Steakhouse operator Ruth’s Hospitality (NASDAQ:) shares have recovered since the pandemic as it peaked off $28.75 highs. The reopening is well underway as the U.S. puts the pandemic in the rearview mirror with the acceleration of COVID vaccinations. With almost all restaurants open and operating with ever loosening capacity restrictions, the Company should stage a strong recovery in the upcoming quarters especially in terms of year-over-year (YoY) improvements. The recent quarter earnings have yet to factor in the acceleration of the return-to-normal has New York and most of the country has since lifted most COVID restrictions. While the stock has made it’s initial peaks, prudent investors have an opportunity to patiently await pullbacks to step into shares of this sizzling hot and iconic brand as the recovery and reopening trend continues.

Q1 FY 2021 Earnings Release

On May 7, 2021, Ruths released its first-quarter fiscal 2021 for the quarter ending March 28, 2021. The Company reported a non-GAAP diluted earnings-per-share (EPS) of $0.26. The Company had 75 of 77 company-owned and managed restaurants operating including 74 offering limited capacity dining service and one restaurant with outdoor seating only. In California, 11 of 12 restaurants re-opened dining rooms as of mid-March 2021. All 72 franchisee-owned restaurants are open and operating including 70 restaurants operating in limited capacity. Revenues for Q1 was $81.6 million, down from $103 million in Q1 2020. Ruth’s Hospitality Group CEO Cheryl Henry stated:

“Our impressive first quarter results reflect not only accelerating sales trends, but also strong margins as our operators continued to execute the efficiency and capacity utilization initiative that we implemented in 2020… With dining rooms now open in nearly all of our restaurants and our improved financial position, we are focusing our effects on growing sales and cash flow, building upon the digital foundation we’ve developed during the last year, and investing in new unit growth. This includes two to three new restaurants this year and an additional three to four planned for 2022.”

Conference Call Takeaways

Ruth’s Hospitality Group CEO Cheryl Henry set the tone:

“During out last call in early March, I mentioned there seemed to be a light at the end of the tunnel, and that we were past peak COVID impact on our business. I’m pleased to reiterate that sentiment today, although we do continue to see pockets of strength and weakness across our system, mostly driven by local market conditions.”

She noted that Texas and Florida are “bright spots” as they have lifted most capacity restrictions. New York and Hawaii are opportunity markets with traditionally higher volumes. She noted that Manhattan will be lifting restrictions in the next few weeks. They actually have completely lifted them. Average weekly sales across the board are accelerating most notably in geographies where COVID restrictions are being lifted. CEO Henry concluded, “With continued sales recovery and ample cash on our balance sheet, we are not only comfortable with a return to investing in growth of our business and strategic initiatives, but we have started to allocate capital to reduce debt, including a $10 million prepayment in April. We intend to continue to pay down our debt as the year progresses until we’re at the leverage ratio in our credit agreement that will allow us to distribute more cash to shareholders.”

Reopening Tailwinds

As restaurants get capacity limitations lifted, pent-up demand should resume impressive YoY growth as sales rebound quickly. The storied history of Ruth’s Chris Steakhouse has set its brand well above others. From the special 1800 degree ovens that enable the steaks to come to the table still sizzling to the odd name which simply states they are Chris steakhouses that Ruth owned (as in Ruth’s Chris), this iconic brand known worldwide has tangible value. Prudent investors can patiently watch for opportunistic pullbacks for exposure to consider scaling into a position.

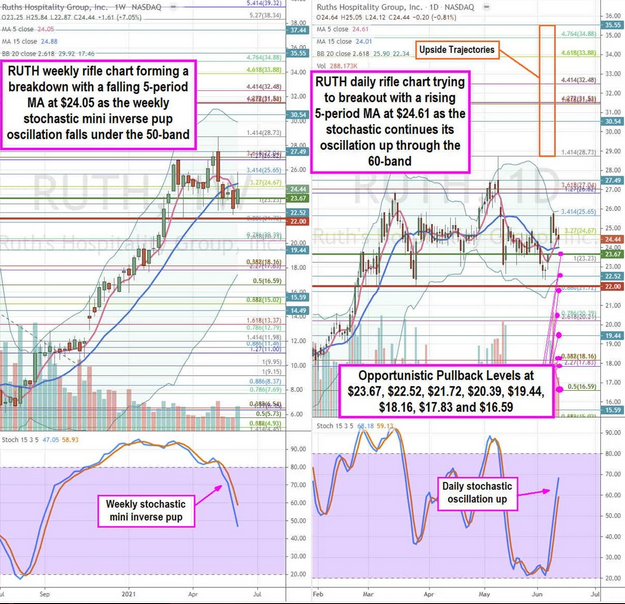

Ruths Hospitality Group Stock Chart

RUTH Price Trajectories

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for RUTH stock. The weekly rifle chart uptrend peaked out at the $28.73 Fibonacci (fib) level. The weekly 5-period moving average (MA) is falling at $24.05 as the downtrend takes shape driven by the bearish weekly stochastic mini inverse pup. The weekly 15-period MA resistance is also stalling at $24.88. The weekly formed a market structure high (MSH) sell trigger on a breakdown below $22. The weekly lower Bollinger Bands (BBs) sit at $17.46. The daily rifle chart triggered the market structure low (MSL) breakout above $23.67. The daily uptrend may be starting to stall with the 5-period MA at $24.61 and rising 15-period MA at $24.01. The daily BBs are compressing with a tightening range despite the rising daily stochastic nearing the 70-band. Prudent investors can watch for opportunistic pullbacks levels at the $23.67 daily MSL trigger, $22.52 stinky 2.50s range, $21.72 fib, $20.39 fib, $19.44 fib, $18.16 fib, $17.83 fib, and the $16.59 fib. Upside trajectories range from the $28.73 fib up to the $35.55 stinky 5s range.