Well, how about that? The little “rally that could” continues. After four down days in a row to end last week, things got on a bit of a roll here. Major indices rose Monday and Tuesday, and continued to look steady in the pre-market hours Wednesday.

It’s a bit disheartening, though, from a technical perspective, that the just missed out on the previous record high of 4257 yesterday, coming within two points of it before pulling back. Technically, it might be helpful today to close above that level if this rally is going to really get some legs. However, the did hit a new record high yesterday, and the SPX remains close. Even if the SPX hits a new high, it could be tough to stay up there without retesting the area below it. You often see some back and forth after new records get established.

Fed Chairman Jerome Powell’s speech late Tuesday afternoon didn’t give people much to trade on, as he stuck firmly to talking points we’ve heard before in testimony to Congress. If Powell’s goal going in was to make sure markets didn’t move on anything he said, he accomplished it, emphasizing again the “transitory” nature of inflation.

The —which can move quickly when the Fed chairman says anything, traded at 1.49% before Powell spoke and finished the day near 1.48%. Now, it’s even lower at 1.47%. The weakness there could be a sign that investors generally agree with the Fed’s view that inflation won’t be a major issue. Time will tell if they’re right.

Powell is in the rear-view mirror, but that doesn’t mean investors can forget about the Fed for the week. First of all, Fed Governor Michelle Bowman is speaking this morning at the Federal Reserve Bank of Cleveland’s Policy Summit. The topic is Community Development and Economic Resilience. Doesn’t sound all that market-moving, but you never know. There’s also Personal Consumption Expenditure (PCE) prices coming up Friday, a measure the Fed says it watches closely for a read on inflation (see more below).

Bank Stress Test Results Up Next

Tomorrow, the Fed’s “stress tests” for major banks are due after the market closes. Results can help determine how much latitude various banks will have from the Fed to use their money on things like buybacks and dividends. In a way, this is like the first bell-ringing of the coming earnings season. The chance for banks to reward investors might get things off to a nice start.

As things churn along this week, the torch-bearer keeps changing. Growth led last Friday, followed by cyclical stocks Monday and then back to growth Tuesday as the tech-loaded NDX led gains for the major indices. The growth vs. value tug-of-war continues and is likely to keep chugging along.

Even with the back-and forth, there’s been a slow-but-sure uptick in two of the largest “mega-caps,” Apple (NASDAQ:) and Microsoft (NASDAQ:). AAPL is quietly closing in on two-month highs. If we’ve learned anything the last few years, when AAPL climbs the ladder, it often pulls up a lot of other stuff with it. Amazon (NASDAQ:), another mega-cap, also had a decent day yesterday amid talk that its first day of “Prime Day” had gone well. We should see the final tally soon.

The prime time earnings season for tech is still a month away, but you can’t write off chances that pre-earnings excitement might be behind some of the recent moves in that sector. Tech is up more than 5% over the last month, outpacing every other SPX sector besides real estate. A bunch of the semiconductor stocks recovered yesterday after a rough day Monday triggered by cryptocurrency concerns. They might have been helped Tuesday by Bitcoin managing to claw back from early lows below $30,000. It traded near $34,000 early Wednesday.

is about the most volatile instrument out there, but overall volatility fell again Tuesday. Just days after some market watchers claimed the “summer doldrums” were over thanks to the Fed’s more hawkish tone, it might have felt like a day at the beach to some investors yesterday as the Cboe Volatility Index () starts the day below 16. It had been above 20 late last week.

Bank of England, Nike, FedEx Dominate Thursday’s Calendar

There’s a little central bank action to be aware of tomorrow as the Bank of England is expected to wrap up its meeting. Analysts quoted in the media say they don’t expect the BoE to change its key interest rate from the current 0.1%.

Thursday is also a big day for earnings back here in England’s old colonies. Nike (NYSE:) and FedEx (NYSE:) are the big ones to watch, especially following last time out when NKE missed analysts’ revenue estimates. Back then, one issue blamed for the miss was port issues delaying shipments. Analysts have since observed that those port tie-ups seem to have subsided a bit, so maybe that’s opened a pathway for NKE to get its products ashore.

NKE’s full-year outlook released in March also played into disappointment on Wall Street. At the time, it forecast fiscal 2021 revenue to rise by a low-to-mid-teens percentage from the prior year. Analysts had been calling for full-year revenue growth of 15.9%, according to Refinitiv. Will NKE raise that guidance tomorrow? If it does, maybe the stock can get a second wind, which would be a change of pace considering how it’s mainly languished most of 2021.

Also keep an eye on e-commerce results for both NKE and FDX. That’s been a shining star for both companies, with NKE’s online sales growing 59% in the most recently reported quarter. Now that there’s been more reopening, it could be interesting to hear what NKE, in particular, has to say about customer traffic at stores.

Speaking of traffic, is a bit higher again this morning, and most metal futures are also higher. Crude is knocking on the door of $74 for U.S. futures after a big drawdown of U.S. inventories announced yesterday.

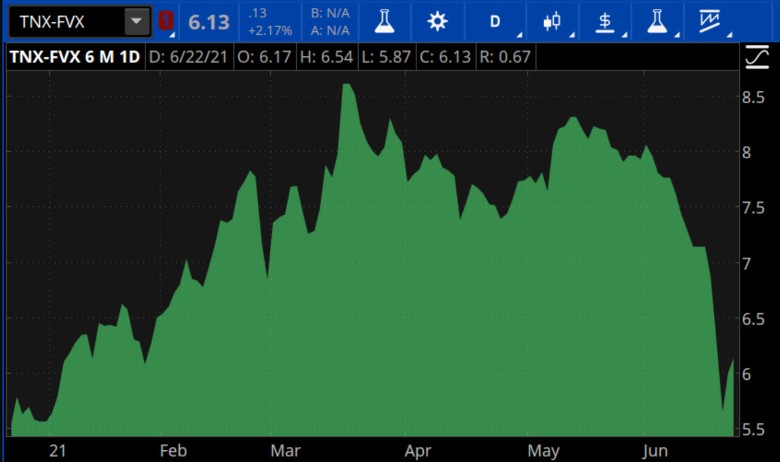

CHART OF THE DAY: NARROW-MINDED. One little-discussed facet of last week’s more-hawkish-than-expected Fed meeting is a kernel of yield-curve flattening. Because the Fed’s rate-hike plans wouldn’t likely kick in until next year, there hasn’t been much change in the front end (two years and under) of the yield curve, there was a 20 basis point narrowing of the spread between the 10-yr yield (TNX) and the 5-yr yield (FVX). Data source: Cboe Global Markets (NYSE:). Chart source: The thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

Buybacks Up, But Impact Debated: Back before COVID companies bought back shares at a sizzling pace. In Q1 2020, the final quarter before COVID really took hold, buybacks reached nearly $200 billion, according to Dow Jones S&P Indices. The buybacks dipped once the pandemic hit and companies got more conservative, but now they’re coming back. Q1 2021 share repurchases totalled $178.1 billion, up 36.5% from Q4 2020’s $130.5B, research firm CFRA reported.

More share buybacks could be on the way depending, in part, on results from the Fed’s bank “stress tests” tomorrow, but buybacks are kind of a mixed bag from an investing standpoint. On the one hand, they do take shares off the market, possibly increasing the value of the remaining shares and helping earnings per share results. Also, in uncertain times, a buyback might make more sense than spending money on a major capital expenditure program. With interest rates and reopening creating a lot of uncertainty, right now might be one of those times where companies are afraid to launch a major new spending initiative and see buybacks as a better option until they have a clearer picture.

However, if a company keeps buying back stock but doesn’t introduce important new products or do any acquisitions, it’s not always a good thing. Also, if a company’s EPS rises mainly because of a reduced share count, that might count a bit less in its favor then growing EPS through solid market growth through new demand for existing or breakthrough products.

No ‘PCE’ From Inflation Data: The Fed continues to say high inflation will start to fade, a debate that’s likely to continue. For now it appears to be sticking around, at least if consensus on Wall Street around this Friday’s personal consumption expenditure (PCE) price data is on the money. Analysts see core PCE inflation rising a heavy 0.6% in May, down just a tick from 0.7% in April. The core number rose 3.1% year-over-year in April, and looks like it could be even higher in May considering the easy comparison to a year earlier when the economy was getting slammed by COVID.

Even a really strong reading on PCE prices may not be enough to influence the market much, however, at least judging from the way it’s reacted over the last week to more hawkish talk from the Fed. The 2-year and 10-year Treasury yields initially jumped last week following the Fed meeting, but then the 10-year turned lower and fell back below 1.5%. The two-year yield has kept its head above the 0.2% mark the last few days, up from before the Fed meeting. That’s the highest it’s been since before COVID, narrowing the so-called “yield curve” in a move that’s sometimes interpreted as a sign of slowing economic growth. Last month’s PCE prices report barely moved yields, so we’ll see if the same holds true this time.

Location, Location, Vacation (Home): Yesterday’s release by the National Association of Realtors (NAR) of May existing home sales was a mixed bag, but with a little something to fit every narrative. The number came in 0.9% lower, but better than analyst consensus of down 2.1%. It’s the fourth consecutive monthly downtick, but prices continue to set new record highs, and inventory remains near record lows. Perhaps the biggest takeaway from the report, however, is that the momentum of price increases may be pricing some first time buyers out of the market entirely—something that will likely come to a head someday.

But there’s another interesting tidbit from another NAR report last week—a byproduct of last year’s lockdowns, remote work, stimulus, and ultra-low interest rates—vacation homes, and homes in far-flung suburbs and remote locations. According to the report, from January to April of this year, the share of vacation home sales to total existing-home sales rose to 6.7% and vacation home sales jumped 57.2% year-over-year (vs. 20% growth in total existing home sales. Post-pandemic, back-to-work days at the office may be different, and although a lot of companies would like to move back to an office-every-day policy, we could see some ebb and flow (with a bit of backlash mixed in). Looking at the numbers from the NAR, one has to wonder whether those robust sales in remote locations will retain their values as we head back to normal office life. Will people’s lives be flexible enough?

Disclaimer: TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.