Nearly every slice of global markets fell in trading for the week through Friday, Sep. 17, based on a set of ETFs. The looks set to spill over into this week, triggered by fears over Chinese property developer Evergrande’s escalating liquidity crisis, which is rippling through markets on Monday, Sep 20.

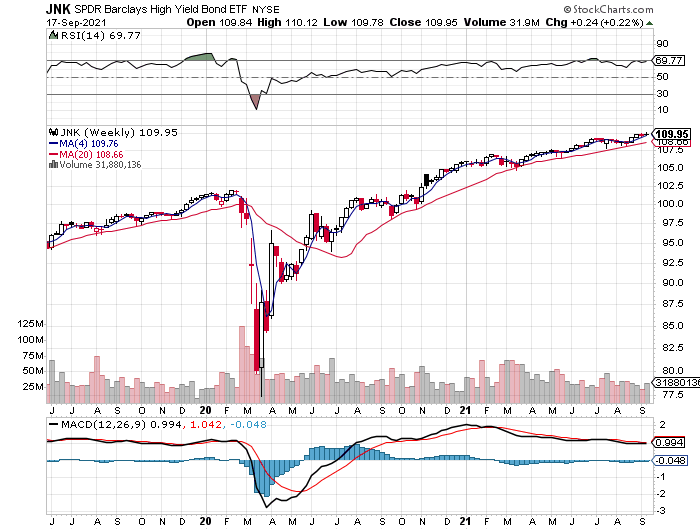

In last week’s trading, US junk bonds posted the only gain for the major asset classes. SPDR Bloomberg Barclays High Yield Bond ETF () edged up 0.2% last week, closing on Friday near a record high.

Although the yield spread for junk bonds over Treasuries is close to a record low, the desperate search for yield in an unusually low-rate environment overall has kept investors snapping up low-grade fixed-income securities.

Meanwhile, companies issuing junk are responding with ever-greater supply. The Wall Street Journal reports that new issuance is on track for a record year in 2021.

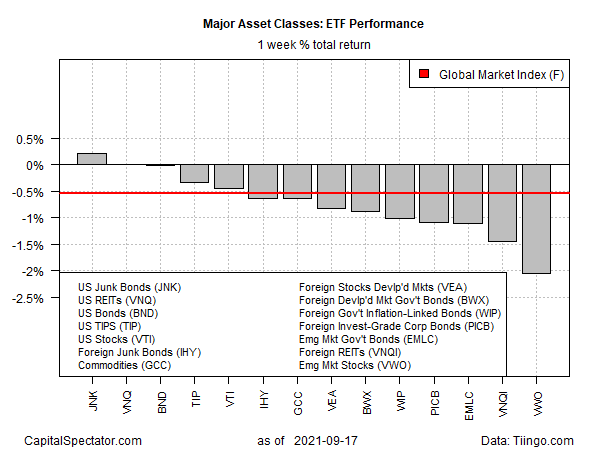

Otherwise, the major asset classes were on the defensive last week as most markets fell. The biggest setback: stocks in emerging markets. Vanguard FTSE Emerging Markets (NYSE:) fell for a second straight week, losing 2.1%.

A benchmark portfolio that holds all the major asset classes continued falling last week. The Global Market Index (GMI.F) slipped 0.5%. This unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights via ETF proxies.

Major Asset Classes ETF Performance Weekly Total Returns

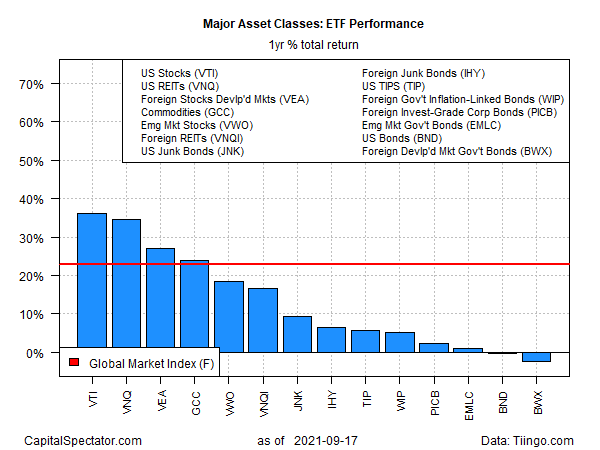

Monitoring the major asset classes via the one-year window still paints an upbeat profile with US shares holding on to the lead. Vanguard Total US Stock Market () closed on Friday with a sizzling 36.1% total return.

At the opposite end of the performance spectrum: foreign government bonds in developed markets (in US dollar terms) via SPDR Bloomberg Barclays (LON:) International Treasury Bond (), which is down 2.3% over the past 12 months on a total-return basis.

GMI.F’s one-year performance: a strong 23.0%.

Major Asset Classes ETF Performance Yearly Total Returns

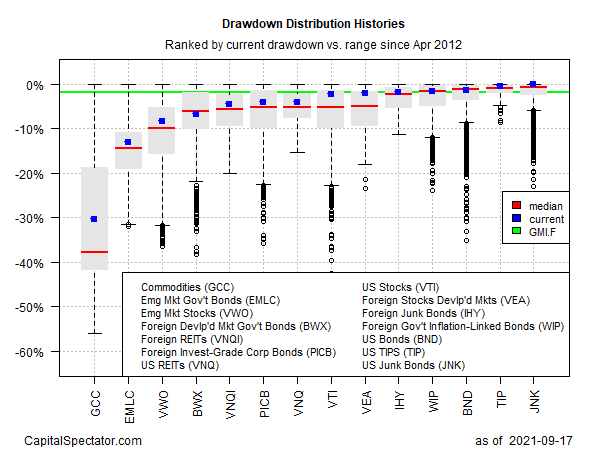

Profiling the major asset classes in terms of current drawdown continues to show most markets with low to nil declines relative to the previous peaks. The main exceptions: commodities () and stocks and bonds in emerging markets ( and , respectively).

GMI.F’s current drawdown is a modest -1.9%.

Drawdown Distribution Histories