The S&P 500 rose 4.6% this past week, after falling over 3% last week.

The fact that January ’21’s S&P 500 return was -1.01%, and the old saw about “As January goes, so goes the market” still gets circulated, means that there continues to be a higher level of caution around the stock market.

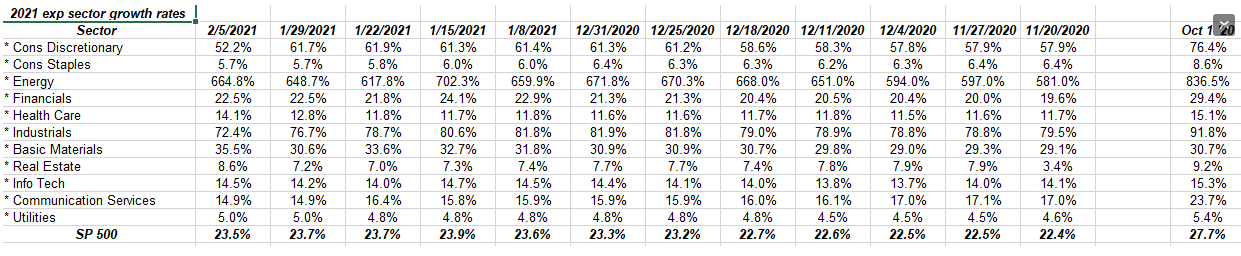

Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL) had blow-out earnings and revenue this week—what the Street calls “upside surprises” and yet 2021 expected growth rates by sector—even Technology and Consumer Doscretionary and Communication Services, have changed little since last fall.

2021 Expected Sector Growth Rates

2021 Expected Sector Growth Rates

The source data for the above table is IBES data by Refinitiv, but expecting strong 4th quarter earnings, just like the 3rd and 2nd quarter of 2020, I started tracking the week-to-week change in expected 2021 sector growth rates, and as you can see from the table—despite strong 2020 earnings—2021 expected growth rates have changed very little.

The bigger question is…what’s that telling us ? The sell-side was far too cautious about EPS and revenue estimates in 2020. Is that continuing? Is there a legitimate risk around growth for 2021? Is the Street simply waiting on a fiscal stimulus package that already we are being told might be too aggressive given the vaccine rollout and a US return-to-normal by summer 2021 ? Roughly 10% of the US population has already been vaccinated that curve will start to steepen each month.

I don’t have the answers for you. Just thinking out loud.

The overall S&P 500 EPS growth rate has increased to 23.5% from 23.3% since December 31 and yet the expected growth rate for Q4 ’20 has risen to +2.4% from -10.3% on January 1 ’21.

The other S&P 500 data:

- The forward 4-quarter S&P 500 EPS estimate jumped to $173.12 this week from $171.33 last week. This is essentially measuring the calendar 2021 S&P 500 estimate since it measures Q1 ’21 – Q4 ’21.

- The S&P 500 PE ratio this week ended at 22.4x.

- The S&P 500 earnings yield fell this week to 4.45% versus 4.61% last week. Surprising given the jump in the EPS estimate although the S&P 500 rallied over 4% too.

- The “average” growth rate for S&P 500 EPS for calendar 2020 and 2021 is now 5%.

Summary / conclusion: Refinitiv, Factset, SP Capital IQ, they all publish earnings data. I am partial to Refinitiv, since it’s the old First Call, which was bought by Thomson, which now owns Refinitiv. This site tries to look at the data from different angles and different time periods.

The fact is 2021 looks like it will be another decent year of S&P 500 EPS growth, but it’s puzzling why those annual estimates for sector growth have yet to change.

On the individual holding spreadsheets where Microsoft (NASDAQ:MSFT), Amazon, Alphabet, the banks, etc. have been modeled since the late 1990s, EPS estimates have seen upward revisions to estimates following the recent Q4 ’20 earnings reports (albeit I’m still working through all the Q4 ’20 reports).

Anyway, food for thought.

Take all data and forecasts on this blog with skepticism, and know that capital markets and data can change quickly. Evaluate all market information in light of your own risk and financial market profile.

Leave a comment