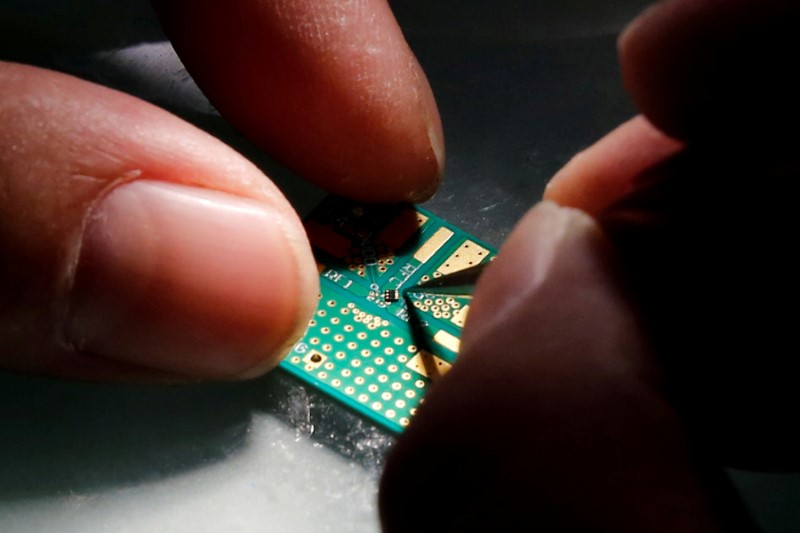

© Reuters. FILE PHOTO: A researcher plants a semiconductor on an interface board during a research work to design and develop a semiconductor product at Tsinghua Unigroup research centre in Beijing, China, February 29, 2016. REUTERS/Kim Kyung-Hoon

© Reuters. FILE PHOTO: A researcher plants a semiconductor on an interface board during a research work to design and develop a semiconductor product at Tsinghua Unigroup research centre in Beijing, China, February 29, 2016. REUTERS/Kim Kyung-HoonBy Sharay Angulo

MEXICO CITY (Reuters) – Mexico’s main autopart association INA forecasts that the severe semiconductor chip shortage that has slammed the brakes on the global auto industry will subside in July and return to normal by the end of this year.

Semiconductor chips are a crucial component for electronics in modern cars, including touchscreen displays as well as driver assist and other safety systems.

The chip shortage in North America alone has caused the region’s carmakers to cut previously expected output by 1.16 million vehicles in May, a figure that has accelerated each month since the start of the year, according to data from IHS Markit.

INA’s head of foreign trade, Alberto Bustamante, forecast in an interview on Thursday that the semiconductor shortage will begin to ease by the second half of July before returning to normal in December.

The supply crunch began last year as the coronavirus pandemic forced the North American auto industry to shut down for a couple of months, which kicked off a cascading series of order cancellations.

Bustamante pointed to steadily growing vaccination rates in major economies and ebbing infections as helping drive a return to normal for the auto sector.

He noted that after Mexico’s autoparts output dropped 20% last year in value terms due to the pandemic, a nearly 18% uptick is expected this year to reach $92.4 billion in production value. A full recovery to pre-pandemic levels is forecast by 2022.

Mexico’s massive auto sector is the country’s top foreign currency earner, and employs more than 850,000 people.

Bustamente predicted that by 2023, the value of the country’s autopart production will likely exceed $102 billion, fueled by a revamped North American trade pact that incentivizes more regionally-produced content, among other factors.

Every vehicle assembled in the United States includes up to $5,500 in Mexican-made parts, he said.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.