Several interesting companies will be posting earning this week. Here’s a look at a few.

Oracle (NYSE:), being “old tech” is up 31% TYD and beat the by roughly 600 bps last year, as value gets a bid.

Lennar (NYSE:) will be an interesting earnings report. has softened and with labor as hard to find as it is, it will be interesting to see Lennar’s margins. No question housing demand is robust though and this housing rally is supply driven, (lack of supply) not necessarily price or credit driven as 2008 turned out to be.

According to IBES data, here’s a ranking of Q2 ’21 sector revenue growth:

- : +90% y/y growth expected vs Q2 ’20’s actual of -55%

- : +31.3% y/y expected vs q2 ’20’s actual rev growth of -15.1%

- : +29.1% y/y expected vs -11.6% in q2 ’20 last year

- : +25.1% y/y growth expected vs -24.8% actual revenue growth in q2 ’20

- : +19.6% y/y rev growth expected, vs -5.4% actual rev growth in Q2 ’20

- : +16.7% y/y growth expected, vs +4.8% actual revenue growth in Q2 ’20

- : +14.4% y/y growth expected, vs +3.7% revenue growth in Q2 ’20

- : +14.3% revenue growth expected, vs -7.0% revenue growth in Q2 ’20

- : +8.1% y/y revenue growth expected, vs -0.5% revenue growth in Q2 ’20

- : +6.8% y/y revenue growth expected, vs -6.3% revenue growth in Q2 ’20

- : -5.5% y/y revenue growth expected vs +5.9% revenue growth in Q2 ’20. (These numbers seem bizarre. Obviously reserve rollbacks and stock repurchases will help EPS, but didn’t expect financial sector to see 5.5% decline in revenue y/y.) For some perspective, Financials EPS growth is expected to be +45% as of last week, for full year ’21.

S&P 500 revenue growth in total is expected to be +18% in Q2 ’11 versus -8.7% in Q2 ’20.

In Q3 ’21, the current S&P 500 revenue estimates anticipate +11.5% y/y growth, up 200 bps or 9.5% since mid-April ’21.

Since 2012, the “average” actual revenue growth for the S&P 500 per quarter is 2.4%, so the 3rd quarter’s expected 11.5% (and still being revised higher) is a good sign.

S&P 500 data by the weekly metrics

- The forward 4-qtr estimate (forward 4-quarter sum of quarterly S&P 500 earning estimates) rose again last week to $191.93, vs the previous week’s $191.52 and the Dec. 31, 2020 estimate of $159.02

- The PE ratio on the forward estimate is 22.13x

- The drop in the last week from 1.56% to 1.46% despite the print actually pushed valuation measures a tad lower

- The S&P 500 earnings yield declined by one bp again to 4.52% from 4.53% the previous week, and 4.23% as of Dec. 31, 2020.

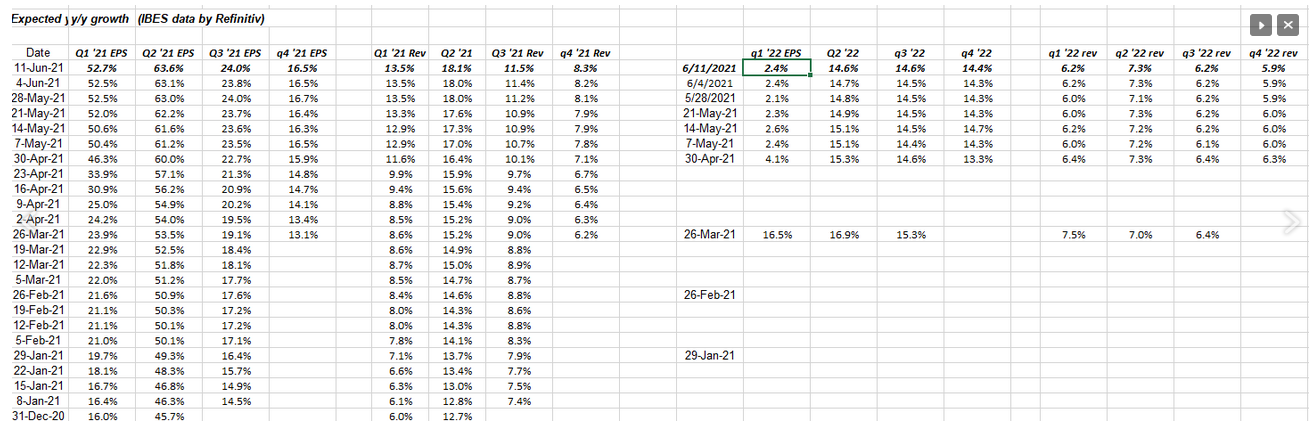

Growth rate revisions by quarter

Data source: IBES by Refinitiv

Click to expand the worksheet. Ignore the cursor, it’s just there to torture me as it floats around whatever spreadsheet is being worked on.

Note the upward revisions to 2021 EPS and revenue by quarter, but also note the early look at 2022 to the right. 2022 is already looking to be above average, in terms of S&P 500 EPS and revenue growth, but it’s a little early to hang your hat on that. Usually after 3rd quarter earnings releases, analysts get a little braver with their following year forecasts and models.

The 2021 EPs and revenue growth rate revisions are still a positive.

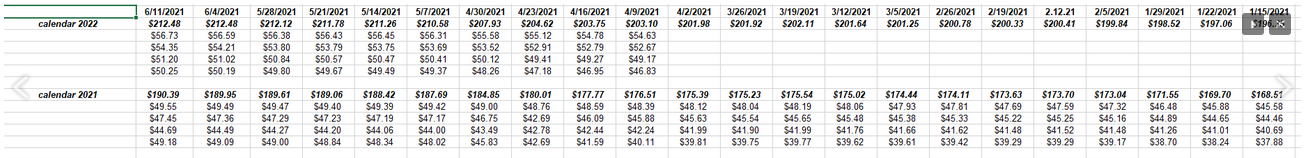

The “forward 4-quarter” EPS curve

Data source: IBES by Refinitiv

This is my own concoction of S&P 500 EPS data by quarter and year. Readers haven’t seen it in a while. but note the “12-week rate of change” which is as strong as ever.

Expect the sequential and 54-week rates of change to slow over the next 4 weeks until Q2 ’21 earnings start to get released.

This data is still trending higher.

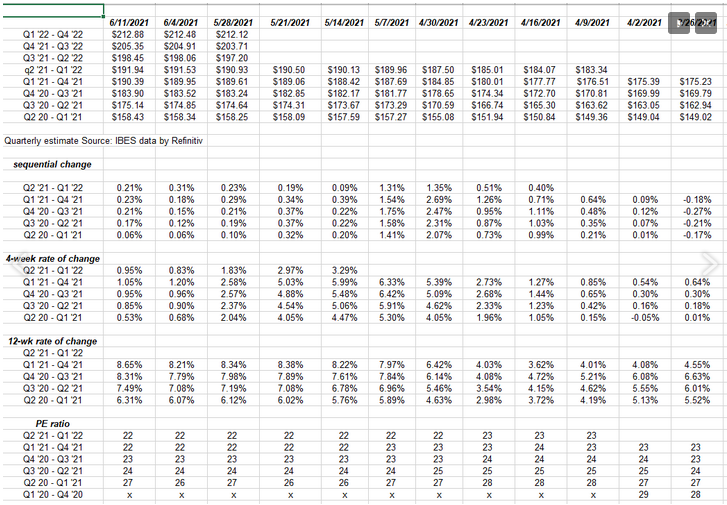

S&P 500 calendar 2021 S&P 500 EPS estimate

Source: IBES by Refinitiv.

We promised readers to keep you updated on the Q2 ’21 bottom-up quarterly estimate, which above is second row from the bottom, first column.

Note how the Q2 ’21 quarterly is STILL $5 shy of the Q1 ’21 quarterly estimate, which will probably rise over $50 by the end of June ’21.

The analysts are still too cowed.

2021 COULD see every quarterly EPS print over $50 per share for each quarter, which means the calendar estimate of $190 for the week, was still likely too low.

The Q2 ’21 quarterly estimate is probably going to rise above $50 (easily) when earnings reports start in mid-July and by mid-August should be headed towards $55. Q2 ’21 is the weakest compare versus last year.

In my opinion the calendar 2021 estimate will likely easily hit $200 per share by late summer, and if Washington doesn’t get stupid with tax hikes, the year will be firmly above $200.

Summary/conclusion

The record high in the S&P 500 last week was made in so-so breadth and little enthusiasm, since it seemed like investors were bored with gradually higher S&P 500 closes.

We’ve expanded some of the metrics being tracked just to see what can be learned at turning points.

If there is one thing about the last 20 years, very few recessions have been “business cycle” recessions, which means that typical earnings analysis might not, and even probably won’t, “predict” the turn. Only in September, 2018’s fourth quarter correction, which eventually led to Jerome Powell changing his tune Christmas week of 2018, did the data tracking top slightly ahead of the correction.

The Treasury market action last week and the 10-Year Treasury yield decline from 1.56% to 1.46%, despite the spike in inflation data, means that all should remain sanguine for the stock market for the foreseeable future. The Fed meeting this week—despite all the angst over tapering—will probably be a sleeper.

With infrastructure, the cap gains tax and the estate tax still up in the air, it seems unlikely the FOMC will change anything about their stance.

Take everything you read here with substantial skepticism and a healthy grain of salt. Markets can change very quickly, particularly corrections in the markets. Invest based on your own financial profile and your ability to handle volatility.

With the headline tonight and the 2022 calendar EPS estimate, you have to always hedge your bets and allow for a sliver of doubt.

Overconfidence can kill you quicker than COVID.