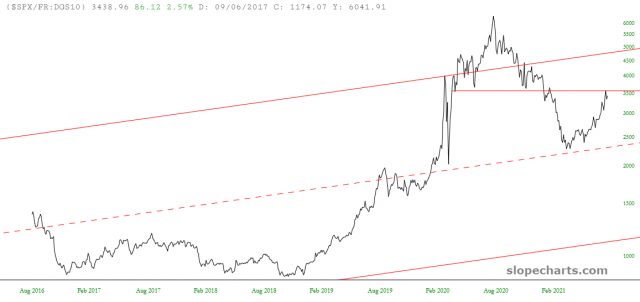

Some of you may recall an interesting ratio chart that I examine from time to time: this is the cash index divided by the interest rate. Over the course of many years, it has followed a channel pattern with remarkable precision.

SPX/FR Ratio Chart

A few months ago, I was troubled by the fact that this ratio had traveled down to its midline, which strongly suggested support and, therefore, a strong equity market. Well, my fears have been fully realized, as this close-up view illustrates. However, take careful note of where the ratio price is now: right up against an important resistance line, which formerly provided the role of support.

SPX/FR Ratio Chart

Looking at the Fibonacci Retracement levels from this same recent peak-to-trough, you can see how we are approaching a major 38.2% resistance level as well (emphasized here with the darker blue line).

SPX/FR Ratio Chart

And just to drive the point home one similar way, below is as ratio chart of two similar instruments to the pair above: in this instance, it is the Invesco S&P 500® Equal Weight Technology ETF (NYSE:) and the iShares 7-10 Year Treasury Bond ETF (NASDAQ:). We can see a superb channel here also and, surprise, surprise, present price levels are mashed right up against resistance.

RYT/IEF Ratio Chart

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.