Chinese global trade platform Powerbridge Technologies (NASDAQ:) stock has started to breakout on heavy volume as a meme stock. This small-cap stock provides software and technology solutions to companies engaged in global trade operations in China. The geopolitical tensions in the backdrop between the U.S. and China are a cause for concern, but shares are reflecting improvement in relations especially as China is cracking down on its own companies like rideshare giant Didi Global (NYSE:). The customers are import and export companies and manufacturers. Powerbridge Technologies platform helps organizations enable more streamlined and easier global trading. The Company enables both software-as-a-service (SaaS) and blockchain-as-a-service (BaaS) offerings. Logistics, port and border trade, data intelligence, smart customs and cross border e-commerce are some of the additional features that the platform empowers. The Company continues to grow and expand as a supply chain solutions provider for organizations in China or doing business in China. Risk tolerant investors seeking to benefit from the recovery in the global supply chain disruption can watch for opportunistic pullbacks in shares of Powerbridge Technologies.

Fiscal 1H 2020 Earnings Release

On Dec. 3, 2020, Powerbridge released its fiscal first-half 2020 for the six months ended December 2020. The Company reported a gross profit increase of $26.2% year-over-year to $5.7 million. Net loss decreased (-93.5%) to $0.02 million YoY. Revenues rose 12.9% to $14.5 million YoY. Powerbridge Technologies Co-CEO, Stewart Lor stated:

“We are pleased with our results for the first half of 2020 as our revenues increased 12.9% over the first half 2020 as compared against the revenue for the first half 2019. This demonstrates that our team is working hard to expand market share throughout the economic slowdown due to COVID-19. We witnessed a rebound in gross margins as we continue to improve our service efficiency. Our technology team continues to develop and launch new products and services to address the pain points and inefficiencies in global trade compliance, logistics and operations. We are confident that we will continue to grow in the rest of 2020 and upcoming 2021 despite the post-pandemic uncertainty.”

Mr. Lor, continued:

“We are grateful for the shared enthusiasm our investors have for our existing trade solutions business and opportunities in out-of-home digital display advertising and media business. We look forward to engaging this new business with partners and accelerating our revenue growth. We plan to utilize our Big Data platform to drive our media business, supported by our capabilities in data collection, data analytics and data display. We look forward to increasing our awareness and communications with shareholders as we seek to build long term shareholder value.”

Data Risk Monitoring Platform at Nanning Customers

On July 24, 2021, Powerbridge launched the Powerbridge Big Data Risk Monitoring Platform at Nanning Customs as part of its Smart Customs initiative. Nanning Customs encompasses cross-border trade across 26 ports and marketplaces along the 497 miles. The platform enables customers agents to monitor and manage a number of regulatory and operational risks pertaining to cross-border customs declarations. The platform integrates sophisticated machine learning algorithms to automate AI-powered data analytics. Powerbridge Technologies CEO Ban Lor stated, “We are pleased that our big data platform is now successfully launched at Nanning Customs. The platform significantly enhances the level of risk control and prevention, a challenge faced by many customs agencies today, in real time. We are aggressively bringing this product across China to help customs authorities effectively manage their regulatory and operational risk control. We believe our series of smart big data solutions will be a significant contributor to our continued revenue growth.”

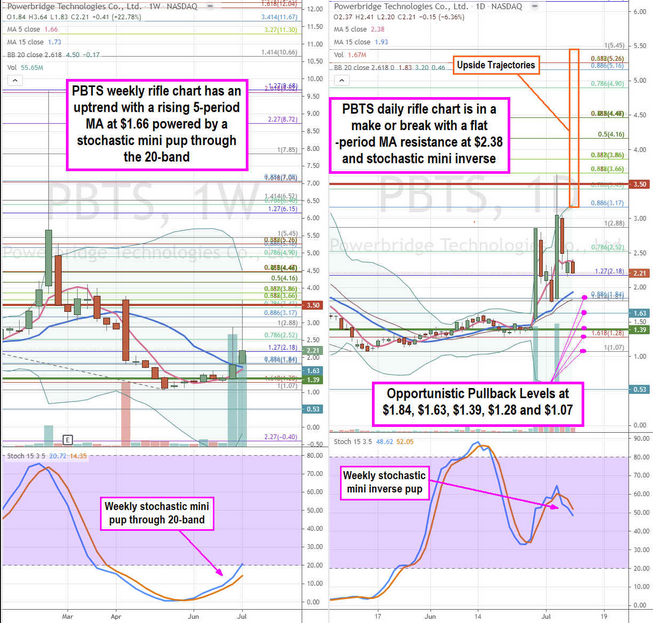

PBTS Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for PBTS stock. The weekly rifle chart breakout has a rising 5-period moving average (MA) at $1.66 Fibonacci (fib) level. The 15-period MA is rising at $1.73. The weekly upper BBs sit at $4.50. The weekly market structure low (MSL) triggered on the breakout through $2.32. Although this is a micro-cap meme stock, the weekly stochastic has a bullish mini pup slowly grinding through the 20-band. The daily rifle chart is in a make or break with flat 5-period MA at $5.12 and a rising 15-period MA at $3.96. The daily stochastic crossed down but is stalled for either a cross back up or a mini inverse pup down towards the 15-period MA. Speculators can monitor for opportunistic pullback levels at the $4.23 fib, $4.02 fib, $3.50 fib, $3.20 fib, $2.48 fib, and $2.13 fib. Upside trajectories range from the $6.70 fib level up to the $10.10 fib.