Tesla's Market Cap Passes Berkshire Hathaway's

Shares of Tesla (NASDAQ:TSLA) surged to an all-time high on Friday, closing at $585.76—giving the electric-vehicle maker a market cap of $555 billion (passing Berkshire Hathaway).

For the first time, it's now valued higher than Berkshire Hathaway (BRK-B), which "only" has a market cap of $543 billion.

This is despite Berkshire generating $27 billion in free cash flow (operating cash flow less capital expenditures) over the past 12 months versus $1.8 billion for Tesla.

Exactly a year ago, Berkshire's $540 billion market cap was nine times Tesla's $61 billion.

If you had asked me for odds on Tesla surpassing Berkshire within a year, I would have said 1,000 to 1.

It's a good lesson on how literally anything is possible in the stock markets—and why shorting is so dangerous…

I continue to like Berkshire's stock a lot more than Tesla's—but I also continue to think that Tesla is a bad short.

Nikola-GM Deal Falls Apart

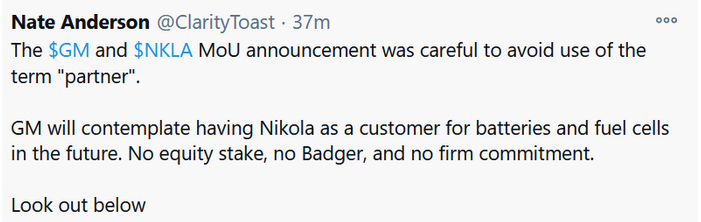

As predicted, electric-truck developer Nikola (NASDAQ:NKLA) announced this morning that its deal with General Motors (NYSE:GM) fell apart, sending its shares tumbling today. Here's what short seller Nate Anderson of Hindenburg Research tweeted:

Nate Anderson Tweet

Nate Anderson Tweet

I agree with my friend, who closely follows the auto sector and e-mailed me this morning:

GM stuck the knife into Nikola this morning, so that story is now over. What a total joke. The Sept. 8 deal is cancelled, and replaced by a deal where they will discuss the possibility of GM becoming a supplier for Nikola's class 7/8 semitrucks *if* Nikola pays for all capex up-front. No more Badger pickup truck. This is the end for Nikola. You can set the timer to the bankruptcy at an hour ago.

Amazon Goes On A Hiring Spree Without Equal

One could make arguments for Tesla, Apple (NASDAQ:AAPL), Facebook (NASDAQ:FB), and Alphabet (NASDAQ:GOOGL), but I think Amazon (NASDAQ:AMZN) is the most important company in the world.

This is why I follow it closely and recommend it to my readers and subscribers (it was among the first stocks we recommended when we launched the Empire Investment Report on April 17, 2019, and since then it's up 71%—more than double the return of the S&P 500 Index).

Here's an article about Amazon's growth from the front page of Saturday's New York Times: Pushed by Pandemic, Amazon Goes on a Hiring Spree Without Equal. Excerpt:

Leave a commentAmazon has embarked on an extraordinary hiring binge this year, vacuuming up an average of 1,400 new workers a day and solidifying its power as online shopping becomes more entrenched in the coronavirus pandemic.

The hiring has taken place at Amazon's headquarters in Seattle, at its hundreds of warehouses in rural communities and suburbs, and in countries such as India and Italy. Amazon added 427,300 employees between January and October, pushing its work force to more than 1.2 million people globally, up more than 50 percent from a year ago. Its number of workers now approaches the entire population of Dallas.

The spree has accelerated since the onset of the pandemic, which has turbocharged Amazon's business and made it a winner of the crisis. Starting in July, the company brought on about 350,000 employees, or 2,800 a day. Most have been warehouse workers, but Amazon has also hired software engineers and hardware specialists to power enterprises such as cloud computing, streaming entertainment and devices, which have boomed in the pandemic.

The scale of hiring is even larger than it may seem because the numbers do not account for employee churn, nor do they include the 100,000 temporary workers who have been recruited for the holiday shopping season. They also do not include what internal documents show as roughly 500,000 delivery drivers, who are contractors and not direct Amazon employees.