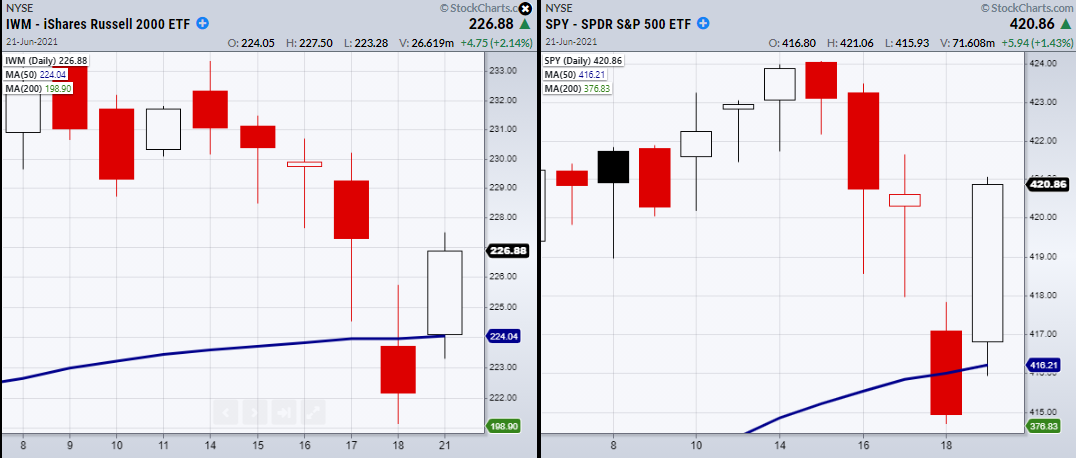

Friday, the major indices including the small-caps via iShares Russell 2000 ETF (NYSE:) and via SPDR® S&P 500 (NYSE:) closed underneath their 50-Day moving average.

However, on Monday, both reversed and ended the day above their 50-DMA.

With Friday’s weak price action, any bearish traders who decided to short these indices based on a break of the 50-DMA would now be underwater in their trades.

For this reason, we follow a simple rule to confirm price breaks under or over major moving averages. The rule is to wait for the price to close for 2 consecutive days under/over the 50-DMA. Often, price can temporarily dip or clear a pivotal MA before reversing.

With that said, no trading rule is perfect, and you risk getting a subpar entry or sometimes completely missing the trade if there is a large gap in price the next day.

However, in the long run, it will pay for itself as there are many times when price action will trap traders before running in the opposite direction.

Some quick tips to make the rule more powerful from a trading perspective would be to watch how strong the 2 closes are and if they stay near the 50-DMA or continue to push away from it.

A second close near the MA shows that price action could still be indecisive and therefore waiting might be the next best plan.

This can help time your entries to make sure you do not get chopped or whipsawed in the market.

ETF Summary

- S&P 500 (SPY) Filled gap to 419.23. Support 414.70.

- Russell 2000 (IWM) 221.13 support.

- () 332.68 support.

- () 342.80 pivotal area.

- (Regional Banks) 64 support.

- (Semiconductors) bounced off 244.77 the 50-DMA.

- (Transportation) 254.65 support.

- (Biotechnology) Needs to hold 159 area.

- (Retail) Did not confirm caution phase. 91.57 support.

- Volatility Index () 32.35 the 10-DMA.

- Junk Bonds () 108.94 support. 109.57 resistance.

- (Utilities) 63.17 support.

- (Silver) 23.92 pivotal.

- (Small Cap Growth ETF) 278.34 support.

- (US Gas Fund) 35.85 resistance.

- (iShares 20+ Year Treasuries) 142.22 support the 10-DMA.

- (Dollar) Watching to hold the 200-DMA at 91.50.

- (Lithium) 66.17 support.

- (Agriculture) 17.67 support with 18.40 resistance.

- (Gold Trust) 164.87 new support.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.