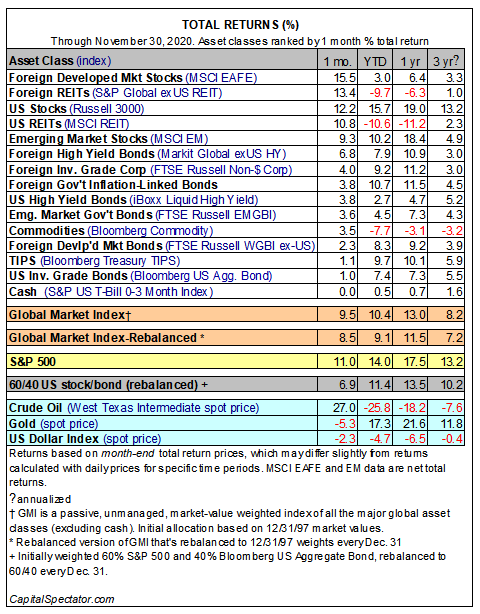

November was unusually kind to risk assets. For a third month this year, all the major asset classes rallied. From the smallest of fractional increases in cash (a gain of one basis point) up to the dramatic 15%-plus rally in stocks in foreign developed markets, a bullish wave lifted all boats last month—again, following across-the-board increases in May and July.

The iShares MSCI EAFE (NYSE:EFA), a measure of developed-market shares ex-US, led the way. After two straight monthly declines, EAFE’s 15.5% surge (net total return) marked the biggest monthly gain in 30 years.

The wide-ranging advances have nearly banished red ink from the return profiles in recent history. For the year-to-date results, only three slices of the major asset classes are underwater: foreign property shares, US real estate investment trusts and broadly defined commodities. Otherwise, everything has rallied so far this year.

US stocks are the top performer in 2020 with one month left to the year. The Russell 3000 is up 15.7%, comfortably ahead of the rest of the field.

GMI Total Returns

GMI Total Returns

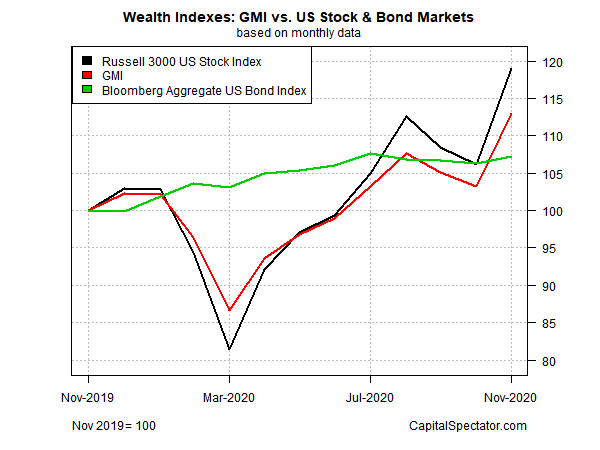

The strong, across-the-board gains in the major asset classes delivered a sharp increase to the Global Market Index (GMI). This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, surged 9.5% in November. The increase is the highest monthly gain for the index over its history, which starts in January1998.

For the trailing one-year window, GMI is also up sharply, posting a 13.0% total return. GMI’s increase is still well behind the 19.0% one-year increase for US stocks (Russell 3000) but well ahead of the US investment-grade bond market’s 7.3% gain, based on the Bloomberg US Aggregate Bond Index.

GMI Vs US Stock & Bond MarketsOriginal Article

GMI Vs US Stock & Bond MarketsOriginal Article