OK, I’ve been quite busy with buys ‘n’ sells over the past 48 hours, but the dust has settled. In a nutshell, I am bullish short-term and bearish long-term. I have a ton of cash undeployed, but here are my live positions now:

- Micron (NASDAQ:) bearish via Sep $80 puts

Semiconductors—VanEck Vectors Semiconductor ETF (NASDAQ:) bearish via Aug. $250 puts

Brazil—iShares MSCI Brazil ETF (NYSE:) bearish via Sept. $43 puts

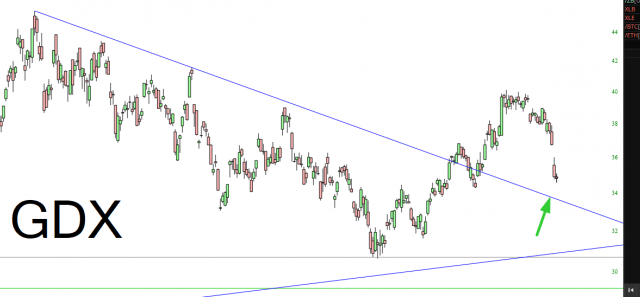

Consumer Discretionary Select Sector SPDR® Fund (NYSE:) bearish via Sept. $175 puts - Precious Metals Miners—GDX (NYSE:) bullish via June 25 $34 calls

Materials Select Sector SPDR® Fund (NYSE:) bullish via July $80 calls

NO CRYPTO POSITIONS AT ALL! (Got scared, thank God)

As for that very short term (just one week to go!) call position on GDX, here’s the chart:

GDX Chart

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.