Stocks finished the day around the flat line with the up about 15 basis points to close at 4486, a new record. The markets’ grind continued even as valuation creeped higher, and the specter of the Fed embarking on a tightening cycle. At this point, we can see that the index was once again bumping up against the top of the uptrend, which we started to watch in the middle of July.

Perhaps it can just continue to trade along the upper trend line to 5,000 or maybe infinity. I don’t know. The index has seemingly lost all sense of reality, and it isn’t even clear what the market is looking at. We are literally trading higher because the Fed went from an in-person to a virtual one. That is supposed to mean the Fed is taking the Delta variant seriously.

Seriously, I doubt Jay Powell was coordinating the event, and it seems unlikely that the event venue change was meant to act as a smoke signal to the market about his intentions on tapering.

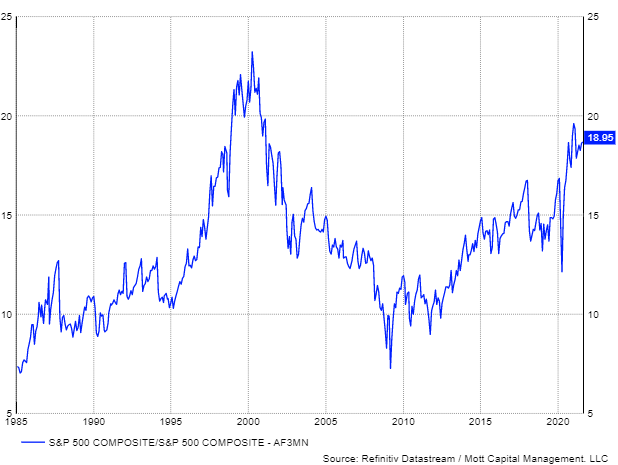

The index now trades for 19 times 2023 earnings estimates; yes, I said 2023 earnings estimates.

S&P 500 Composite Chart

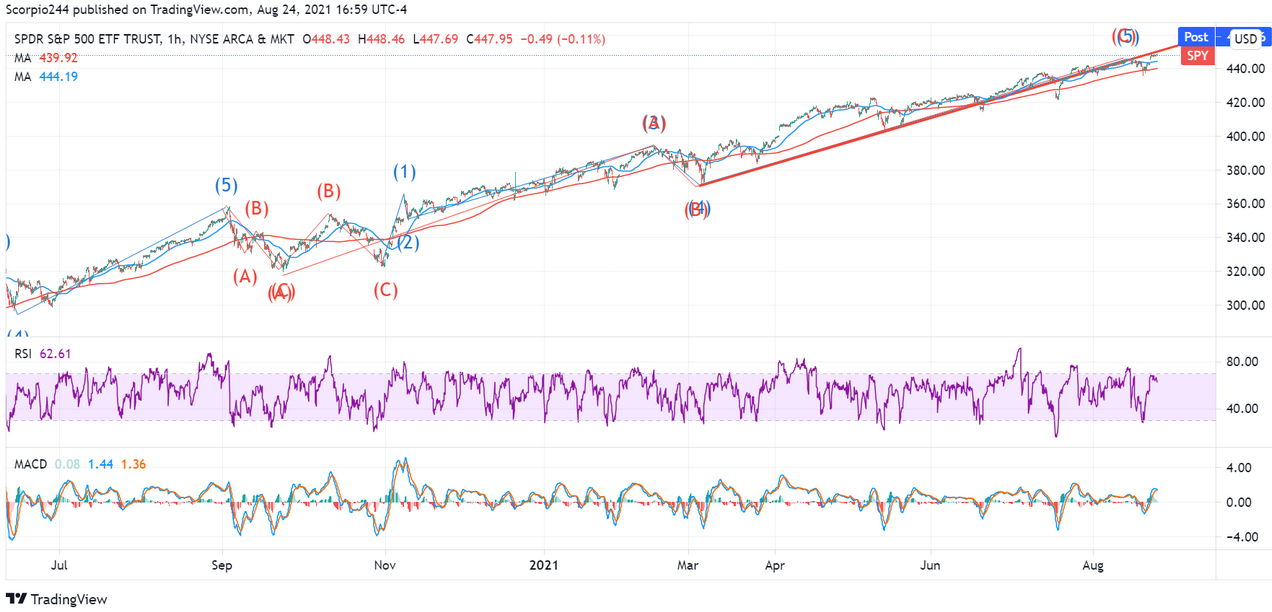

Anyway, my view hasn’t changed; my count remains unchanged on the SPDR® S&P 500 (NYSE:). So, therefore, I still believe this region serves as a potential turning point for a corrective wave lower.

10-Year Treasury Bond ETF

moved up Tuesday, closing around the 1.3% level. We were once again watching for a potential at this level. A potential break-out sets up a rise to around 1.4% or as high as 1.55%.

Salesforce

Salesforce.com (NYSE:) broke out, and they should be reporting today. The stock was obviously expecting strong results. They always seem to beat on earnings; after all, they tend to get a nice boost from their investment portfolio due to reporting unrealized gains and losses. So if they beat today and the stock goes down, make sure you check and see how much of their beat was due to “other income.” There is nice resistance around $260, as well.

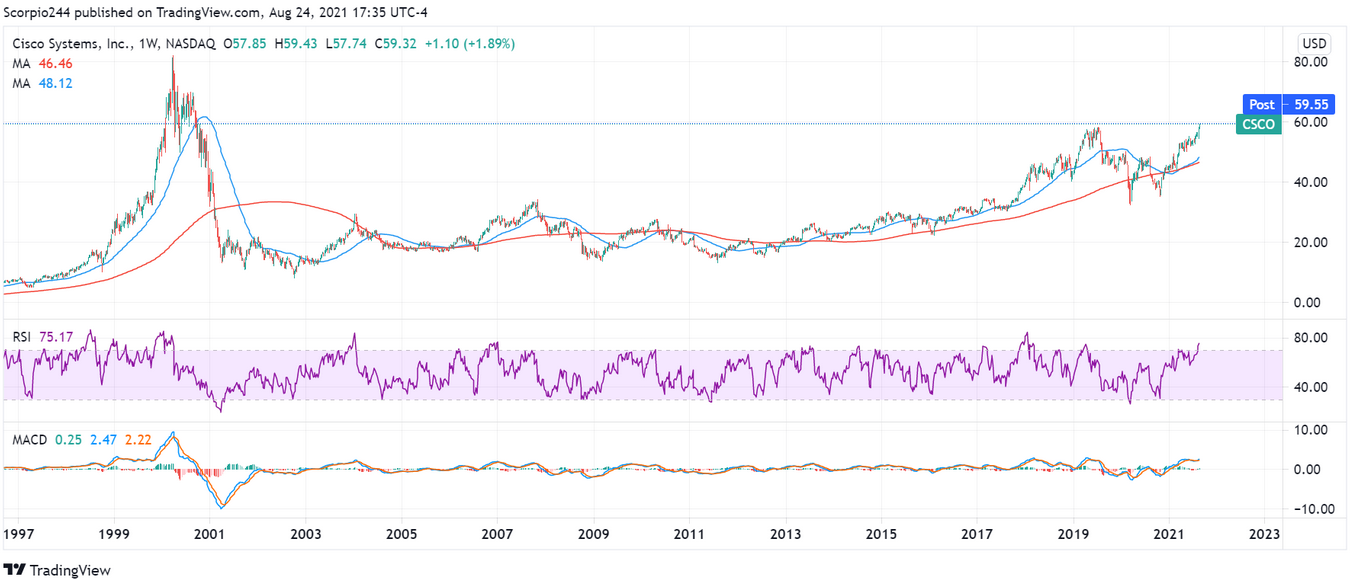

Cisco

Cisco Systems (NASDAQ:) was still climbing, breaking above resistance at $58; the stock hasn’t been this high since 2001. I have stopped following this one for the time being.

Splunk

Splunk (NASDAQ:) today as well. The stock broke out of the falling wedge back in June and managed to get to resistance at $151 yesterday. I like the company long-term; the problem is when they report results. They never seem to please investors, and they have this whole thing with converting revenue into this subscription-like model. Anyway, I wouldn’t be surprised if it traded follow results like it did last quarter.