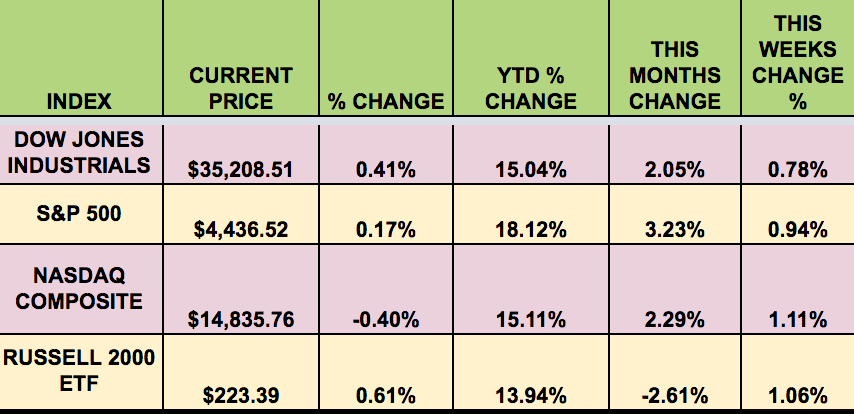

Market Indexes:

All 4 indexes gained again last week, led by the and the . “The logged record closing and intraday highs on Friday, extending record-setting gains from a day earlier. The added more than 100 points, or 0.4%, and also set a record high. The NASDAQ dipped as Treasury yields gained across the curve after the better-than-expected print on the labor market’s recovery.” (YahooFinance)

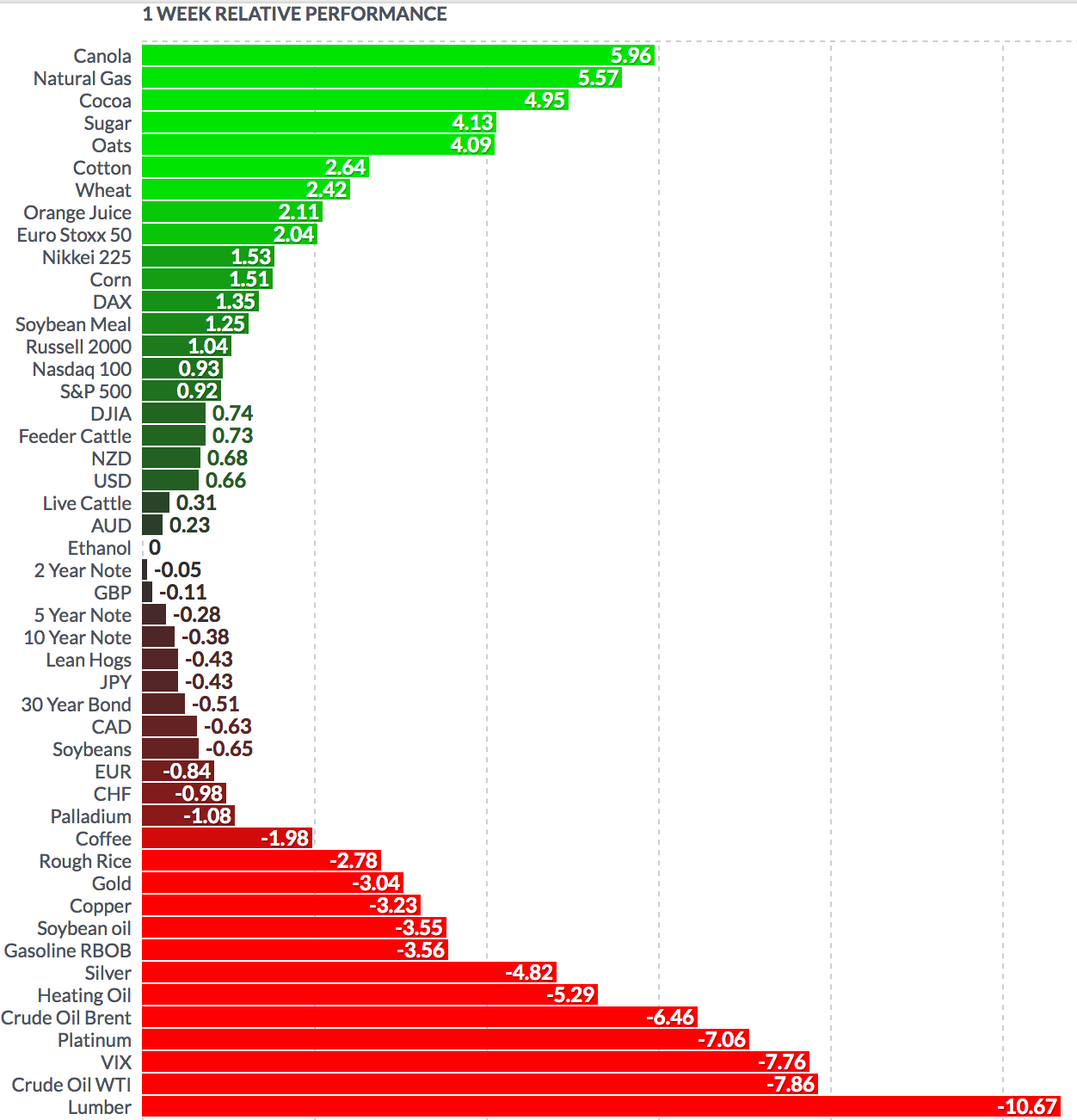

Volatility: The fell 12.5% last week, after spiking as high as $25 intraday on Monday’s pullback, and ended the week at $16.30.

High Dividend Stocks: These high dividend stocks go ex-dividend this week: Eagle Point Cred (NYSE:), Hercules Capital Inc (NYSE:), Enable Midstream Partners LP (NYSE:), Prosperity Bancshares Inc (NYSE:), First National Corp (NASDAQ:), Westlake Chemical Partners LP (NYSE:), Enbridge Inc (NYSE:), Enviva Partners LP (NYSE:), Rio Tinto ADR (NYSE:), Rattler Midstream LP (NASDAQ:).

Market Breadth: 14 out of 30 DOW stocks rose last week, vs. 15 the week before last. 54% of the S&P 500 rose, vs. 72% the previous week.

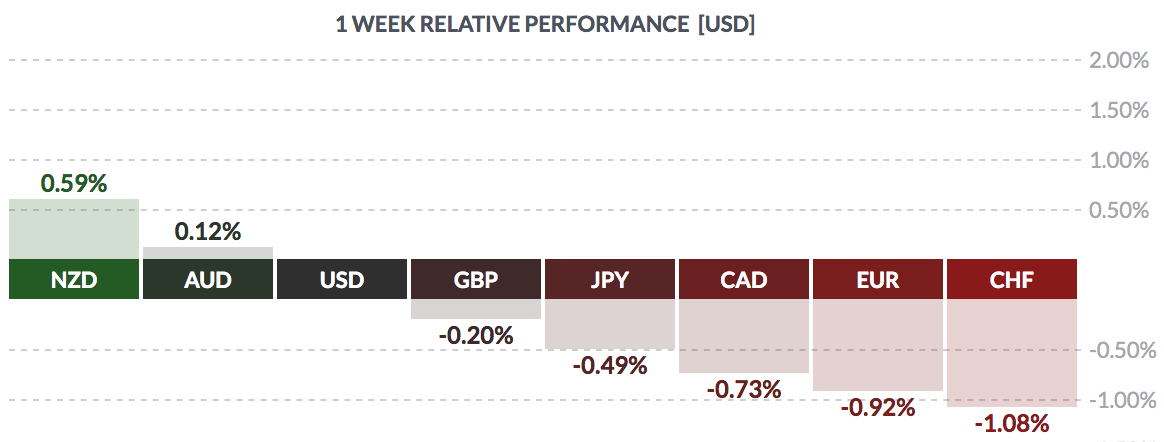

FOREX: The rose vs. other major currencies, except the and .

Economic News: “At 943,000, last month grew by the most since August 2020.

The Unemployment rate fell to vs. 5.7% expected and 5.9% in June.

Job growth was also upwardly revised for May, coming in at 614,000 versus the 583,000 previously reported, and for June, with an upward revision to 938,000 from 850,000.

The economy, however, is still trying to recoup millions of jobs lost since the start of the pandemic. On net, the economy has shed 5.7 million payrolls since March of last year, with much of this deficit still present in the leisure and hospitality industries. These employers shed a total of nearly 2 million jobs since the pandemic first brought about shutdowns across the U.S.

Leisure and hospitality employers were again the leaders in bringing back jobs last month, with payrolls rising by 380,000 to comprise more than a third of the total July jobs gains. In the private sector, education and health services employment also contributed notably, with payrolls increasing by nearly 90,000.

A significant contributor to the July payrolls report also came from government jobs, especially in education. Overall, government payrolls were up by last month. These increases, however, may overstate the extent of actual job growth occurring in the sector, given seasonal adjustment issues due to the pandemic.

“Staffing fluctuations in education due to the pandemic have distorted the normal seasonal buildup and layoff patterns, likely contributing to the job gains in July,” the Labor Department said in its report.” (Yahoo)

“New orders for U.S.-made goods increased more than expected in June, while business spending on equipment was solid, pointing to sustained strength in manufacturing even as spending is shifting away from goods to services. Factory orders rose in June after advancing 2.3% in May. Economists polled by Reuters had forecast factory orders increasing 1.0%.

Orders soared 18.4% on a year-on-year basis. Demand pivoted towards goods during the COVID-19 pandemic as millions of Americans were cooped up at home, boosting manufacturing, which accounts for 11.9% of the U.S. economy. But the surge in demand is straining the supply chain. The increase in factory goods orders in June was broad, with notable gains in machinery, computers and electronic products, as well as electrical equipment, appliances and components.” (Reuters)

“U.S. President Joe Biden’s administration on Friday announced a final extension of a coronavirus relief pause on federal student loan repayments, interest and collections until Jan. 31, 2022.” (Reuters)

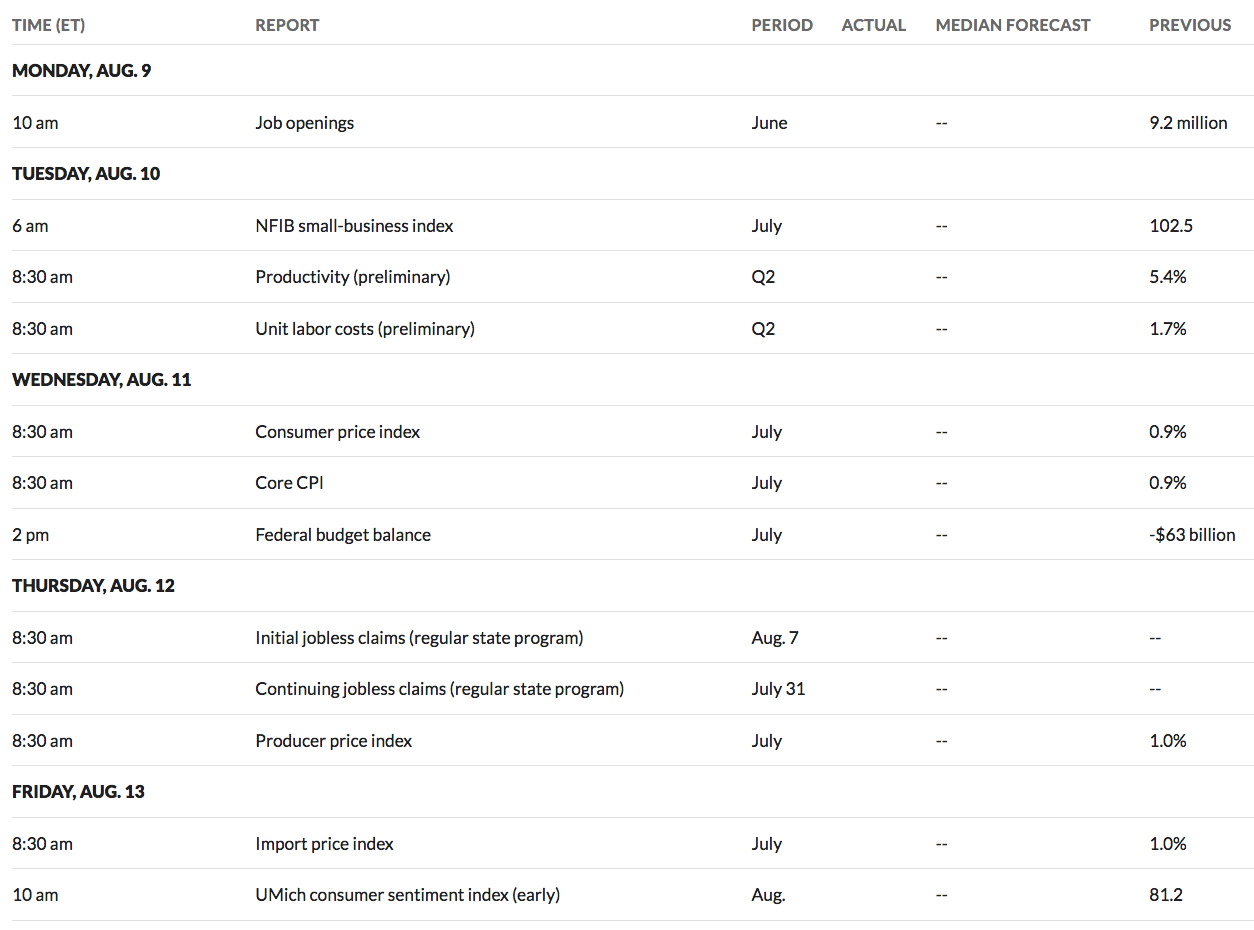

Week Ahead Highlights: CPI, PPI and Consumer Sentiment reports are due out next week.

Q2 ’21 Earnings season starts to wind down, with 9 members of the S&P 500 reporting, including .

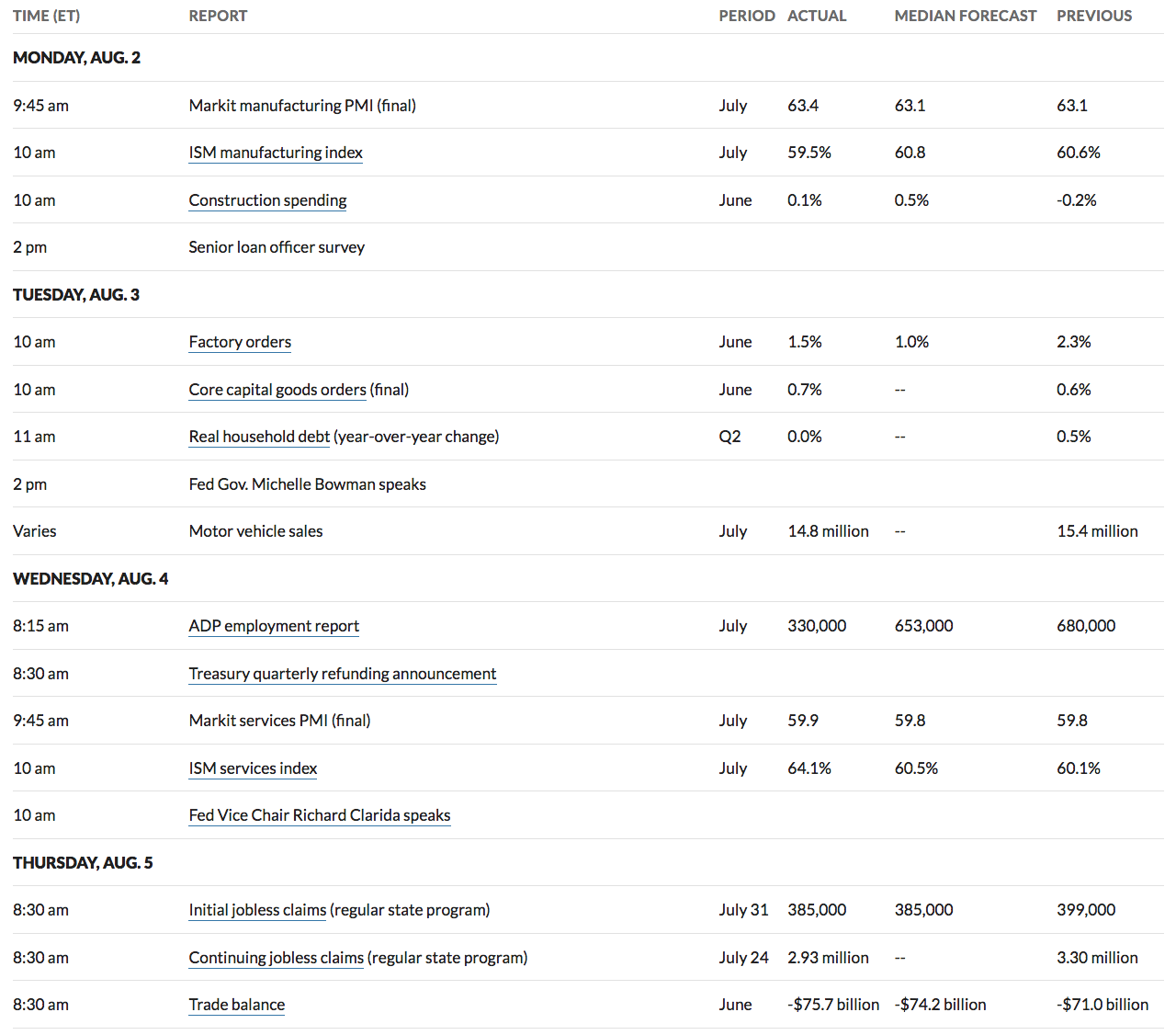

This Week’s US Economic Reports:

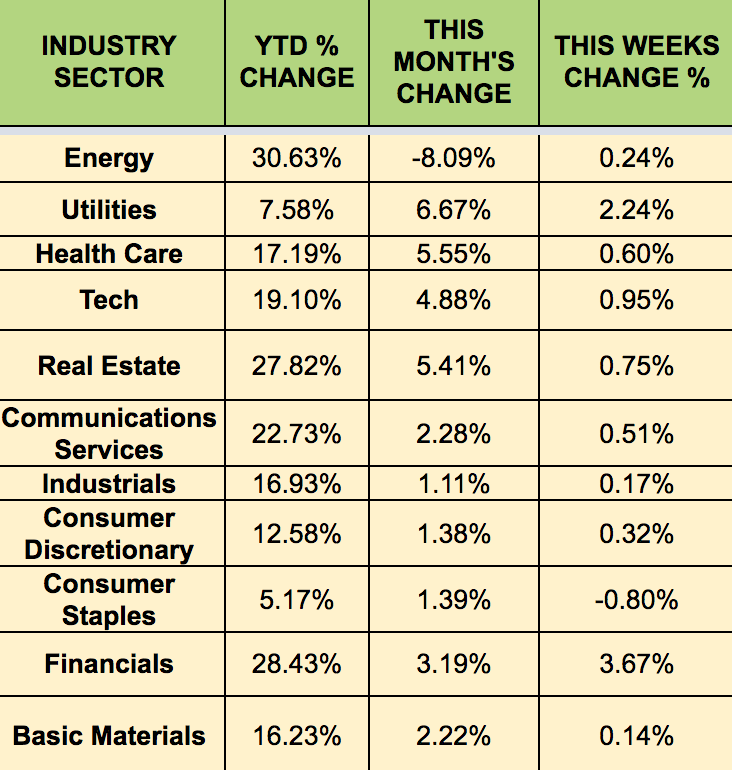

Sectors: , and led last week, with the sector lagging.

Futures: Crude fell -7.86%, ending at $68.00, while rose 6%.