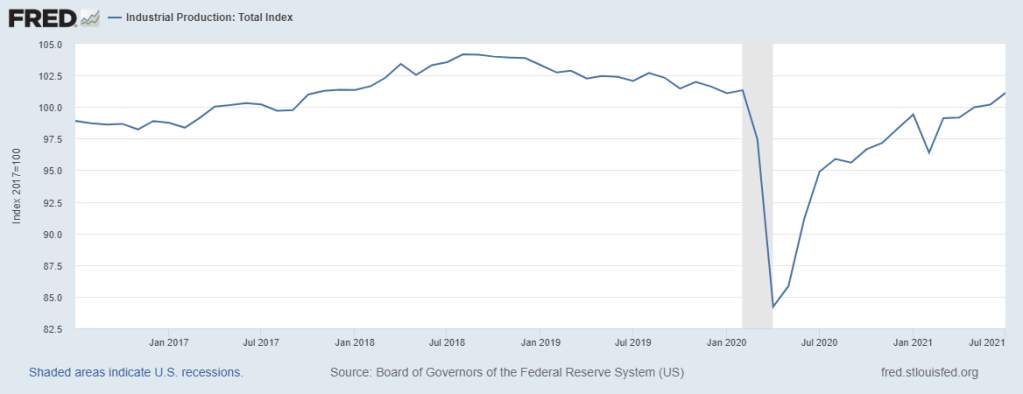

Industrial production increased in July, and over the last 12 months. Capacity utilization increased from 75.4% to 76.1%. Industrial production has now recovered 98.8% of the COVID losses.

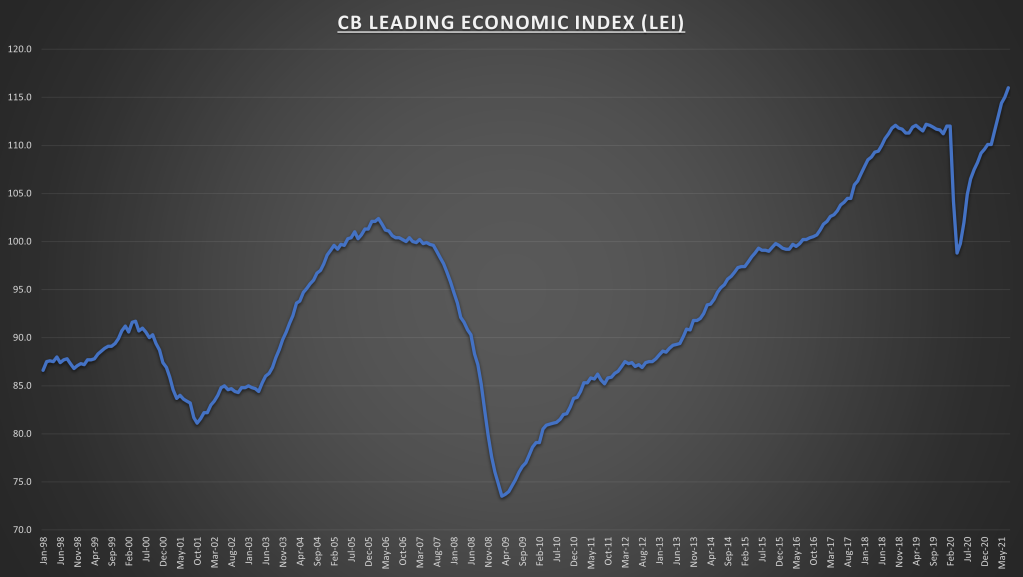

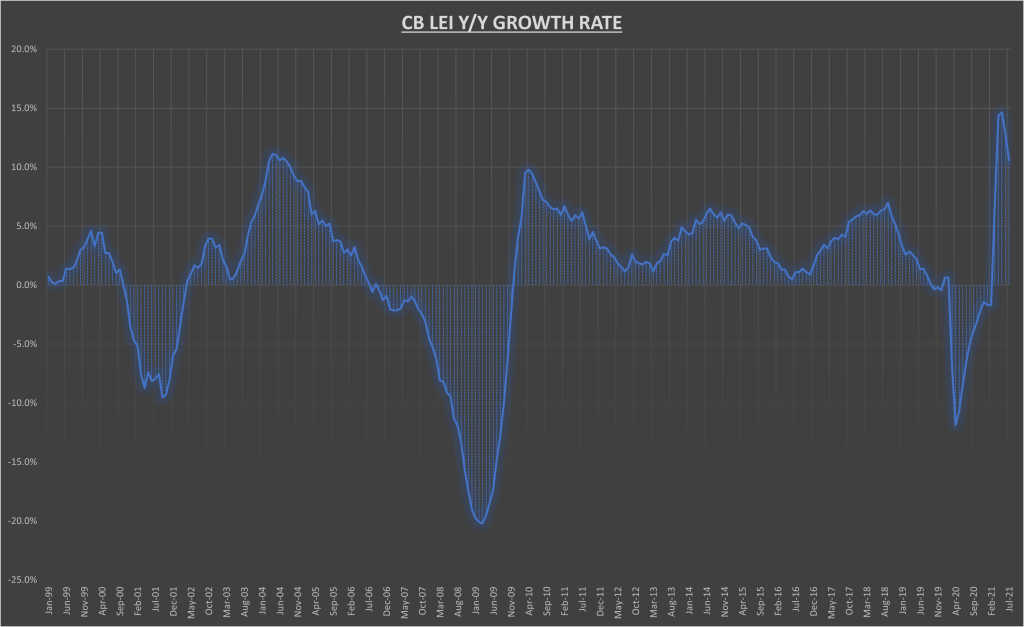

Conference Board Leading Economic Index (LEI) increased a better than expected in July, now at 116. June was revised down from 115.1 to 115, while May was revised up from 114.3 to 114.4.

“The U.S. LEI registered another large gain in July, with all components contributing positively. The Leading Index’s overall upward trend, which started with the end of the pandemic-induced recession in April 2020, is consistent with strong economic growth in the second half of the year. While the Delta variant and/or rising inflation fears could create headwinds for the US economy in the near term, we expect real GDP growth for 2021 to reach 6.0 percent year-over-year, before easing to a still robust 4.0 percent growth rate for 2022.”

The LEI is now +10.6% higher over the last 12 months, and +5.4% over the last 6 months. Well in growth territory.

Notable earnings

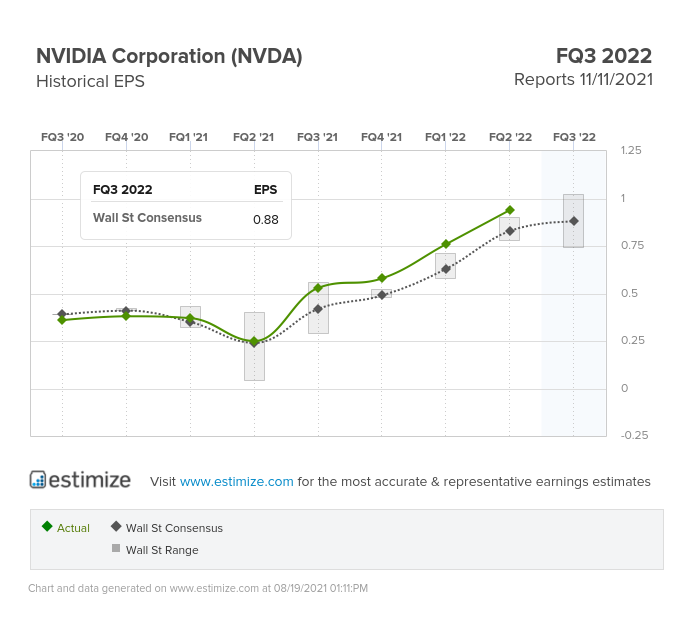

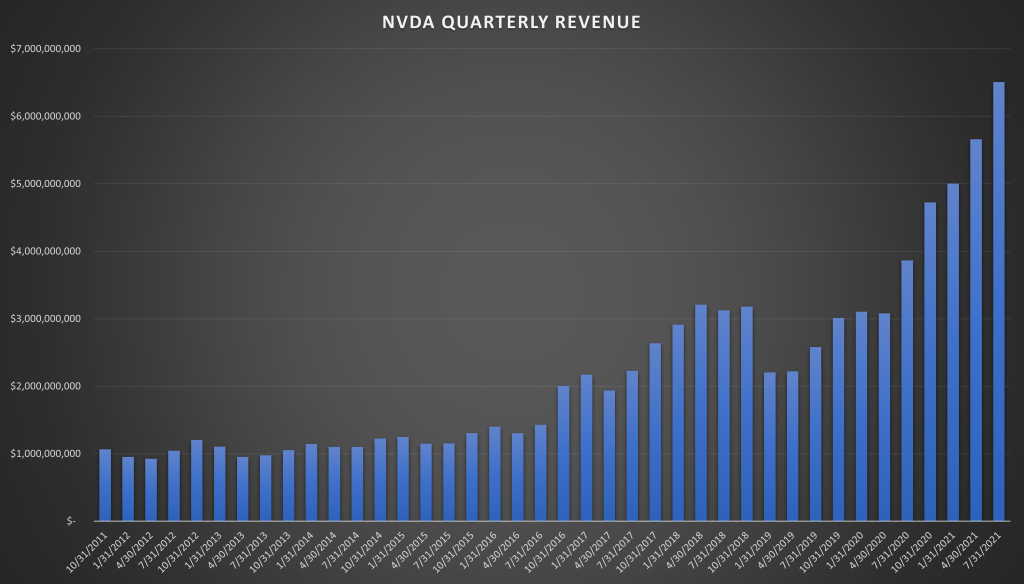

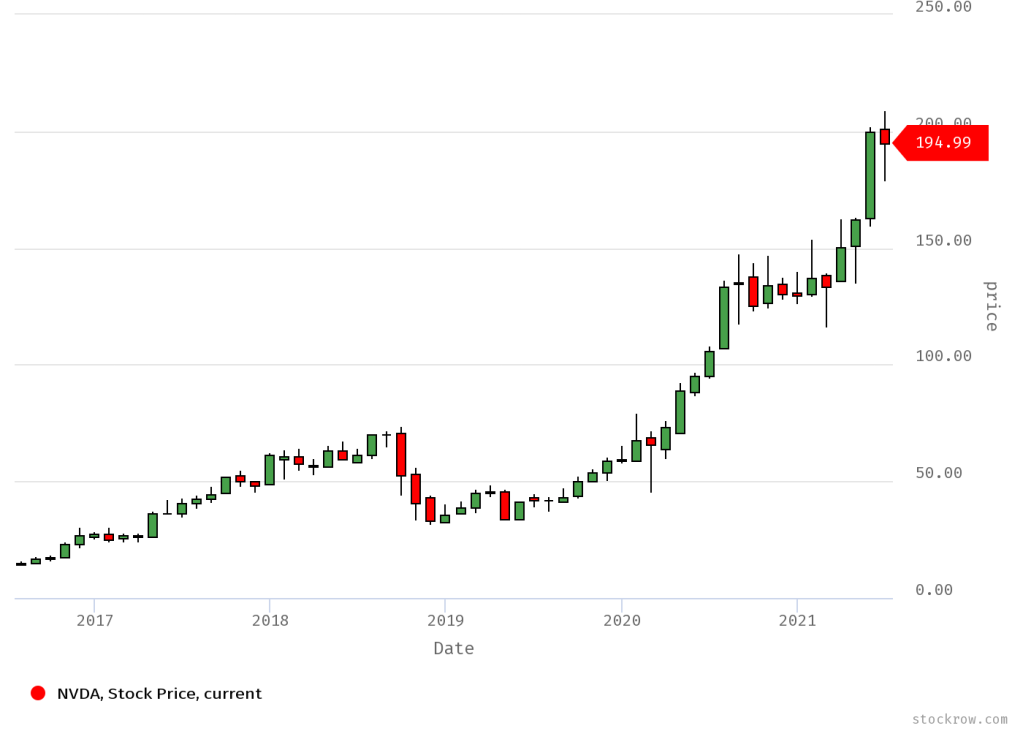

Nvidia (NASDAQ:) reported another strong . Adjusted EPS came in +13.3% above expectations, for a growth rate of +280%. Gross margins came in at 64.8%, which was an improvement both sequentially and year-over-year. Operating income grew +275% on a GAAP basis. The company projected sales growth of 44% for Q3, with further margin expansion.

Nvidia reported quarterly sales of $6.5 billion, a growth rate of 68% and 3% above expectations. There was strong growth along all product lines, with record revenue for gaming (+85% growth) and data center (+35% growth).

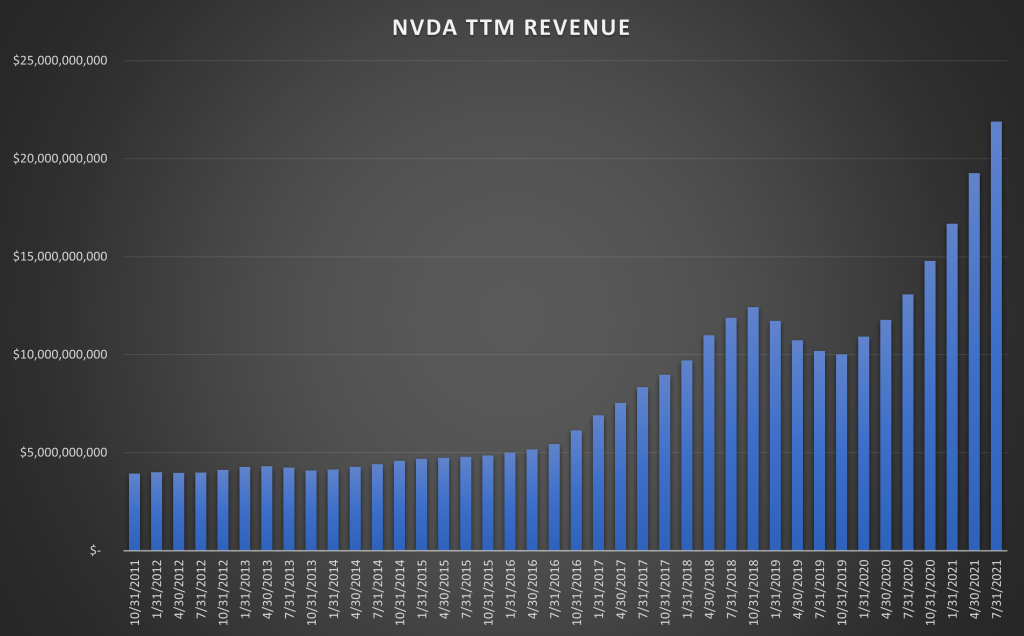

This makes $21.9 billion in sales over the last 4 quarters, or trailing twelve months (TTM).

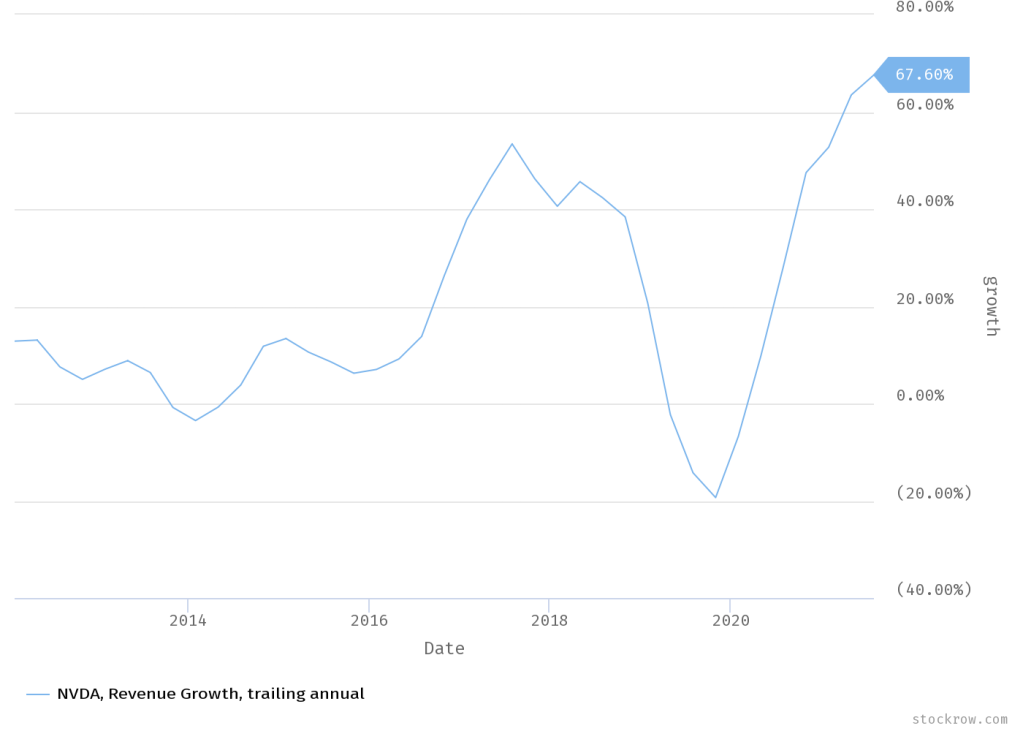

TTM revenue growth rate is now +67.6%.

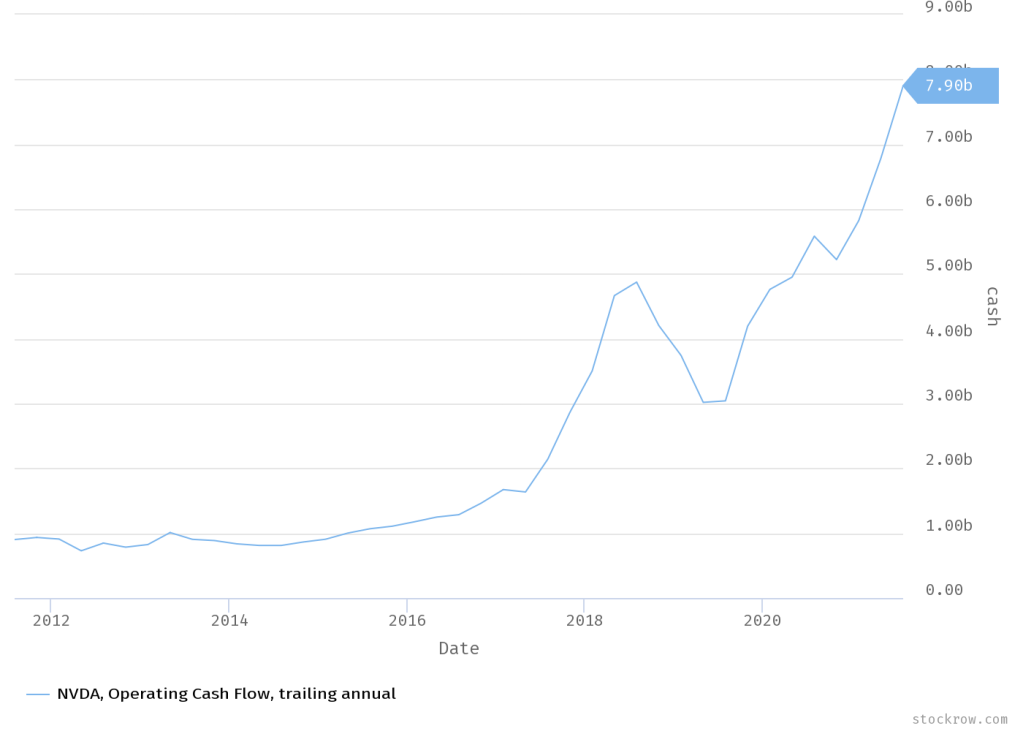

Operating cash flow over the last 4 quarters has now soared to a company record $7.9 billion.

The stock trades about 51x forward earnings and 25x sales, so its far from cheap but not quite as expensive as The Trade Desk (NASDAQ:) either. Maintaining a full position in the company, they are obviously killing it and poised for further growth. I’d add to the position if price ever fell to the $160 area, about a 25% decline from most recent highs.

Chart of the week

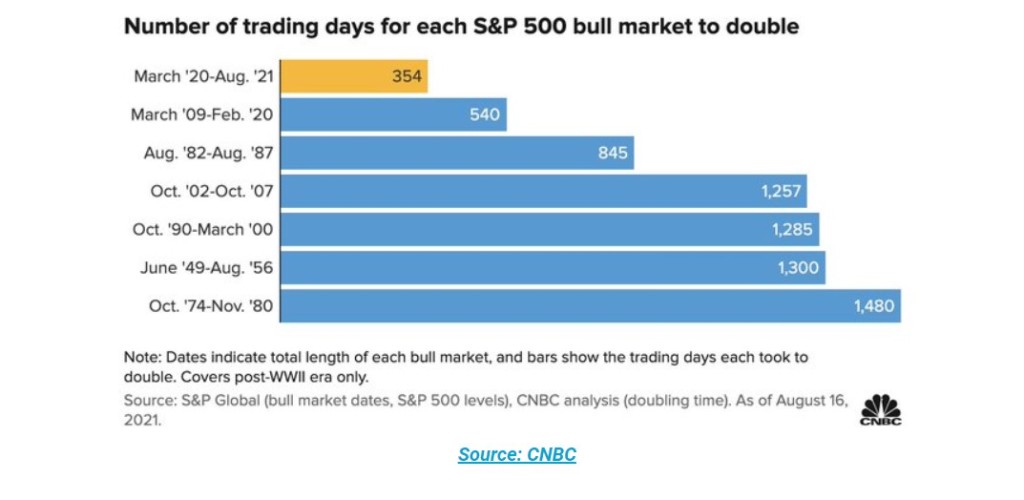

The S&P 500 doubled from the March 2020 low point in a record 354 trading days. This is the fastest recovery in the post WWII era. It goes to show what strong earnings, low rates, and government stimulus can do. The COVID recession was different in a lot of ways. It wasn’t a result of overinvestment, it was a product of self-imposed shutdowns. But you simply can’t turn an economy off and on like a light switch. We are dealing with the repercussions now, as supply chains are damaged and is the result.

Summary

The economic data last week was mixed. Retail sales came in below expectations, but industrial production and the LEI came in better. Earnings continued to increase and rates remained low.

The will be the main event this week. It will be interesting to see what comes out of the Symposium, and it will also be interesting to see how the market reacts to whatever comes out.

I have zero interest in trying to predict what may happen. I’d rather just react to whatever the market gives me. If the market freaks out about the bond buying reduction plans, just remember that they are doing it because the economy is on solid footing.

I am monitoring a minor bearish divergence on the advance/decline line (chart above). While the S&P 500 had been making new record highs up until last week, the advance/decline line has made no progress since June; making lower highs in succession. It’s too early to tell whether this is a sign of exhaustion or consolidation for the next leg higher.

Perhaps market participants are on hold, waiting to hear what comes out of the Jackson Hole Symposium. This week could be the determining factor for the markets next move. If this is the start of the long awaited, perfectly normal and healthy (and much needed IMO) pullback, get your shopping list ready. Otherwise, enjoy the ride.

This week: We have 13 S&P 500 companies reporting earnings. I’ll be paying attention to Intuit (NASDAQ:) on Tuesday and Salesforce (NYSE:) on Wednesday. For economic data, we have on Tuesday, our second look at on Thursday, and inflation reading on Friday. The Jackson Hole Symposium will begin Thursday, and extend through Saturday.