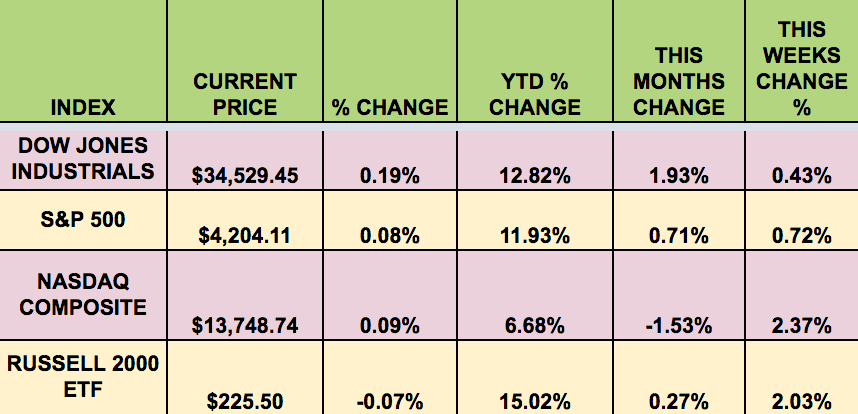

Market Indexes: The indexes had positive results last week, with the and small caps leading. The led for the month of May, with the NASDAQ losing -1.5%.

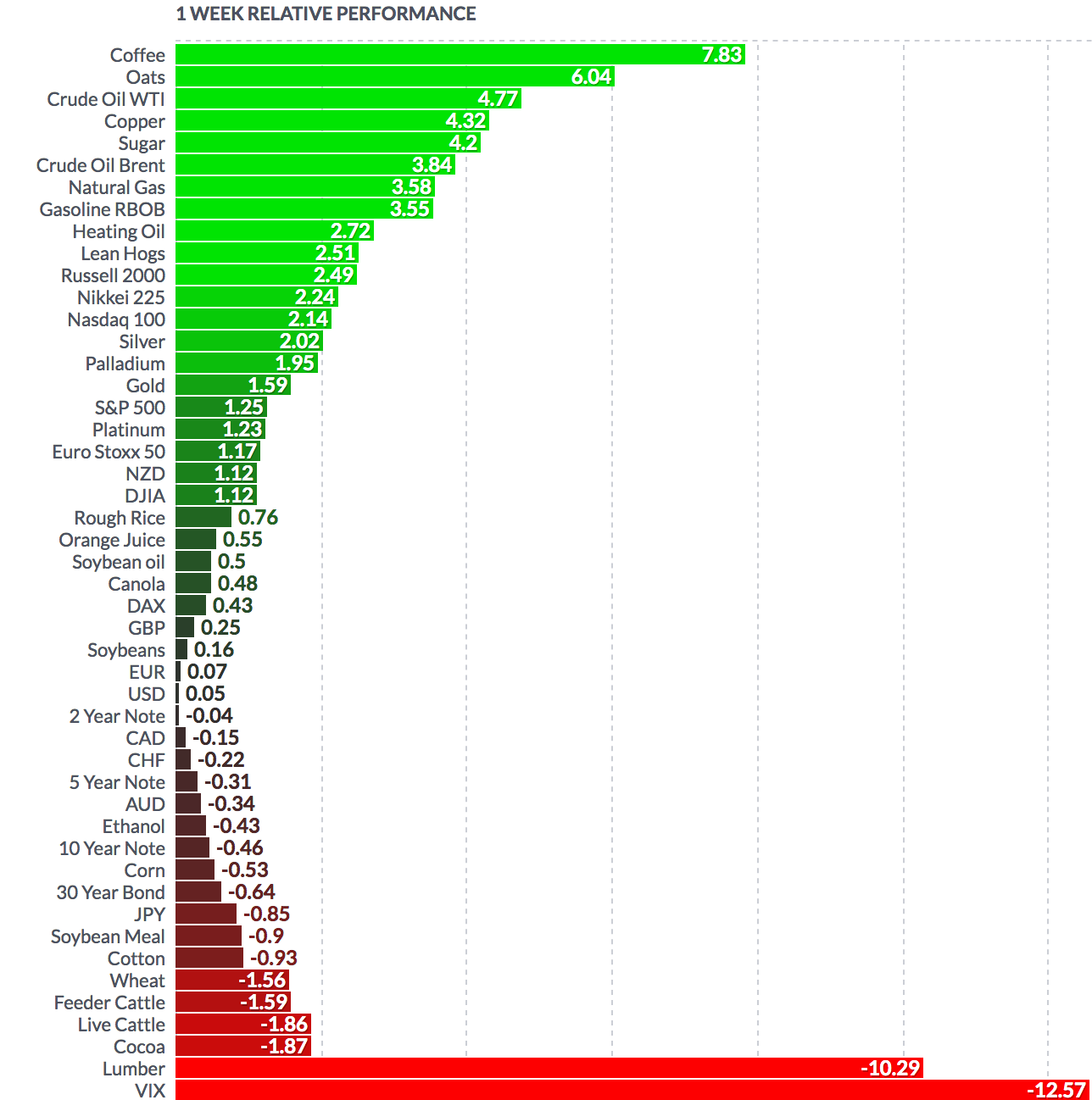

Volatility: The fell 16.8% last week, ending the week at $16.76.

High Dividend Stocks: These high dividend stocks go ex-dividend next week: , , .

Market Breadth: 20 out of 30 Dow stocks rose this week, vs. 19 last week. 72% of the rose, vs. 58% last week.

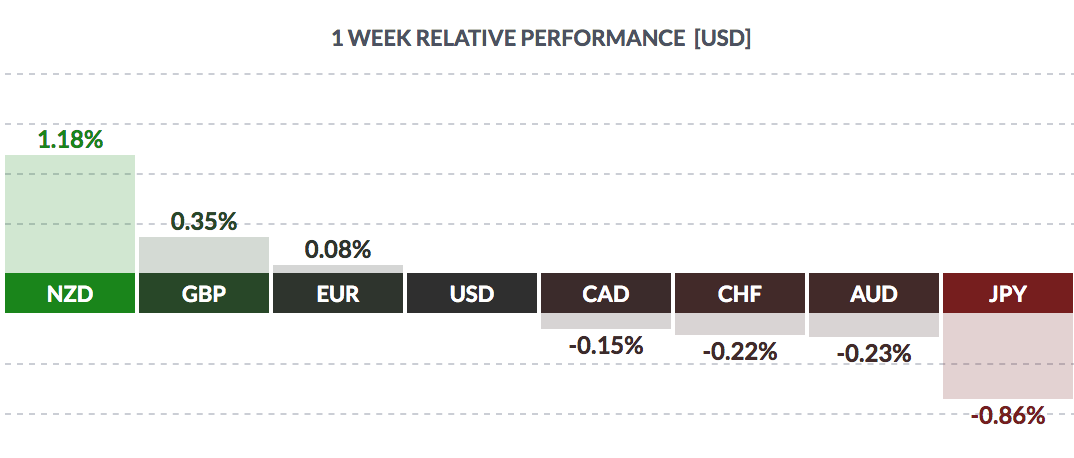

FOREX: The fell vs. the , the , and the this week, and rose vs. the , the , the and the .

Economic News: “US increased at an annual rate of 6.4% in the first quarter of 2021. Upward revisions to consumer spending and nonresidential fixed investment were offset by downward revisions to exports and private inventory investment. Imports, which are a subtraction in the calculation of GDP, were revised up. (BEA)

“U.S. surged in April, with a measure of underlying inflation blowing past the Federal Reserve’s 2% target and posting its largest annual gain since 1992, reflecting pent-up demand as the economy reopens.

Consumer prices as measured by the personal consumption expenditures () price index, excluding the volatile food and energy components, increased 0.7% last month. That was the biggest rise in the so-called core PCE price index since October 2001 and followed a 0.4% gain in March.

In the 12 months through April, the core PCE price index vaulted 3.1%, the most since July 1992, after rising 1.9% in March. Economists polled by Reuters had forecast the core PCE price index rising 0.6% in April and surging 2.9% year-on-year.

The core PCE price index is the Fed’s preferred inflation measure. Year-on-year readings could remain higher for a while because of the so-called base effects before subsiding later this year. The strong inflation readings reported by the Commerce Department on Friday had been widely anticipated as the COVID-19 pandemic’s grip eases, thanks to vaccinations, and will have no impact on monetary policy. Fed Chair Jerome Powell has repeatedly stated that higher inflation will be transitory, with supply chains expected to adapt and become more efficient.

Most economists share the U.S. central bank chief’s views. The supply constraints largely reflect a shift in demand towards goods and away from services during the pandemic. Inflation is also accelerating as last spring’s weak readings drop from the calculation.” (Reuters)

“The recovery of global goods trade is accelerating from a steep drop a year ago due to COVID-19, although some regions are lagging given an unequal roll-out of vaccinations, the World Trade Organization said on Friday.

The WTO said its goods trade barometer had surged to 109.7 points in May, well above the baseline of 100, from 103.9 in February and the low of 88.1 in the second quarter of 2020, when global goods trade volume fell 15.5%. “The relatively positive short-term outlook for trade is marred by regional disparities, continued weakness in services trade and lagging vaccination timetables, particularly in poor countries,” it said.

The Geneva-based trade body said that the largest gains were seen for export orders, air freight and electronic components. Automotive products and agricultural raw materials, mostly wood for construction, were also strong, likely reflecting improved consumer sentiment.” (Reuters)

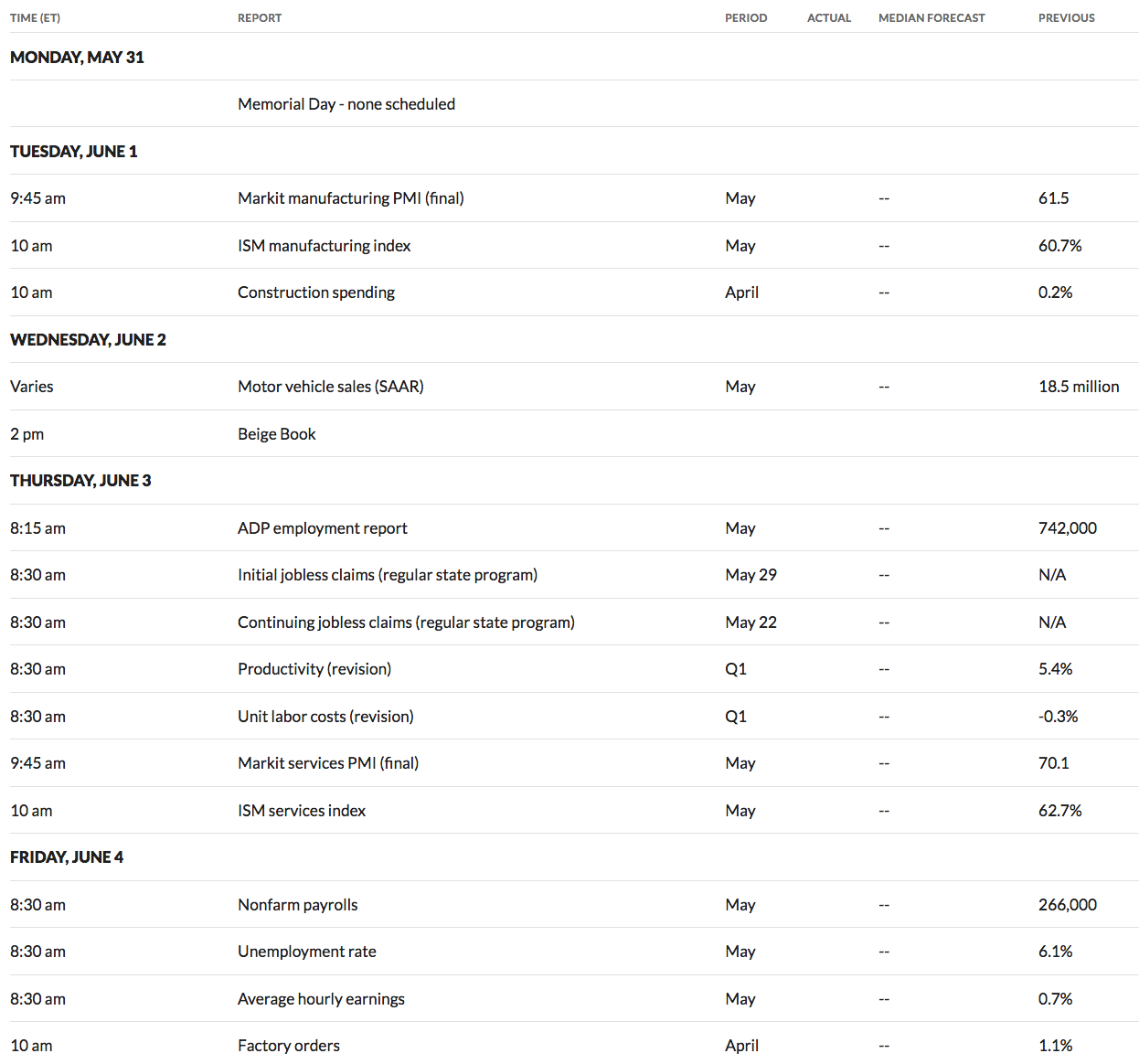

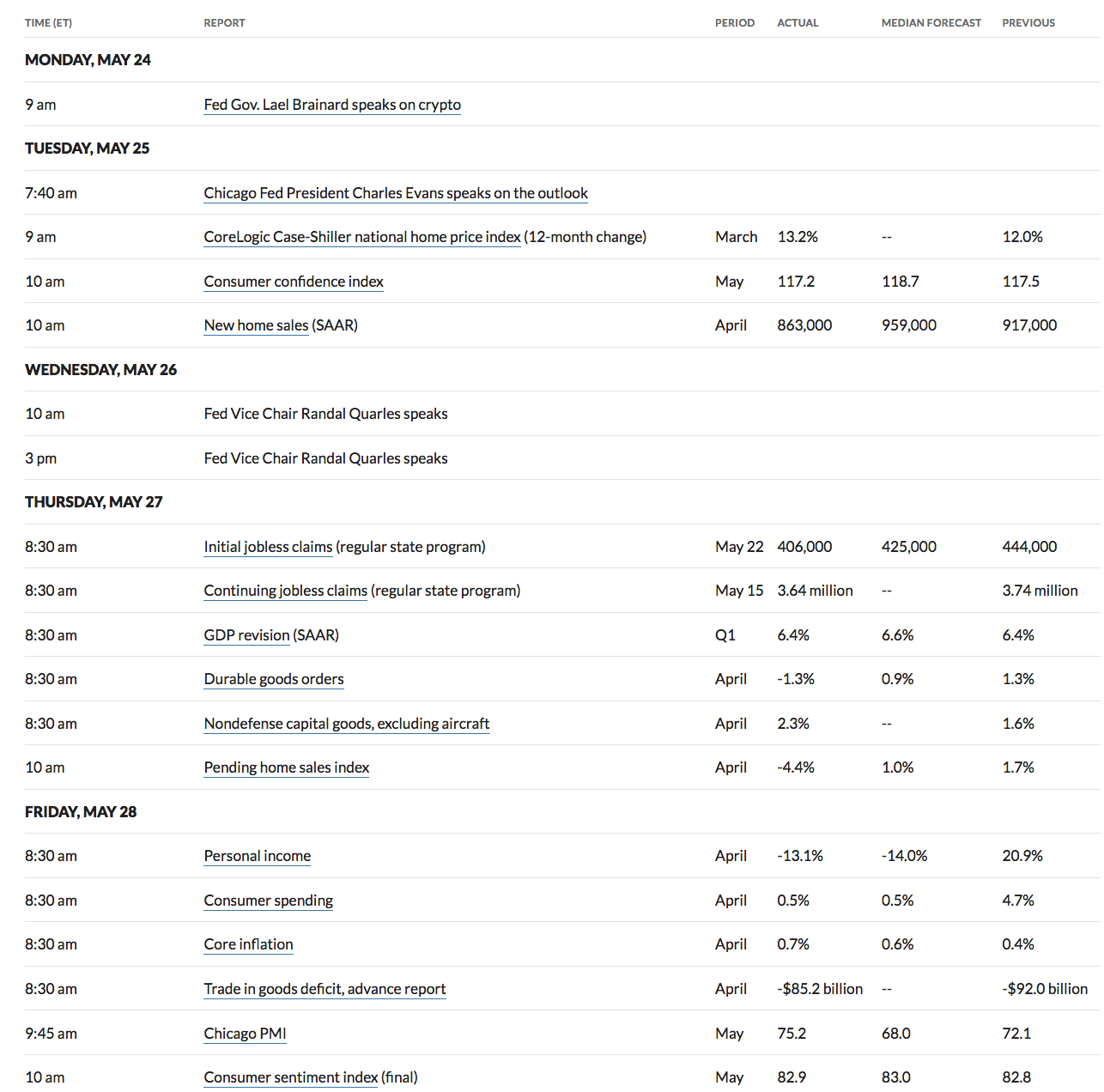

Week Ahead Highlights:US Markets are closed on Monday for Memorial Day. The report is due out on Friday, along with the .

US Economic Reports:

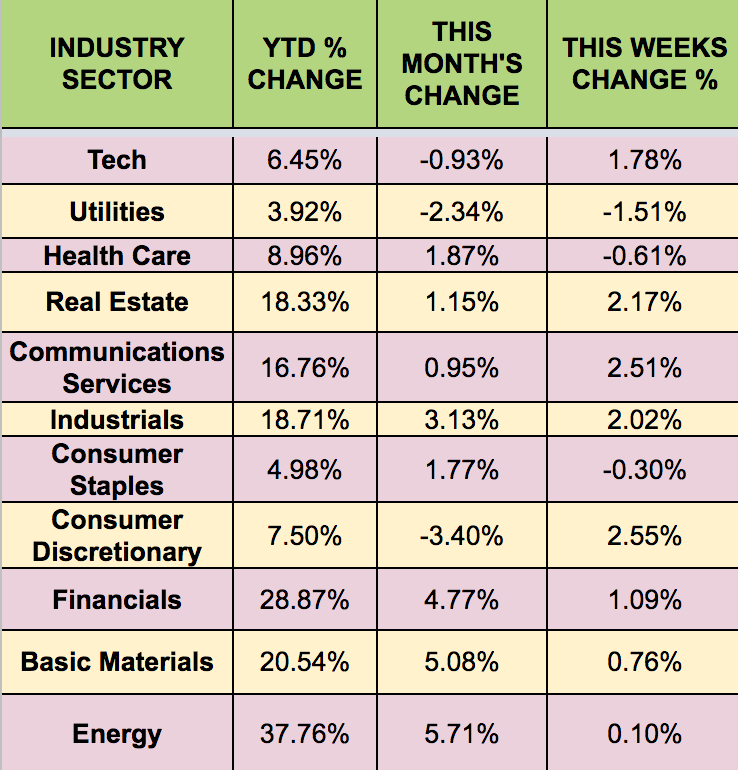

Sectors: The sector led this week, while the sector lagged.

Futures: rose 4.77%, ending at $66.63, its highest since November 2018.