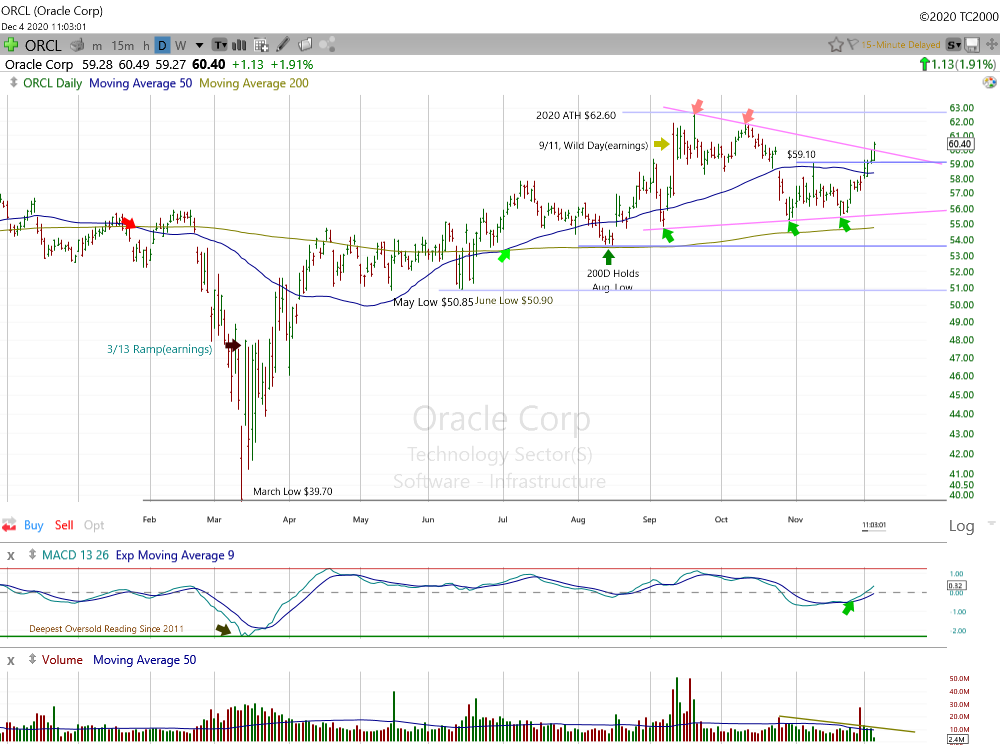

Oracle Corp Daily Chart.

Oracle Corp Daily Chart.

Ahead of next week’s earnings report (Dec. 9) shares of Oracle (NYSE:ORCL) are beginning to perk up. The stock has been consolidating since mid-September as it battled heavy resistance near the old highs: http://thisweekonwallstreet.com/orcl-4/. The September peak was printed shortly after ORCL’s wild post earnings action on Sept. 11.

ORCL is piercing a key overhead trendline (links Sept/Oct highs) as the week comes to a close. The stock has a very solid foundation in place as it works on a fourth straight higher monthly low. We believe an upside resolution to the current consolidation pattern is looking very likely. Certainly one to watch next week.

Some levels to watch ahead of next Thursday’s news include this week’s low. A close below the $57.00 area would be a clear warning sign. The $59.00 (November high) to $58.35 area (50-day moving average) is a nearby support zone.

Note: We are long ORCL in some managed accounts.

You can read Gary S. Morrow's original post here.

Leave a comment