A discussion with a reader prompted me to take a closer look at the trends in “expected” sector growth rates for the S&P 500 for 2021.

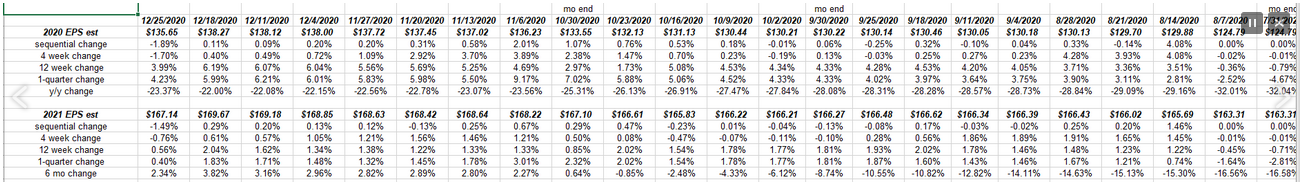

First, here is the trend in the calendar year 2021 S&P 500 top-down estimate, with rates of change for various periods.

2020-2021 EPS Estimates

2020-2021 EPS Estimates

The above table shows the trend in the 2020 and 2021 S&P 500 calendar year (top down) estimates per IBES data by Refinitiv.

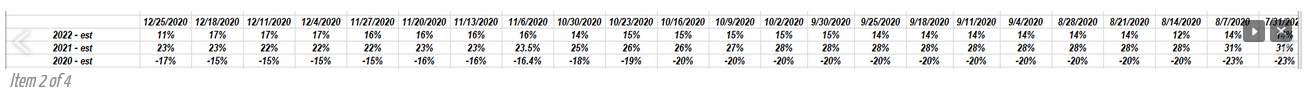

S&P 500 Estimated Y/Y Growth

S&P 500 Estimated Y/Y Growth

This second table above shows the “expected” y/y growth rates for the S&P 500 for 2020-2022.

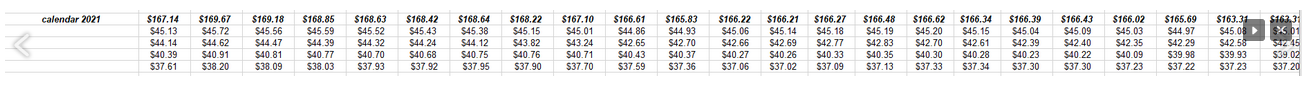

SP 500 Dollar Estimate Trend

SP 500 Dollar Estimate Trend

This third table shows the top-down S&P 500 dollar estimate trend and—underneath—the bottom-up estimates for the 4 calendar quarters for 2021.

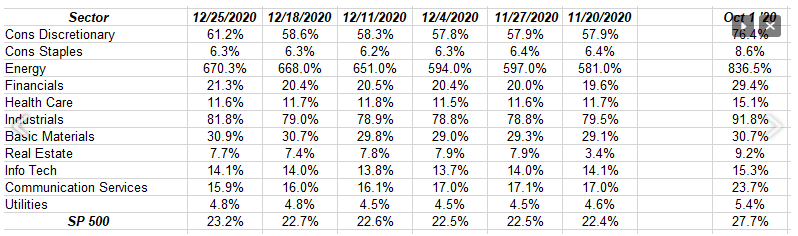

Now, let’s look at the changes for expected growth rates by sector for the S&P 500 for 2021:

S&P-500 2021 Sector Growth Rates

S&P-500 2021 Sector Growth Rates

This table—using using old editions of This Week in Earnings from Refinitiv—shows the last 6 week progression in expected growth rates for the 11 S&P 500 sectors.

What sticks out for 2021 as of today?

Technology: The Tech sector grew earnings 6% y/y from 2019, despite the S&P 500 expected full-year EPS falling 15%, and all of this is before 4th quarter earnings starting or due out beginning January 10th or so. In 2021, the S&P 500 is expected to grow full-year EPS +23%, while the Tech sector is expecting relative earning growth underperformance at +14%. Is this why Tech—particularly the Big 5 FAAMG—has gone cold since September 2nd, 2020? This could be one reason.

Energy / Basic Materials: The trend in expected growth rates for both sectors for 2021 looks very positive. However Energy and Basic Materials are subject to wild revisions, post earnings. Some Energy Select Sector SPDR® Fund (NYSE:XLE) was bought for clients about 4 weeks ago in a few accounts, but it was quickly exited as the explosion in EV (electric vehicles) is not a positive for long-term crude oil demand. For “value” investing, I’ll use Financials and old Pharma. Every time I buy an Energy or commodity company for clients—like Greg Norman from the 1980’s PGA Tour—I start to get the “yips.” There is the old debate about buying a pure commodity ETF versus the publicly-held company whose operations are very sensitive to price changes of that commodity i.e. Phelps-Dodge and copper, Newmont Mining (NYSE:NEM) and gold, etc. Both these sectors are now less than 5% of the S&P 500 market cap, whereas just 6-7 years ago, both sectors would have been close to 20% of the benchmark’s market-cap weight.

Staples / Health Care: Both are probably rock-solid for 2021 given the growth rate trends. Expected growth rates have been very stable for both sectors for next year.

Financials: Obviously, the assumption of buybacks by the Fed for big banks is a plus. Expect the big banks and brokers to announce their repurchase plans for 2021 with Q4 ’20 earnings. The Financials usually start reporting first of all the major sectors and then finish first. By mid-January, we’ll know what Financial sector guidance looks like for 2021. The Financial sector EPS growth for 2021 is expected to be inline with the S&P 500’s expected EPS growth next year.

Summary / conclusion: An article on the use of forward S&P 500 earnings data as a “market-timing” tool is long overdue, but I would caution readers to NOT use this site as a strict market-timing device, simply because market corrections and recent recessions have been caused or catalyzed by very different events. The classic business cycle recession has been gone for decades.

The expected 2021 sector growth rates shown above could change dramatically over the next 30 days, particularly as earnings start and company managements begin giving guidance for 2021.

One scenario for 2021 might be that the stocks that were crushed in 2020 i.e. airlines, cruise lines, Energy, basic commodities, Industrials—all of whch face very easy comps in the 2nd and 3rd quarter of 2021—might demonstrate better relative strength than the companies like Zoom Video Communications (NASDAQ:ZM). Think of what Zoom’s “compares” will look like for 2021 after the summer of 2020.

That is simply one perspective, too. Some airline stocks have already rallied nicely.

Take everything you read here with a grain of salt and substantial skepticism. All of this data changes daily and with 2020 evolving as it did, think how rapidly the data changed, and how badly the sell-side analysts missed the 2nd and 3rd quarter, 2020 results. There were substantial upside surprises in EPS and revenue when the 2nd and 3rd quarter of 2020 reports started being released.

Leave a comment