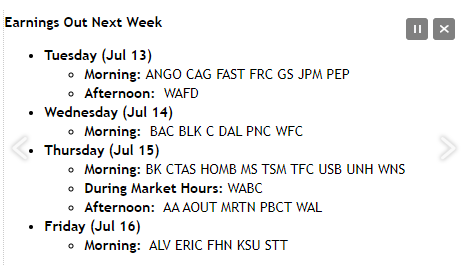

Briefing.com publishes a list of the coming week’s earnings releases every Friday, and above is this week’s slate of companies scheduled to report their Q2 ’21 financial results.

The Week’s Earnings

On Tuesday, July 13, pre-market, we get (NYSE:), and (NYSE:) and then Wednesday we see ‘s (NYSE:) second quarter’s results as well as (NYSE:).

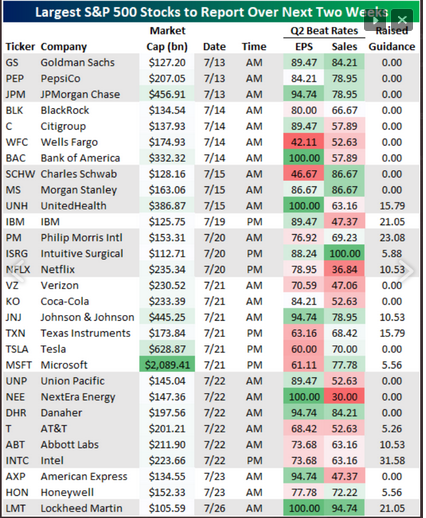

At least 18 major financial services firms report this week. Here is another look at scheduled earnings releases over the next 2 weeks, from Bespoke:

Earnings Releases Over The Next Two Weeks

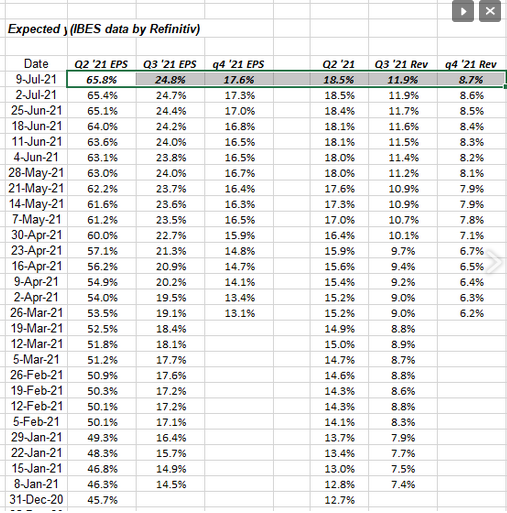

Expect Y/Y Growth Rates To Slow Going Forward

Expect Y/Y Growth Rates

The source data is IBES by Refinitiv, but the trends tracked weekly by us, shows that y/y growth rates will slow as compares get tougher against 2020’s recovery.

That’s probably not a big surprise to readers.

Look at the y/y growth in percentages for Q2 ’21 EPS and revenue. The second quarter’s ’21 EPS expected growth rate as of this weekend rose 20% since Dec. 31, 2020. Expected revenue growth rose from 12% to 18% for Q2 ’21.

The “average” y/y revenue growth rate for the going back to Q4 ’12 (when I first started tracking the data) was +2.5%. Average EPS growth was +4.9%.

Look at the above and below spreadsheets against that historical average.

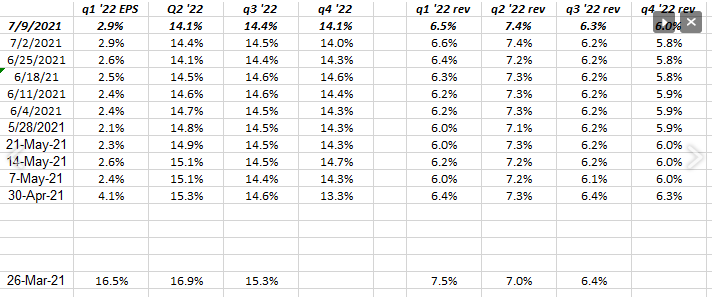

How Does 2022 Look?

2022’s expected quarterly growth rates for the S&P 500 will return to a more normal, historical pattern.

S&P 500 data:

- The forward 4-quarter estimate last week was $199.63 vs. the previous week’s $199.34 and the Dec. 31, 2020’s estimate of $159.02

- The PE on the forward estimate is now 21.89x

- The S&P 500 earnings yield is 4.57% vs the previous week’s 4.64%.

Top 10 client positions as of June 30, 2021:

- Microsoft (NASDAQ:): +22.3% YTD return

- Blackrock Strategic Income (NYSE:): +1.11% YTD return

- Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:): +9.09% YTD return

- Amazon (NASDAQ:): +5.63% YTD return

- JP Morgan Income Fund:+3.45% YTD return

- Schwab (NYSE:):+37.95% YTD return

- JP Morgan (JPM): +23.82% YTD return

- Invesco S&P 500® Equal Weight ETF (NYSE:):+19.06%

- Oakmark International (): +13.68% YTD return

- Tesla (NASDAQ:):-3.68% YTD return

S&P 500 YTD return as of June 30, 2021: +15.25%

Top 10 equity positions as of June 30, 2021:

- MSFT

- VWO

- AMZN

- SCHW

- JPM

- RSP

- OAKIX

- TSLA

Summary/Conclusion

While everyone wants to talk individual stocks and individual stock earnings expectations, tracking the S&P 500 data as a whole—and the patterns in evidence—still indicates the higher revisions to expected quarterly growth rates hasn’t changed for the key benchmark for the last 6 months.

The big reports this week will come from . Expected revenue growth for the sector is -5.3% for the second quarter, while EPS growth is expected at +102%. Third quarter, 2021 Financial sector revenue growth is -2.7% while EPS next quarter is looking at +15.2% as of last week.

We’ll know more after the financials report this week. With loan loss reserve releases, there still should be capital to return to bank and financial sector investors.

Take everything you read with a healthy dose of skepticism. Invest your money based on your financial profile and your own appetite for volatility and risk.