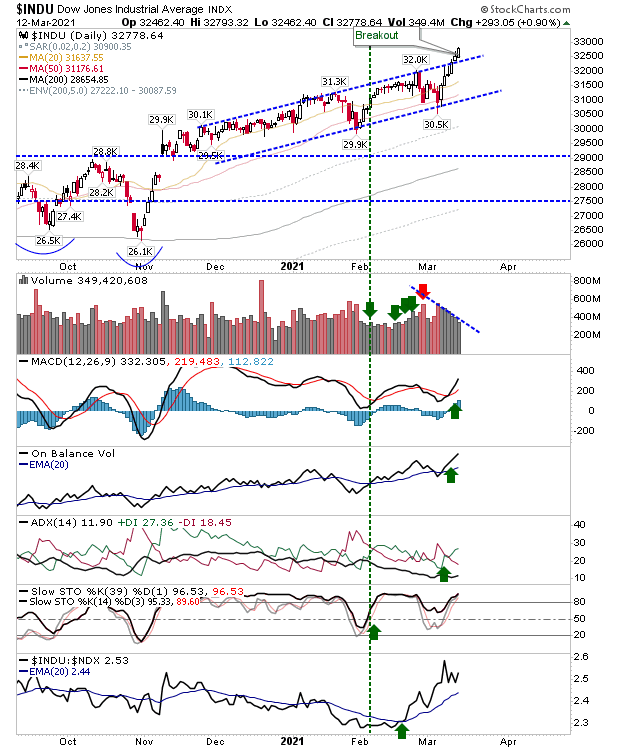

The last couple of days have seen the Dow Industrials Average grab my interest as it continues to ascend beyond channel resistance to new all-time highs. Technicals are all net bullish with the index sharply outperforming the NASDAQ 100; only volume disappoints (a little).

INDU Daily Chart

INDU Daily Chart

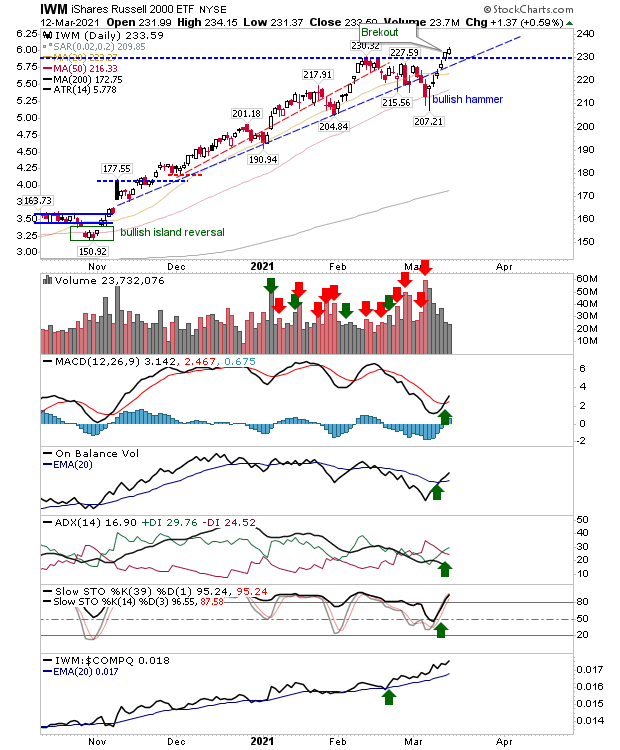

The Russell 2000 (via IWM) has also made it to new all-time highs with technicals suitably bullish. Like the Dow Industrials Average, this is an index seeing falling volume at new highs—which isn't great—but price is the lead.

IWM Daily Chart

IWM Daily Chart

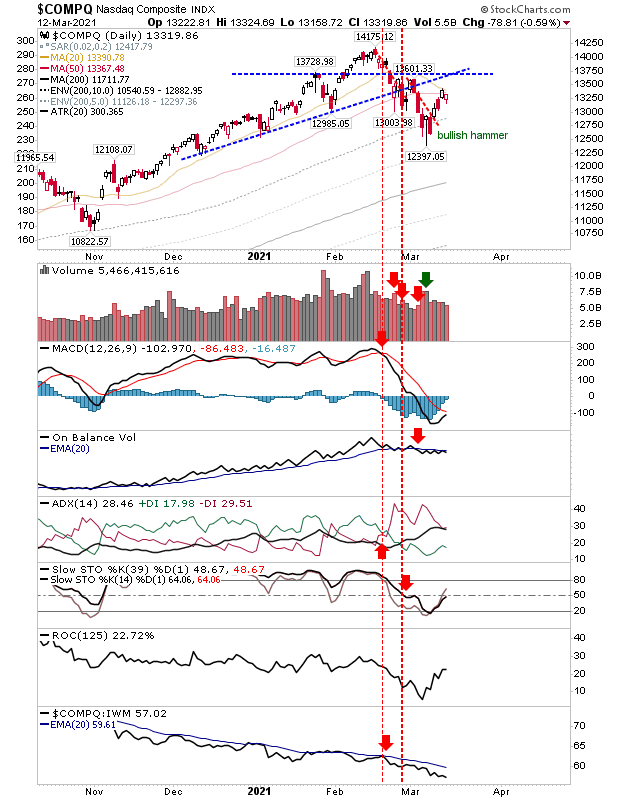

The NASDAQ rebounded off its 20-day MA in modest action. Technicals are still net negative as it remains some way off its highs.

COMPQ Daily Chart

COMPQ Daily Chart

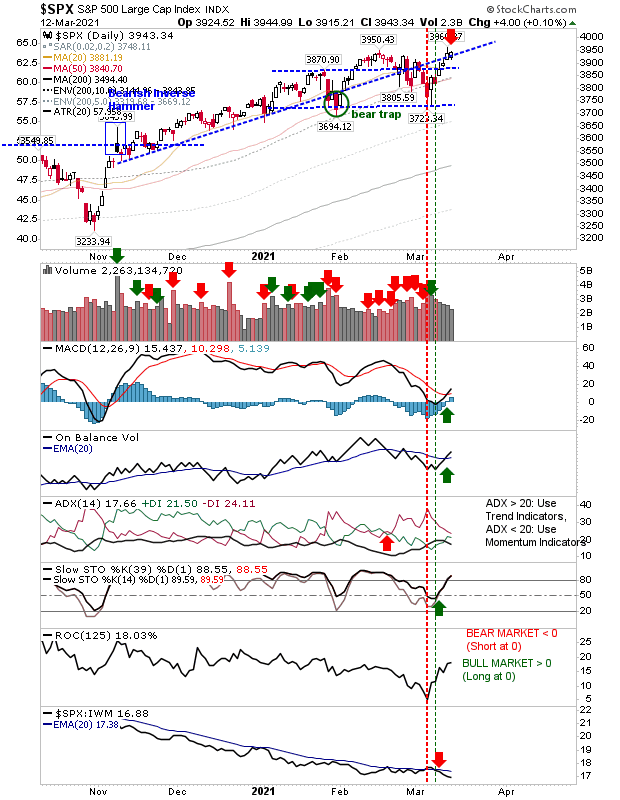

The S&P is up against resistance in a possible double top, but as the Dow Jones Industrial Average has handily pushed beyond its last swing high, the expectation would be for the S&P to follow suit to new highs. I have marked it as a possible top at resistance, but today has its opportunities.

SPX Daily Chart

SPX Daily Chart

For today, the S&P sits at a pivot between a breakout or a potential double top. With Large Caps favoring a breakout and the Russell 2000 pushing new highs, the likelihood of the S&P heading higher is the more probable outcome.

Leave a comment