Shareholders in the fantasy sports platform DraftKings (NASDAQ:) have had solid returns so far in 2021. Year-to-date, DKNG stock is up about 12%. But that metric tells only half the story about the widely followed shares of the digital sports entertainment and gaming company.

Since seeing a record high of $74.38 in March, DKNG stock has lost more than 25% of its value. It now hovers around $53.54.

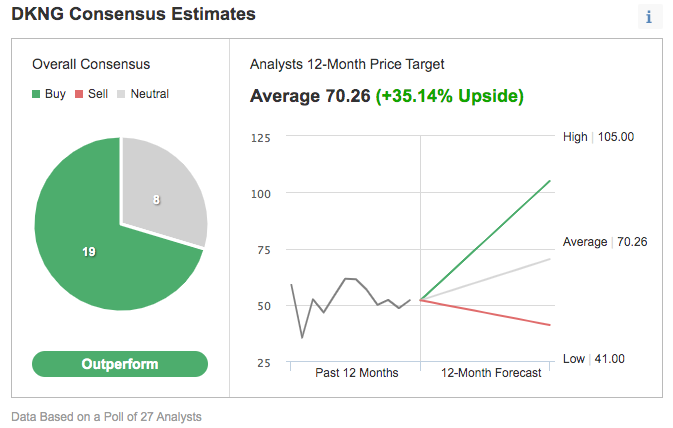

Yet, in terms of a 12-month price forecast, according to 27 analysts polled by Investing.com, the median target for the fantasy sports heavyweight is $70.26, implying a return of about 34%.

Chart: Investing.com

So, today, we look at how bullish investors might consider selling cash-secured put options on DKNG stock. Such a trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own DraftKings shares for less than their current market price of $53.54, at the time of writing.

We previously the detailed mechanics of cash-secured put selling using Exxon Mobil (NYSE:) stock. Readers who are new to put selling may want to consider reviewing that article.

How Q2 Earnings Fared

DraftKings began life in 2012 as a daily fantasy sports platform, and went public in April 2021 at an opening price of $20.49.

Recent metrics highlight:

“Global demand for fantasy sports market size, in terms of revenue, was worth of US$20.69 billion in 2020 and is expected to reach US$48.07 billion by 2027, growing at a CAGR of 12.8% from 2021 to 2027.”

DraftKings’ business model further benefited from a 2018 ruling by the U.S. Supreme Court, which struck down a federal law, namely the Professional Amateur Sports Protection Act. As a result, all 50 states got the green light to organize related sports betting, which was limited to just a number of states prior to May 2018.

DraftKings released on Aug. 6. Its revenue of $298 million showed an increase of 320% from a year ago. Analysts paid close attention to Monthly Unique Payers (MUPs) for the Business-to-Consumer (B2C) segment. MUPs increased 281% compared with Q2 2020.

On average, around 1.1 million MUPS a month engage with the platform. As a result, the Average Revenue per MUP (ARPMUP) came in at $80, showing a 26% increase year-over-year.

Analysts concur that DraftKings is one of the leading names to benefit from increased legalized sports betting in the U.S. Therefore, DKNG stock could potentially find a place in growth-oriented portfolios. However, there is likely to be short-term volatility in DKNG shares. Therefore, potential investors should do further due diligence before hitting the “buy” button.

Selling Cash-Secured Puts On DKNG Stock

Investors who write cash-secured puts are typically bullish on a stock during the timeframe that extends to the option expiry date. They generally want one of two things. Either to:

- Generate income (through the premium received by selling the put); or

- Own a particular stock, but find the current market price per share (i.e., $53.54 for DKNG now) higher than what they’d like to pay.

A put option contract on DraftKings stock is the option to sell 100 shares. Cash-secured means the investor has enough money in their brokerage account to purchase the security if the stock price falls and the option is assigned.

This cash reserve must remain in the account until the option position is closed, expires or the option is assigned, which means ownership has been transferred.

Let’s assume an investor wants to buy DKNG stock, but does not want to pay the full price of $53.54 per share. Instead, the investor would prefer buying the shares at a discount within the next six to 10 weeks.

One possibility would be to wait for DraftKings stock to fall, which it might or might not do. The other possibility is to sell one contract of a cash-secured DKNG put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) DKNG put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let’s assume the trader is putting on this trade until the option expiry date of Oct. 15. As the stock is currently $53.54, an OTM put option would have a strike of 50.00. So the seller would have to buy 100 shares of DraftKings at $50.00 if the option buyer were to exercise the option to assign it to the seller.

The DKNG Oct. 15, 2021, 50-strike put option is currently offered at a price (or premium) of $2.95.

An option buyer would have to pay $2.95 X 100, or $295 in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future, i.e., until or on the day of expiry. This put option will stop trading on Friday, Oct. 15.

Risk/Reward Profile For Unmonitored Cash-Secured Put Selling

Assuming a trader would enter this cash-secured put option trade at $53.54, at expiration on Oct. 15, the maximum return for the seller would be $295, excluding trading commissions and costs.

The seller’s maximum gain is this premium amount if DKNG stock closes above the strike price of $50.00. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of DraftKings stock is lower than the strike price of $50.00) any time before or at expiration on Oct. 15, this put option can be assigned. The seller would then be obligated to buy 100 shares of DKNG stock at the put option’s strike price of $50.00 (i.e., at a total of $5,000).

The break-even point for our example is the strike price ($50.00) less the option premium received ($2.95), i.e., $47.05.

This is the price at which the seller would start to incur a loss.

On a final note, the calculation of the maximum loss assumes the put seller was assigned the option and purchased 100 shares of DraftKings at the strike price of $50.00. Then, in theory, the stock could fall to zero.

If the put seller gets assigned the option, the maximum risk is similar to that of stock ownership but partially offset by the premium (of $295) received.

Bottom Line

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This strategy can be a way to capitalize on the choppiness in DKNG stock in the coming weeks.

Those investors who end up owning DraftKings shares as a result of selling puts could further consider setting up to increase the potential returns on their shares. In other words, selling cash-secured puts could be regarded as the first step in stock ownership.