We first wrote about Cboe Global Markets (NYSE:) less than eight months ago. The had already recouped all its COVID selloff losses and was hovering at new all-time highs. CBOE, in contrast, was still down 30% from its 2018 record, trading below $97 a share.

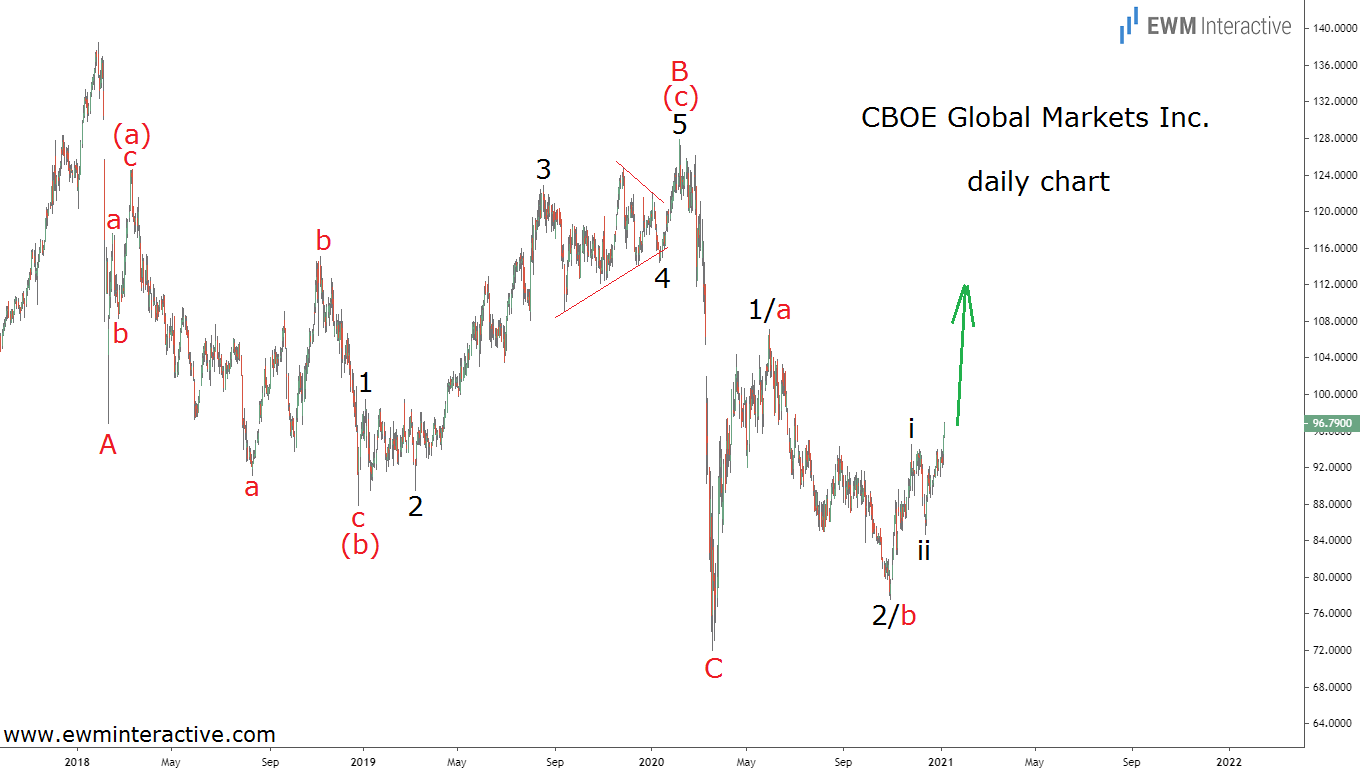

For some reason, the market was ignoring the company’s sound balance sheet and cash flow generating abilities. We saw this as an opportunity to snatch up shares in the world’s leading options exchange at an attractive price. However, there was more than just good fundamentals to our decision to join the bulls. The Elliott Wave chart below, shared with our readers on Jan. 8, 2021, suggested CBOE was on the verge of a 30%+ surge.

CBOE ‘s daily chart revealed that the 48% drop from $138.54 to $72.01 was a simple A-B-C zigzag correction. What made the labeling a little tricky was the structure of wave B, which was an expanding flat correction. Waves (a) and (b) were both simple a-b-c zigzags, where wave (b) made a new low. Wave (c) – an impulsive recovery to $127.93 – completed wave B in February, 2020. Then, the coronavirus panic dragged CBOE to barely above $72.

Elliott Wave Analysis Put CBOE Investors Eight Months Ahead of the Rumor

The time between January 2018 and March 2020 was definitely not an easy one for CBOE shareholders. The first quarter of 2020 must have been especially painful. On the other hand, once a correction is over, the larger trend resumes. In a sense, that selloff planted the seeds of the rally that followed.

CBOE stock has been making higher highs and higher lows for the past eight months. On Aug. 18, it surged 12% to a new all-time high of $139 after the Financial Times wrote that CME Group (NASDAQ:) was preparing to acquire the company for ~$150 a share. Naturally, traders tried to pocket the spread between the market price and the supposed acquisition price. Unfortunately for them, CME quickly denied the report, prompting CBOE stock to close down for the day.

We don’t know if CBOE is eventually going to be acquired or not. The Elliott Wave structure of the post-March 2020 recovery, however, suggests the bulls are not ready to give up yet. It appears a sequence of fourth and fifth waves can lift the stock to $150 a share on its own.