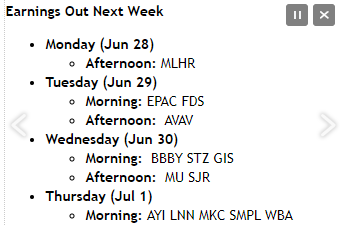

Next Week’s Earnings Releases

Per Briefing.com, here is the list of companies by ticker that are expected to report earnings this coming week. On July 2nd, the exchanges are expected to be open for the June report, with the NYSE expected to be closed on July 5th, 2021, for the July 4th holiday. No companies are scheduled to report financial results Friday, July 2nd, 2021.

Companies of interest are Bed Bath & Beyond (NASDAQ:), which has seen a resurgence since the change in management. It’s a meme stock though, so it’s hard to tell what’s fundamental and what’s Reddit-driven.

No question Micron Technology (NASDAQ:) and Walgreens (NASDAQ:) financial results will be scrutinized. Semi’s are trying to work off a longer correction after a strong 2019 and 2020 and Walgreens, being a value stock, has seen a resurgence since “value” started to rally last fall. Walgreens is also thought to be a beneficiary of the vaccination rush, and the re-opening trade.

The quarterly roll happens next Thursday July 1, as a new quarter starts. The forward EPS curve estimate today, shows a $199.02 estimate for Q3 ’21 through Q2 ’22.

S&P 500 data: by the numbers:

- The forward 4-quarter estimate jumped again this week to $192.56 from last week’s $192.17 and the 12/31/20 print of $159.02. As of today, the full-year 2021 EPS estimate is $190.92, but I’m guessing from tracking the numbers all these years, 2021 will wind up over $200 per share by the end of this year. The expected 2021 EPS estimate has increased $30 just since 12/31/20 and needs just another $10 over the next 6 months.

- The PE ratio on the forward estimate is now 22.24x. If we use $200 for the Sp 500 for full-year ’21, the PE is 21x.

- The S&P 500 earnings yield this week is 4.50% vs last week’s 2021 high of 4.61%.

The quarterly roll happens next Thursday July 1, as a new quarter starts. The forward EPS curve estimate today, shows a $199.02 estimate for Q3 ’21 through Q2 ’22. There is no “rate of change” difference, so expect the new “forward 4-quarter” estimate next week to be around $199 – $200.

Forward estimate source: IBES data by Refinitiv

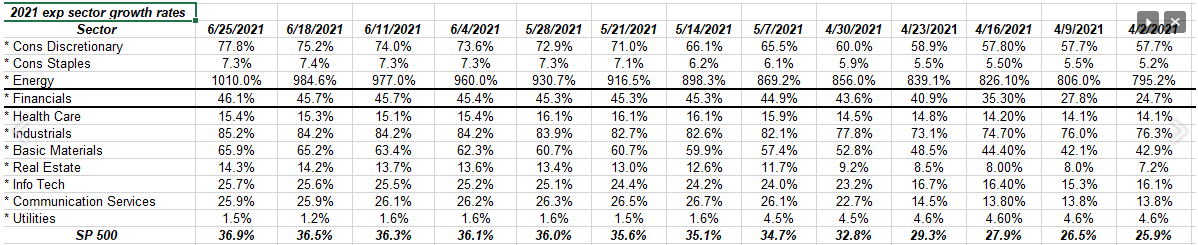

How have full-year 2021 S&P 500 sector growth rates changed since early April, ’21?

What kills me is the growth rate of the Energy sector, and yet if you look at the other “Refinitiv / IBES” data, Energy’s weight in the S&P 500 as a percentage of the S&P 500’s is just 2.9%. Yes, even with the rally in the sector the last 8 months, it’s the same market cap weight today.

Energy peaked as a percentage of the S&P 500’s market cap weight in late 2014 near 14% – 15% just as peaked near $100 per barrel, only to fall to $28 per barrel in Q1 ’16.

Think about that.

The Financial sector market cap weight has risen to 11.3% from it’s base or bottom around 9.9% while Health Care is right at 13% weight.

All readers really need is to own 4-5 (of the 11 total) sectors to get the majority of the S&P 500’s market cap weight.

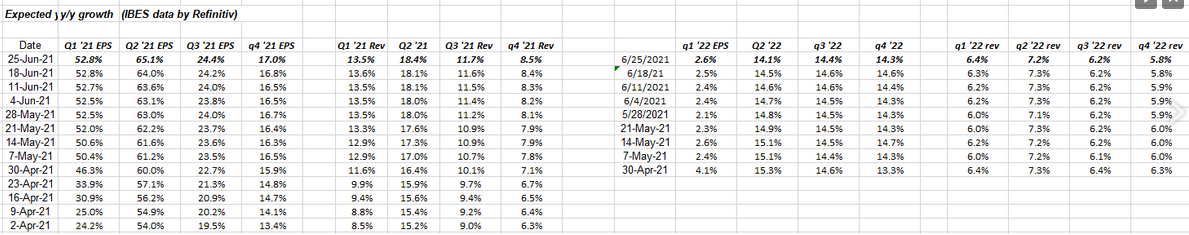

Readers can see the revision to 2021 and 2022 EPS and revenue growth rates for the S&P 500 compliments of the IBES / Refinitiv data. (See top line highlighted in black.)

The spreadsheets and tables are my own concoction, but I’m starting to pay more attention to 2022 revisions as we move into July ’21.

The bias still seems higher in terms of revisions for EPS and revenue growth rates, but that can change quickly.

Summary / Conclusion: This coming week, the forward estimate, which will cover the Q3 ’21 quarter through Q2 ’20, should be very close to $199 – $200 per share, which is what the forward EPS curve for the S&P 500 is showing today.

Absent a couple of companies next week, noted above, S&P 500 earnings will be quiet until the banks start reporting between July 12th and July 15th, 2021.

Take everything you read here with a healthy skepticism. Invest your own money based on your financial profile and your personal appetite for market volatility.