Iconic clothing brand Levi Strauss (NYSE:) stock is performing strong during the reopening phase post-pandemic. The Company has clearly emerged from the pandemic as a stronger and more e-commerce oriented organization. The acceleration of COVID vaccinations should continue to build momentum. The pandemic bolstered its direct-to-consumer (DTC) channel mainly through digital channels resulting in a strong recovery and continue strength as brick and mortar stores reopen. Management was able to cut expenses, hoard cash during the pandemic while bolstering its DTC and digital channels on the tails of its 167-year iconic brand awareness to exceed pre-pandemic levels. The shift to casual wear during lockdowns was a large tailwind which investors may fear is coming to an end. Prudent investors who missed the rally last year can look for opportunistic pullbacks to get back into Levi Strauss shares.

Q2 2021 Earnings Results

On July 8, 2021, Levi Strauss reported their fiscal Q2 2021 results for the quarter May 2021. Non-GAAP EPS was $0.23, beating consensus analyst estimates by $0.14. Topline revenue growth was up 156.5% year-over-year (YoY) to $1.28 billion versus the $1.21 billion analyst estimates. Gross margins hit records at 58.8% driven by higher direct-to-consumer net revenues, price increases, sourcing savings, lower promotions, and more full-price selling. Ecommerce from all digital channels grew 75% YoY. Ecommerce penetration rose to 23% of total sales. Levi’s CEO Chip Bergh stated:

“We generated strong momentum in the second quarter with the accelerated recovery of our revenues and delivered growth across all regions and channels. This was underscored by the strength of our brands and our ability to capitalize on evolving denim trends and a continued shift to casualization. As we move into the second half of 2021, we are focused on emerging stronger with our strategic priorities of leading with our enduring brand, accelerating our direct-to-consumer connections, and diversifying across categories, channels, and geographies.”

Upside Guidance

Levi Strauss raised guidance for fiscal full-year 2021 to be in the range of $1.29 to $1.33 versus $1.15 consensus analyst estimates. The Company expects 2H 2021 revenue growth of 27% to 29% versus the current consensus of 24% resulting in a 4% to 5% growth versus 2019. Levi’s also increased the quarterly dividend to $0.08 per share from $0.06 per share. Levi’s CFO Harmit Singh commented:

“We significantly exceeded our expectations on revenue, adjusted gross margin, and adjusted EBIT. Revenues in most markets are recovering faster than anticipated, and we are emerging from the pandemic with sustainable and improved structural economics.”

Conference Call Takeaways

Levi Strauss CEO Bergh set the tone:

“Our results reflect the enduring power of our brand in a time when consumers are seeking out authenticity from companies that reflect their own values. In addition to seeing strong denim and casualization trends, we are also benefiting from the ongoing execution of our strategic initiatives. And we are excited to see consumers returning to our stores as markets reopen with sequentially improving traffic trends. While the pandemic continues to impact our business, we are encouraged by accelerated revenue recovery in the quarter with all regions and channels growing versus prior year and compared to Q2 2019 reported revenues are down only 3 points. The recovery was led by the U.S. and sales exceeded Q2 2019 levels in more than 10 markets across the globe, including China.”

He noted this was the third quarter of consecutive record gross margins. He continued:

“In our DTC channel, we’ve continued to accelerate our omni-channel capabilities to ensure that our consumers can get product wherever and whenever they choose. Our company-operated e-commerce business grew 42% on a reported basis, a great result considering we were lapping strong growth in the prior year.”

Does DTC Cannibalize Brick and Mortar?

CEO Bergh all addressed investor’s concerns of DTC drop-off as stores reopen:

“We were particularly pleased that the growth rate remains strong even as brick-and-mortar stores reopened in the second quarter. We’re investing in leading technology and expanding our fulfillment capabilities. And earlier this month, our largest distribution center in Henderson, Nevada became our first owned-and-operated facility to fulfill orders for e-commerce, retail and wholesale channels.”

He concluded on the subject of data-driven predictive analytics:

“In terms of digitizing our own business, we are transforming the way in which we plan with AI now forecasting initial demand for each product next season. Results from our first wave test showed that AI-driven demand forecasting improved accuracy. So, scaling it should enable more precise inventory investment, lead to less markdowns and clearance, prevent waste, and enhance sustainability, all of which will improve our margins. This will be powerful in combination with the ongoing work AI has been contributing to pricing and promotion.”

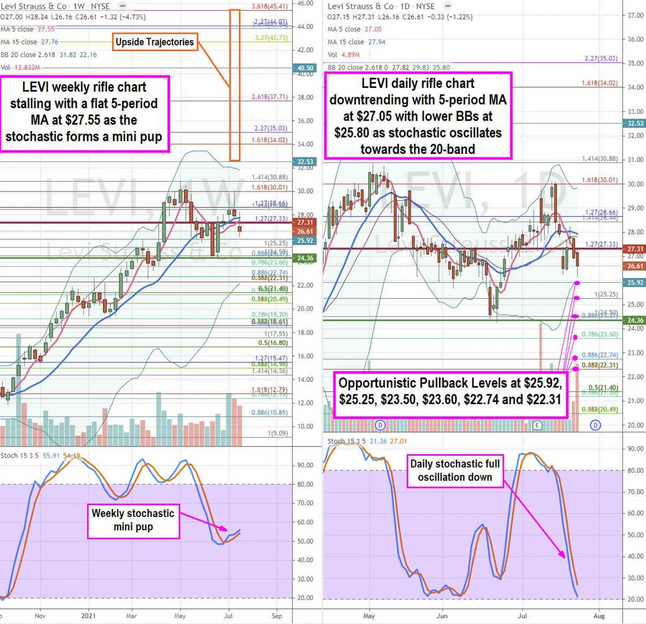

Levi Strauss Stock Chart

LEVI Opportunistic Pullback Levels

Using the rifle charts on a weekly time and daily time frames provides a precision view of the landscape for LEVI stock. The weekly rifle chart has a strange rising 5-period moving average (MA) and flattening 15-period MA on a downtrend. The weekly stochastic has a stochastic mini pup. The strong resistance sits near the $30.01Fibonacci (fib) level. The weekly Bollinger Bands (BBs) have been compressing at $27.55 upper BBs and $22.16 lower BBs. The weekly market structure high (MSH) sell triggers under $27.31. The daily rifle chart is in an active downtrend with a falling 5-period MA at $27.05 with lower BBs at $25.92. The daily market structure low (MSL) buy triggered on a breakout above the $24.36 level. Prudent investors can monitor for opportunistic pullback levels are at the $25.92 fib, $25.25 fib, $23.50 fib, $23.60 fib, $22.74 fib, and the $22.31 fib. Upside trajectories range from the $32.53 level up to the $45.41 fib level.