As readers may already know, Germans head to the polls on Sunday September 26 to elect a new Bundestag, or federal parliament. In all likelihood, two or three parties will have to form a coalition after the initial results to decide who will succeed Angela Merkel, who is standing down after 16 years as chancellor.

In the lead up to the hotly-contested election, we’re sharing a series of articles analyzing how major markets may react under different scenarios. Over the last few weeks, we’ve covered the possible implications for the , the , Germany’s , and . Today we’ll examine the potential consequences for major German stocks like SAP (NYSE:) (DE:), Volkswagen (OTC:) (DE:), and Siemens (OTC:) (DE:).

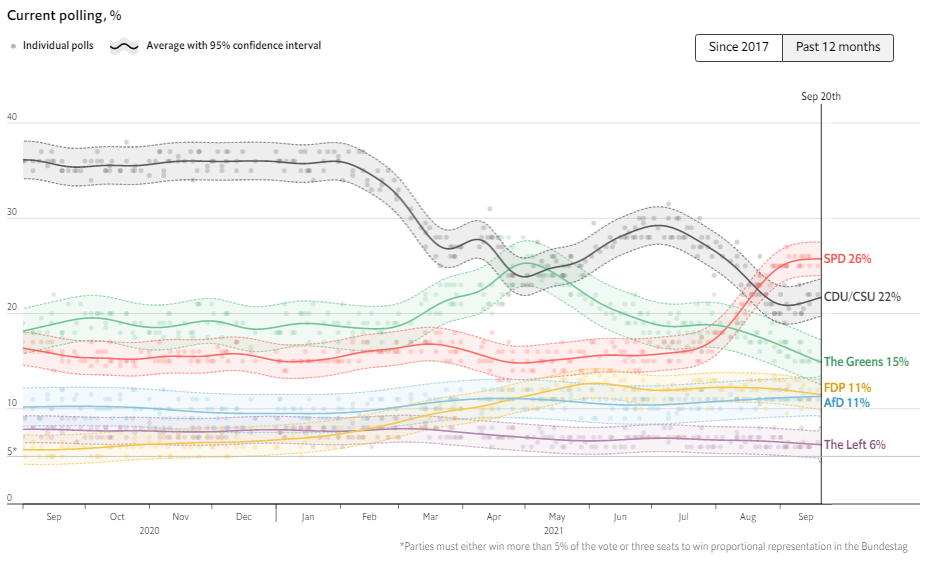

After more than a decade and a half of rule by Merkel’s conservative Christian Democratic Union / Christian Social Union (CDU/CSU) party, the polls are pointing to a tightly-contested race between the CDU/CSU, the center-left Social Democratic Party (SPD) and the liberal Green party:

Source: The Economist

Below, we explore the possible implications for major German stocks under coalitions led by each of these three parties, though of course the coalition partner(s) will also have a major impact on policies and the market’s reaction:

1. An SPD-led coalition

With a marginal, but potentially narrowing, lead in the polls as we go to press, a coalition led by the center-left SPD is the most likely scenario. As a more left-leaning party than the established CDU/CSU, an SPD-led coalition could be a relatively bearish development for German stocks, as the party has advocated for raising minimum wages, raising taxes, and supporting “labor” at the expense of “capital” at the margin.

While the SPD’s corporate policies have not been fully fleshed out, other left-leaning European parties have put tech giants in their regulatory crosshairs, so the outlook for SAP in particular will be worth watching closely if Olaf Scholz is able to carry the SPD to victory. Of course, the likelihood of more liberal-leaning policies getting enacted will depend on the coalition partner(s) and their priorities.

2. A CDU/CSU-led coalition

Angela Merkel will be a tough act to follow, and that responsibility may well fall on Armin Laschet, the premier of North Rhine-Westphalia, Germany’s most populous state. With the CDU/CSU and SPD seemingly at odds after eight years of a coalition, a CDU/CSU victory later this month would likely result in a new coalition and a conservative shift in policy.

All else equal, this may be a bullish outcome for large German conglomerates like Siemens and multinational manufacturers like Volkswagen, with a lower likelihood of higher taxes, additional regulations, and labor reforms. That said, if a CDU/CSU victory leads to Germany isolating itself and avoiding deeper integration with the rest of Europe, it could weigh on the other companies in the index as time moves along.

3. A Green-led coalition

It’s said that markets absolutely hate uncertainty, and a victory by the left-leaning Green party, led by Annalena Baerbock, would certainly introduce a heavy dose of uncertainty into Germany’s politics. The party advocates for an ambitious climate-change policy, widespread public investment, and deeper European integration, all of which could increase costs for German businesses. Therefore, a Green-led coalition could well be the most bearish election result for major German stocks at least in the short term. If this scenario emerges, traders may be especially worried about the outlook for Volkswagen, which has a checkered environmental track record dating back to the emissions scandal in 2015.

While the above outlines three different high-level scenarios to watch, along with the potential implications for certain key German stocks, there are countless permutations of coalitions that traders will have to sift through in the wake of the election.