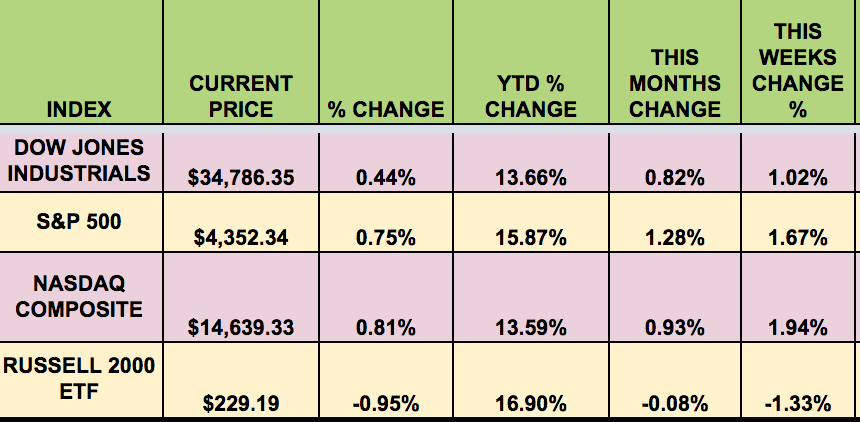

Market Indexes

It was another up week for most of the indexes, except for the , which fell -1.33%. The and hit record highs again last week, as a “Goldilocks” reaffirmed US economic expansion, but not to the point of fanning inflation fears.

Volatility: The fell 3.5%, ending the week at $15.07.

High Dividend Stocks: These high dividend stocks go ex-dividend this week: British American Tobacco (NYSE:), AT&T (NYSE:), American Financial TRS Inc Class A (NASDAQ:), Eagle Point Cred (NYSE:), EIC, Global Net Lease (NYSE:).

Market Breadth: 19 out of 30 stocks rose last week, vs. 16 the previous week. 70% of the S&P 500 rose, vs. 60% the week before.

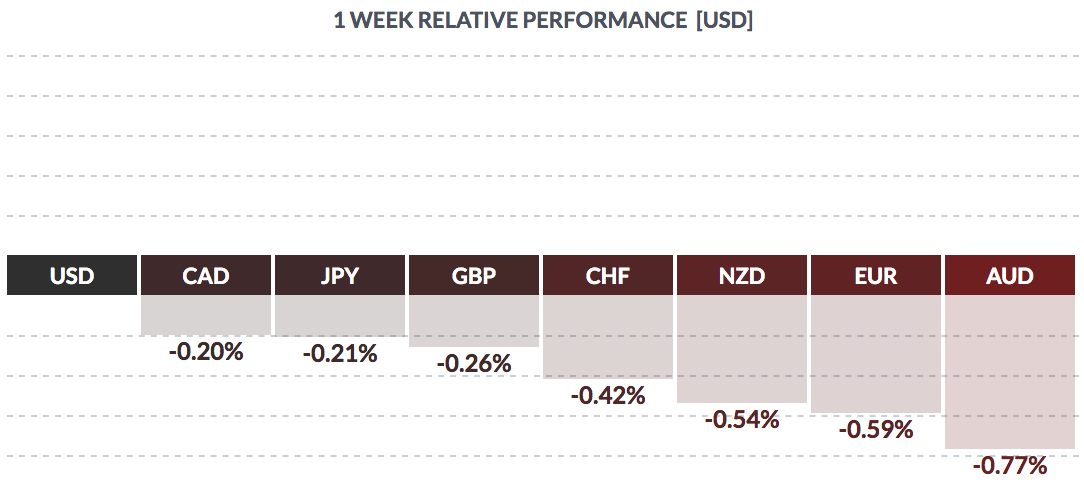

Forex: The reversed once again and rose vs. most foreign currencies last week.

Economic News

From Reuters:

“The Labor Department’s closely watched employment report showed nonfarm payrolls increased by 850,000 jobs last month, as companies raised wages and offered incentives to draw millions of reluctant unemployed Americans back into the labor force. The unemployment rate rose to from 5.8% in May, while average hourly earnings rose last month, lower than forecast.

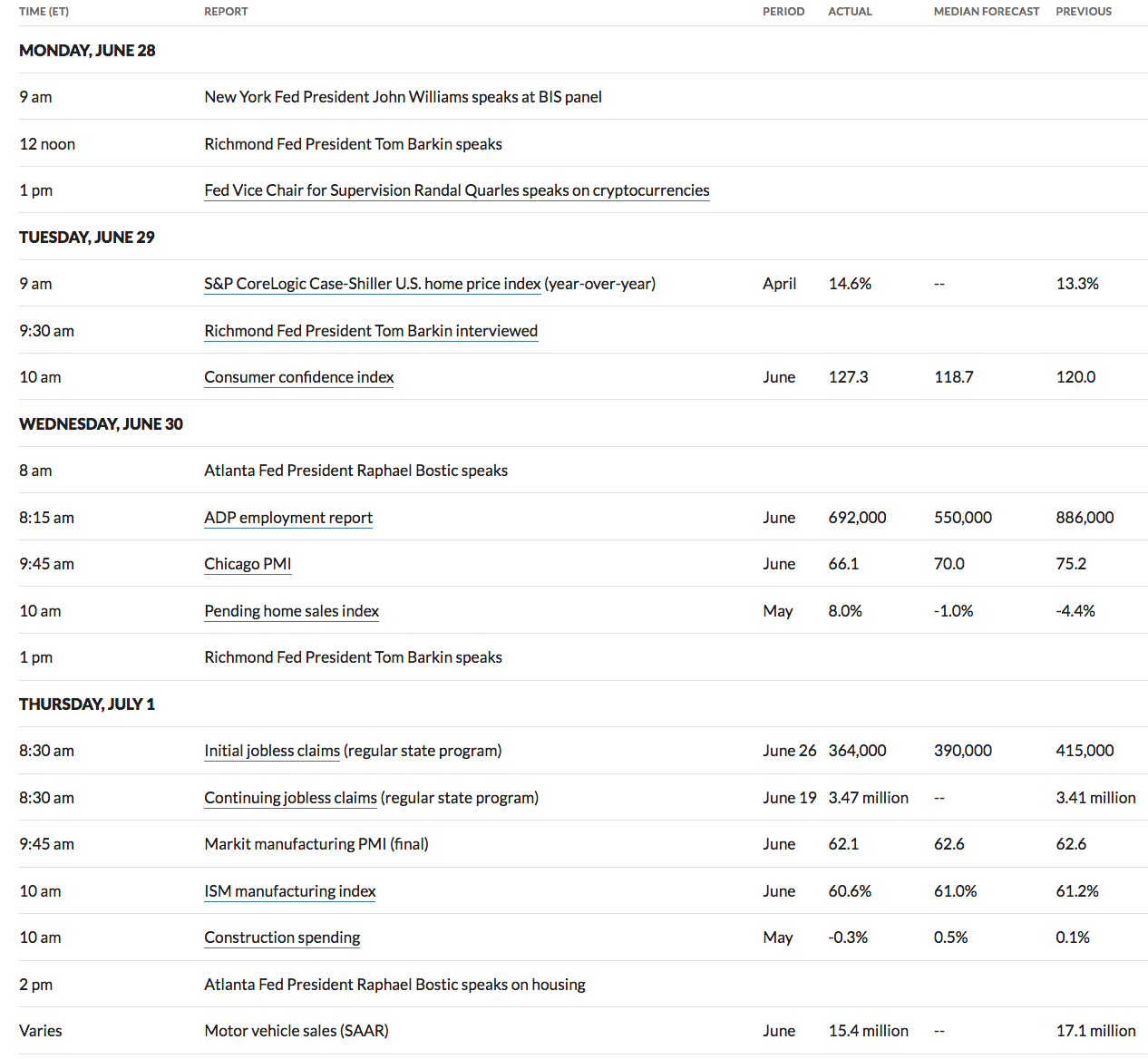

“U.S. consumer confidence increased in June to its highest level since the COVID-19 pandemic started more than a year ago, bolstering expectations for strong economic growth in the second quarter. The Conference Board said on Tuesday its consumer confidence index jumped to a reading of this month, the highest level since February 2020, from 120.0 in May. The survey places more emphasis on the labor market.”

“U.S. single-family home prices in 20 key urban markets rose in April from a year earlier by the most in over 15 years, a closely watched survey said on Tuesday. The S&P/Case Shiller composite index of 20 metropolitan areas gained through the 12 months ended in April, the largest annual price increase since December 2005. On month-to-month basis, the 20-city composite index rose from March. Home prices have surged nationwide in large part due to limited supply.”

“Contracts to purchase previously owned U.S. homes rose strongly in May to the highest level for that month since 2005.”

The National Association of Realtors (NAR) said on Wednesday its Pending Home Sales Index, based on contracts signed last month, rose to 114.7. Pending home contracts are seen as a forward-looking indicator of the health of the housing market because they become sales one to two months later. Compared to one year ago, pending sales were up 13.1%.”

“The Congressional Budget Office, a nonpartisan scorekeeper, predicts the economy will grow by 6.7 percent for the year, after adjusting for inflation. That would be the fastest annual growth since 1984 in the United States, and it is significantly faster than the budget office and the Biden administration had each predicted earlier this year.” (NY Times)

“Five of the six largest U.S. banks said Monday they would hike their payouts after the Federal Reserve last week lifted previous temporary restrictions on dividends and share buybacks. Monday’s announcements amount to an extra $2 billion in dividends to be paid out in the third quarter. The Fed had restricted payouts during the pandemic and asked banks to preserve capital. But it said last week that stress tests showed that 23 of the largest banks could easily suffer a combined $500 billion in losses while meeting their capital requirements.” (MarketWatch)

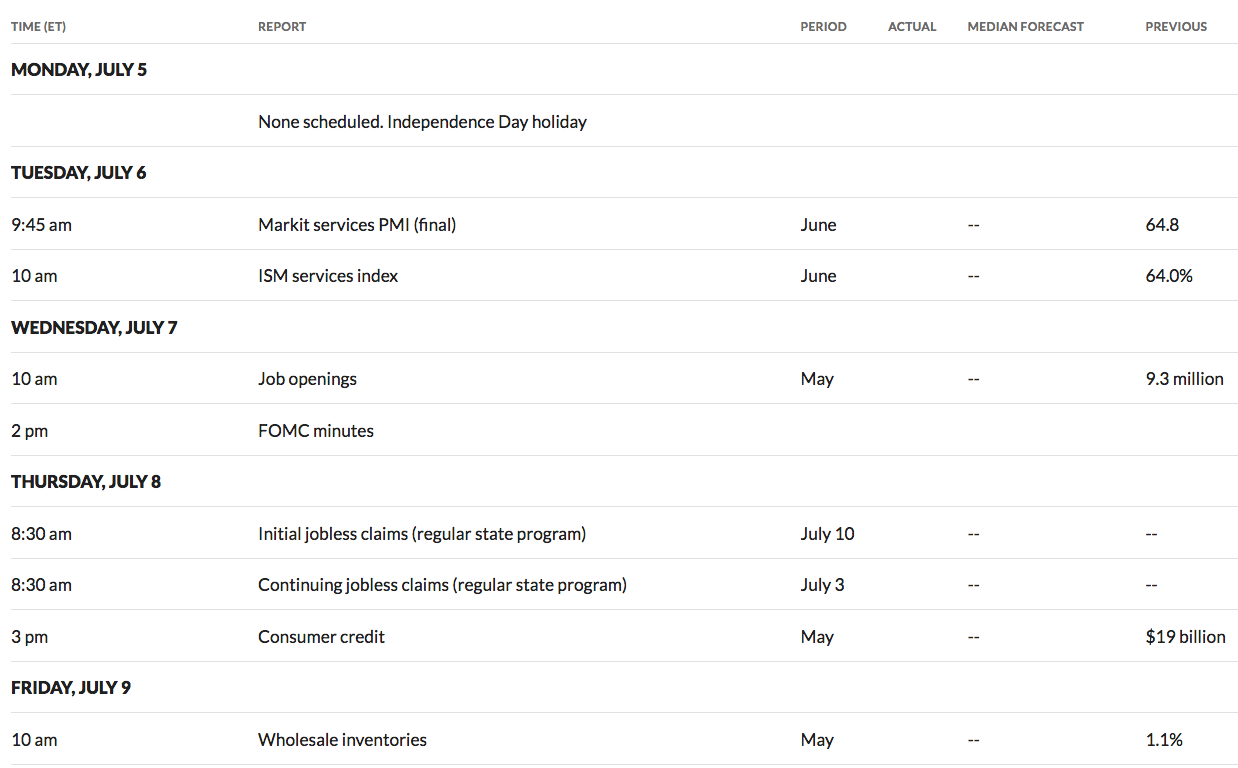

Week Ahead Highlights

US markets are closed Monday for the July 4 holiday.

“Focus now also shifts towards the second-quarter earnings season and progress on President Joe Biden’s infrastructure bill that could help the equity market keep the momentum.

“Investors will look to from the Fed’s June policy meeting next week which will offer more details on the policymakers thinking on inflation, bond tapering and interest rates at a time when easy monetary policy appears to be at an inflection point amid a booming U.S. economy.” (Reuters)

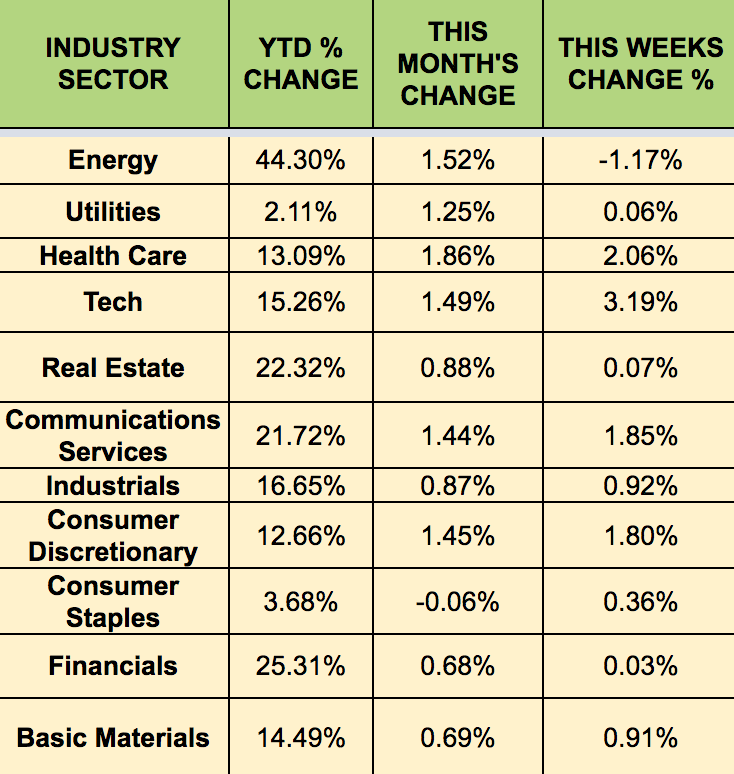

Sectors: The sector led the week, while lagged. Energy continues to lead all sectors by a wide margin so far in 2021.

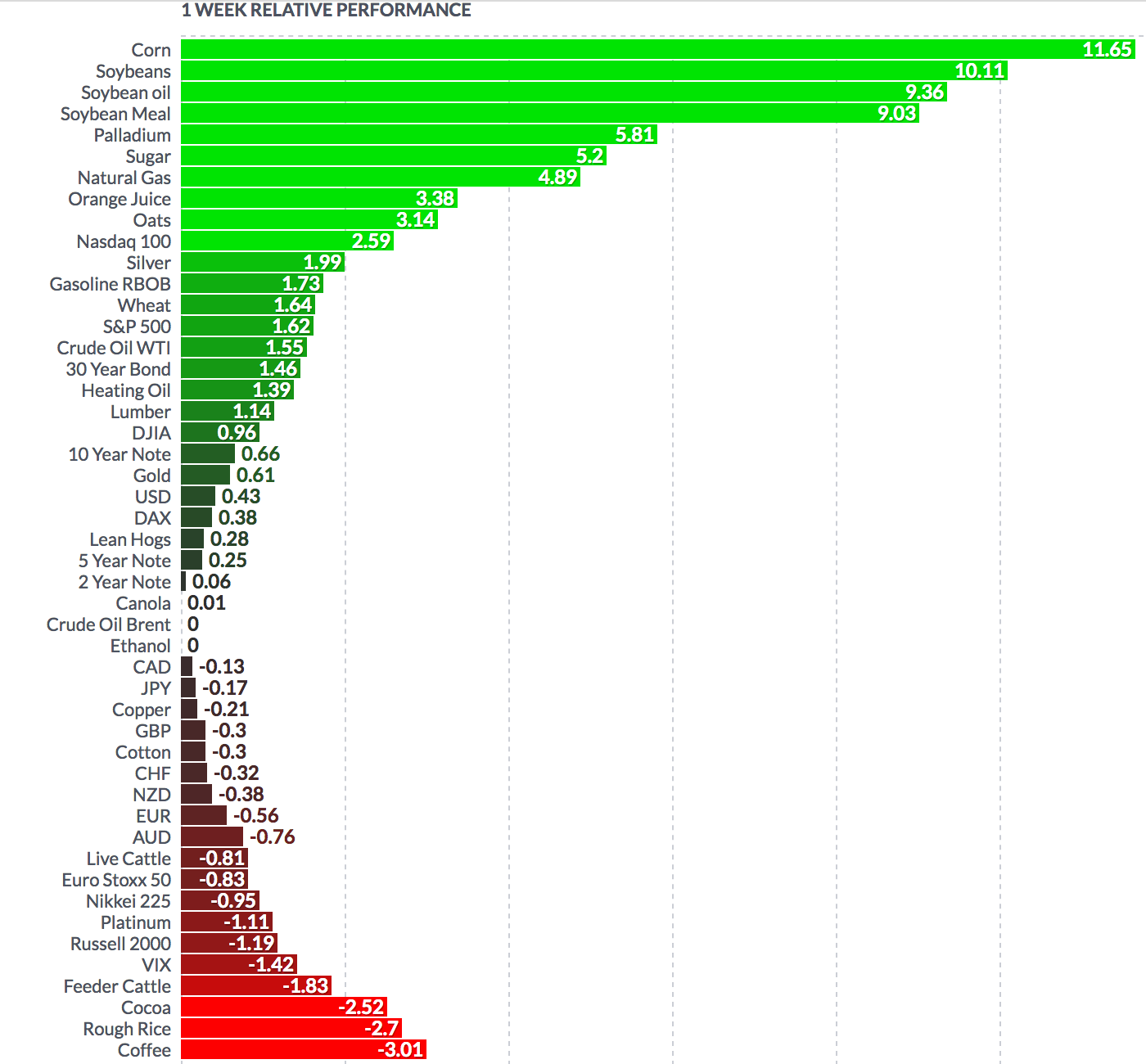

Futures: At time of writing, WTI Crude rose 1.55%, ending at , its highest point since October 2018.

“OPEC expects oil demand in industrialized nations to increase by 2.7 million barrels a day in 2021, up 6.3%. More than half of that growth will come from the U.S., at 1.5 million barrels a day, it said. The trend will accelerate in the second half, with a consumption boost of 3.1 million barrels a day.” (WSJ)