This article was written exclusively for Investing.com

Rio Tinto (NYSE:) is the world’s second largest metals and mining company ( is the largest). Headquartered in London, the company has operations around the globe.

The company’s products include , , , diamonds, titanium, and . While mining and processing these materials tends to be energy intensive, the firm is proactively developing and implementing procedures that will reduce carbon emissions. The company reports that it has reduced the greenhouse gas emissions intensity of its products by 27.8% since 2008.

It has been a bumpy year for RIO shareholders because of COVID and volatility in commodity prices, and these factors are related. Recently, China has set restrictions on steel production which have driven iron ore prices down by 30% over the past month, the largest 1-month drop on record. Iron ore reached an all-time high in May of 2021.

After closing at a 12-month high of $94.65 on May 11, RIO has fallen 23.5% to its current level. The decline has been especially precipitous in August. The stock dropped 19% from the Aug. 3 close of $89.39 to $72.38 on Aug. 20.

Yet even with the recent declines, RIO is up 9.08% for the YTD, and an annualized 24.97% per year for the trailing 5-year period.

RIO: 12-month price history

Source: Investing.com

At the current price, RIO has a 9.46% dividend yield, and the stock is currently between the ex-dividend date and the payment date. RIO pays dividends twice per year.

Part of the recent decline in the shares is because the stock is currently between the ex-dividend date and the payment date. RIO has a TTM P/E of 6.3, which is very low for an individual stock. However, miners tend to have low P/E ratios and RIO’s P/E was most recently at or below the current level at several points in 2019.

Looking ahead, RIO’s expected earnings growth depends on global economic conditions, inflation, tariffs and trade restrictions in China and elsewhere, and national priorities relating to infrastructure investment. To form an overall viewpoint for RIO, I rely on two forms of consensus outlooks.

The first is the Wall Street analyst consensus rating and 12-month price target. The second is the market-implied outlook, which is derived from options prices.

The price of an option represents the market’s estimate for the probability that the share price of the underlying stock or index will rise above (call option) or fall below (put option) a specific level (the strike price) over a specific period of time (from today until the option expiration). By analyzing call and put prices at a range of strikes, it is possible to calculate the probabilistic outlook for price return for the stock or index that reconciles the options prices.

This is the market-implied outlook and it represents the consensus outlook of options buyers and sellers. For those who are not familiar with market-implied outlook, I have written an overview post, which includes links to relevant financial literature and examples.

Wall Street Consensus Outlook for RIO

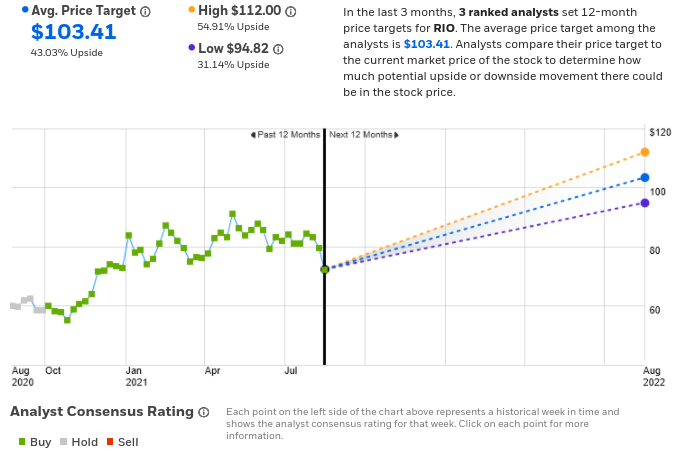

eTrade’s calculation of the Wall Street consensus combines the views of 3 ranked analysts who have issued or updated rankings and price targets within the last 90 days. This is an unusually small number of analysts for a major company, but foreign-listed firms trading in the U.S. as ADRs tend to have light analyst coverage.

The consensus is bullish and the 12-month price target is 43% above the current price.

Source: eTrade

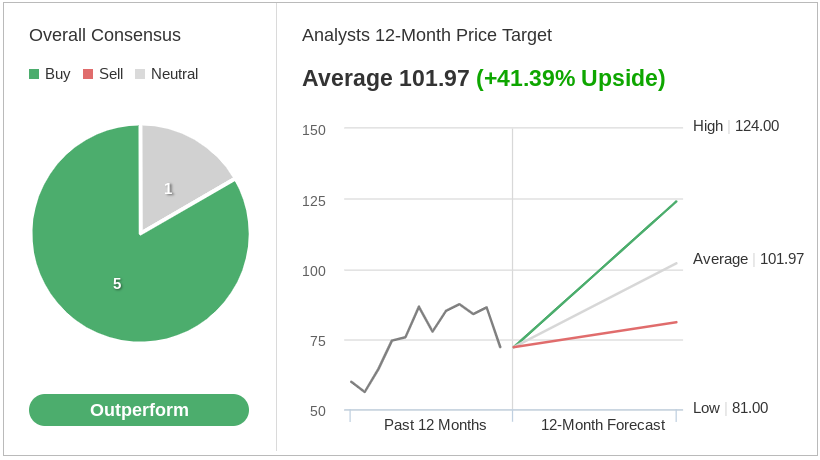

Investing.com’s version of the Wall Street consensus is an aggregate of the outlooks from 6 analysts. The consensus outlook is bullish and the 12-month price target is 41.4% above the current price.

Source: Investing.com

Even considering the small number of analysts covering the stock, the uniformly bullish price targets are notable. Trefis.com, an analytics company that calculates fair value for stocks using fundamental models and discounted cash flow (DCF), estimates the current fair value of RIO to be $100.25.

Market-Implied Outlook for RIO

I have analyzed put and call options at a range of strike prices, all expiring on Jan. 21, 2022, to generate the market-implied outlook for the next 5 months (between now and the expiration date). I chose this expiration date to provide an outlook through the end of 2021 and because January options tend to be liquid.

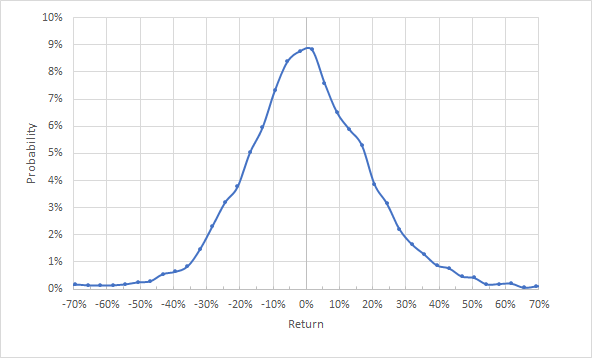

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal axis.

RIO: Market-implied outlook for 5M period, today to Jan. 21 2022

Source: author’s calculations using options quotes from eTrade

The market-implied outlook for the next five months is highly symmetric, with similar probabilities of positive and negative returns of the same magnitude. The maximum probability corresponds to a price return of +1.9%. The annualized volatility derived from this distribution is 33%, which is moderate for an individual stock.

I was quite surprised that the forward estimate of volatility was not higher, given the large recent drop in RIO. RIO’s volatility over the past month scales to an annualized 46% (calculated using daily closing prices). The trailing 6-month annualized volatility is 35%. Options prices suggest that the recent month’s higher volatility is an anomaly. This is a positive sign because falling volatility indicates that the market’s confidence in RIO is firming up.

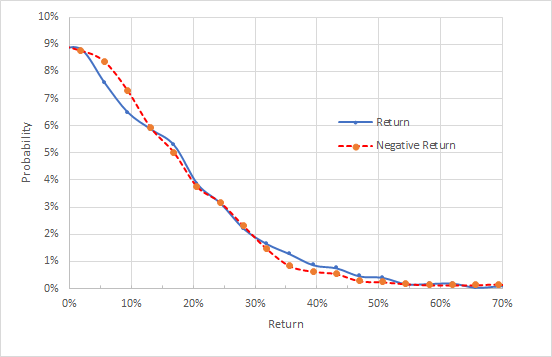

To make it easier to directly compare the probabilities of positive and negative returns, I look at a version of the market-implied outlook for which the negative return side of the distribution is rotated about the vertical axis (see below).

RIO: Market-implied outlook for 5M period, today to Jan. 21 2022

The negative return side of the distribution is rotated about the vertical axis (Source: author’s calculations using options quotes from eTrade)

The options market assesses almost identical probabilities of positive and negative returns (the red dashed line and the solid blue line lie almost on top of one another). In theory, a neutral outlook from the options market would correspond to a somewhat elevated probability of negative vs. positive returns because risk-averse investors tend to pay more than fair value for put options which protect against losses.

A symmetric market-implied outlook, as we see here, is therefore a somewhat bullish indicator from the options market. The slightly higher probability of negative returns vs. positive for smaller-magnitude changes (from 0% to 12% in the chart above) is small enough that I don’t see it as meaningful.

Summary

Evaluating RIO, a huge metals miner and producer, depends on outlooks for metals prices, global trade and economic recovery from COVID. The analyst coverage, while limited, is bullish and the expected price appreciation for the stock over the next twelve months is about 40%.

The market-implied outlook is also moderately bullish and the expected (annualized) volatility derived from the options market is 33%, not terribly high for an individual stock. The P/E is low compared to historical levels and the dividend yield is above 9%. Income investors should remember, however, that dividends from ADRs tend to be less persistent and predictable because many foreign companies are less committed to steady dividend appreciation than U.S. firms and, of course, dividends paid by ADRs are impacted by fluctuations in currency exchange rates.

If we assume that the expected price appreciation for RIO is half what the analysts predict, a 20% expected return for a stock with annualized volatility outlook of 33% is still attractive. And, of course, there is also the substantial dividend income.

While RIO has some downward momentum going, both the equity analysts and the options market indicate a favorable view for Rio Tinto. My overall rating for RIO is bullish.