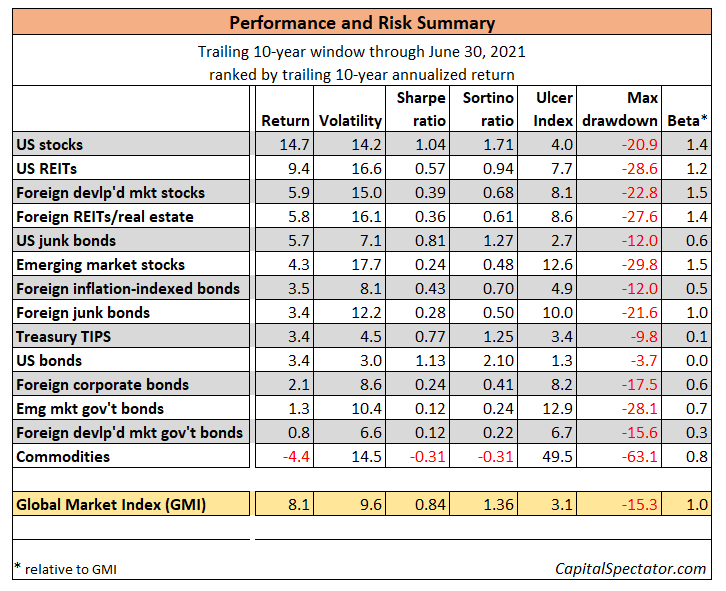

Risk-adjusted performance for the Global Market Index (GMI) continued to push higher in June, based on the annualized Sharpe ratio (SR) for a rolling ten-year window via monthly data.

GMI’s 10-year SR increased to 0.84, the highest in 18 months. A Sharpe ratio of 1.0 equates with return matching risk (return volatility). Higher (lower) Sharpe ratios indicate higher (lower) risk-adjusted performance.

GMI-Sharpe Ratio Monthly Data Chart

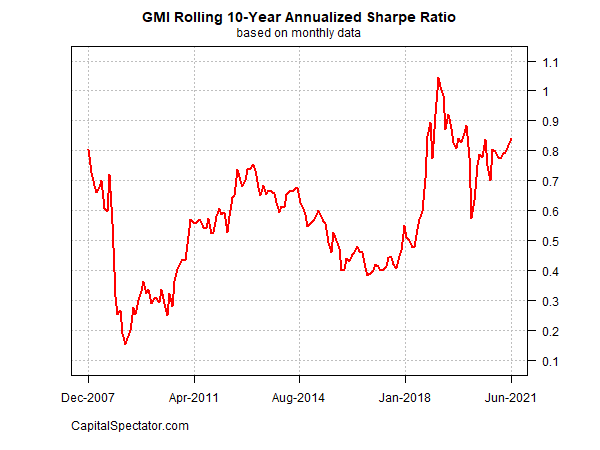

Meanwhile, GMI continues to enjoy a zero drawdown. June marks the fifth straight month of a nil peak-to-trough decline.

GMI Monthly Drawdown Based On Monthly Data

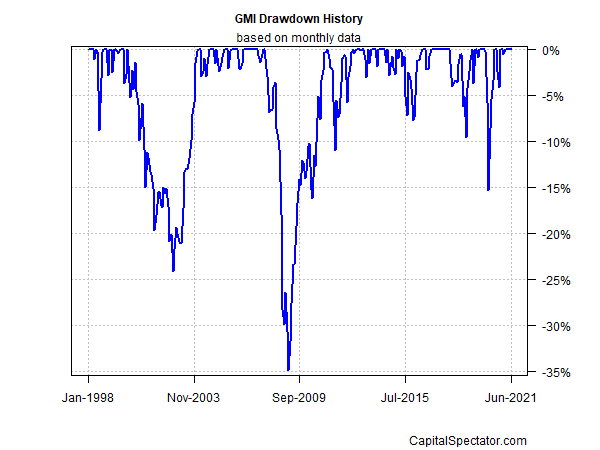

GMI is an unmanaged, market-value-weighted portfolio that holds all the major asset classes (except cash) and represents a theoretical benchmark of the “optimal” portfolio. Using standard finance theory as a guide, this portfolio is considered an optimal strategy for the average investor with an infinite time horizon. Accordingly, GMI is useful as a baseline to begin research on asset allocation and portfolio design. GMI’s history suggests that this benchmark’s performance is competitive with active asset-allocation strategies overall, especially after adjusting for risk and trading costs.

For additional context, the table below presents additional risk metrics for GMI and its underlying asset classes on a trailing 10-year basis.

Here are brief definitions of each risk metric:

Volatility: annualized standard deviation of monthly return

Sharpe ratio: ratio of monthly returns/monthly volatility (risk-free rate is assumed to be zero)

Sortino ratio: excess performance of downside semivariance (assuming 0% threshold target)

Ulcer Index: duration of drawdowns by selecting negative return for each period below the previous peak or high water mark

Maximum Drawdown: the deepest peak-to-trough decline

Beta: measure of volatility relative to a benchmark (in this case GMI)

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.