Stocks increased on Aug. 5 ahead of the . Over the past three months, the index has rallied sharply on the BLS job report. Maybe that changes today? So it seems logical that some are trying to front today’s report. The was stuck all day at resistance around 4,420, and in the final 30 minutes, made a fairly big push higher once resistance was cleared.

Financials

Most of the action today came from the , with the ETF climbing by 1.3%. To close back at resistance around $37. The big IF here is if the banks can rise and push higher from here. They are trying, but rates are going to need to rise, and spreads widen for that to happen. To this point, yields are not really changing much. Today could change that.

UPS

UPS (NYSE:) has stopped falling at support around $188. For the stock to have come this far and not fill the gap at $178 seems odd. You’d think that gap would get filled before any attempt to push higher again.

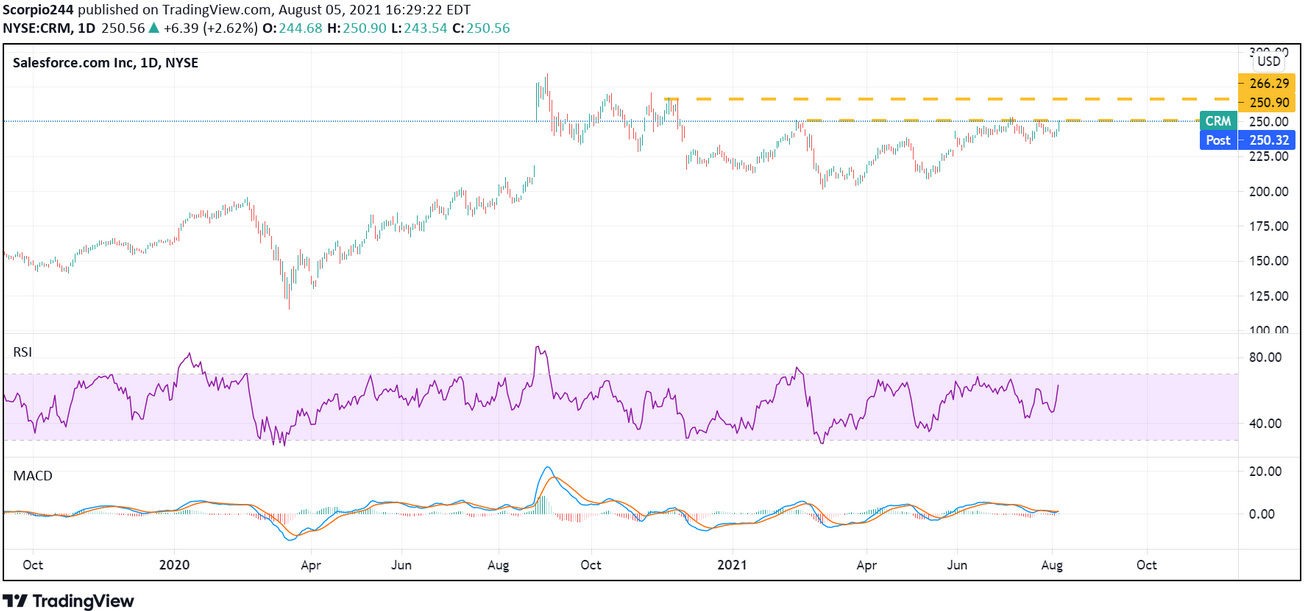

Salesforce

Salesforce (NYSE:) is very close to breaking resistance at $250. The stock has been trying to break higher for months. It might finally happen, with a room to run up to around $265.

Uber

Maybe Uber (NYSE:) has finally bottomed, the stock made a lower low, but the RSI did not. That can, at times, indicate a reversal of a trend. Things may start getting better for Uber.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.