It’s a shopping extravaganza this week as retailers line up to report.

The fun starts tomorrow when Walmart (NYSE:) steps to the plate. Before that, focus this morning appears to be on the Fed, China and Afghanistan. Data showed the Chinese economy growing a little slower than analysts had expected, which is one factor putting pressure on crude this morning.

China’s factory output and retail sales growth slowed sharply in July, Reuters reported, as new COVID outbreaks and floods disrupted business operations. This, following some other soft numbers recently, has some analysts worried that the recovery there is losing momentum.

All this is happening thousands of miles away, but the ramifications could be big for the world’s economy, considering China is such a powerful force. Energy sector firms might feel some pressure today if demand worries keep crude on its heels. Materials companies and multinationals with big business operations in China could also come under a bit of scrutiny.

Another thing thousands of miles away that appears to be weighing this morning is the collapse of Afghanistan. With that, potential for political conflict has ticked up a notch. Major U.S. indices are near all-time highs, so people are, shall we say, a bit more sensitive. It arguably doesn’t take as much to trigger selling.

Another thing to watch today is volatility, which rebounded pretty sharply overnight from last week’s lows and may reflect the Afghanistan news. It also could be building up in anticipation of Fed Chairman Jerome Powell participating in a town hall meeting tomorrow. This is one he’s doing with teachers and students, so it seems doubtful he’d make any major policy announcements. You never know, though.

As Earnings Approach Finish Line, Looking Back At Great Quarter

By now, pretty much everyone following the market must be aware what an outstanding Q2 earnings season we’ve had. A lot of the focus is on earnings per share, but remember that companies can manipulate income statements to make EPS cover up some other stuff. If you want a better look at exactly how much money is coming in, it’s hard to beat a look at the top line.

As of Friday, 91% of the companies in the S&P 500 have reported actual revenue numbers for Q2. Of these companies, 87% came in above the average analyst estimate, according to FactSet, with overall revenues averaging about 4.9% above expectations. The health care (97%), communication services (96%) and information technology (95%) sectors have the highest percentages of companies reporting revenue above estimates, FactSet said.

What’s really amazing is that when you look at the five biggest tech companies—Apple (NASDAQ:), Microsoft (NASDAQ:), Facebook (NASDAQ:), Alphabet (NASDAQ:) and Amazon (NASDAQ:)—their earnings climbed sharply in Q2, and that was without the benefit of easy COVID comparisons. Remember, these companies were generally doing great in Q2 of 2020, benefiting from the “stay at home” economy during the lockdowns. So unlike, say, financials and industrials—which were going through very tough times in Q2 2020 and had easy comparisons this time around—big tech didn’t have a built-in advantage and turned in a great performance despite that.

Walmart, Target And Other Retailers All Reporting This Week

The earnings parade continues this week with retail firms storming to the front lines. Walmart leads off tomorrow morning and analysts sound pretty optimistic about the quarter, though they note WMT is up against tough year-ago comparisons.

“Walmart U.S. sales growth may outpace Amazon’s total ‘online stores’ growth” thanks to added merchandise, same-day delivery and pickup, and other perks,” Bank of America (NYSE:) said in a recent note to clients. “We believe Walmart’s omni-channel transformation in the U.S. will continue to gain momentum, and support more sustainable and predictable positive same-store sales and traffic at U.S. supercenters and U.S. e-commerce,” the note said.

Others set to report this week include Target (NYSE:), Macy’s (NYSE:), Kohls (NYSE:), Lowe’s (NYSE:) and Foot Locker (NYSE:). Cisco (NASDAQ:) and Nvidia (NASDAQ:) also are scheduled to report in the days ahead.

In other company news, Tesla (NASDAQ:) was weak in overnight trading after the government opened a probe into its autopilot system. Also, watch shares of T-Mobile (NASDAQ:), which is investigating claims of a data breach involving millions of U.S. customers.

Summery Market Features Few Catalysts, Lots Of Questions

We may need some major new catalysts to recharge the market. Don’t be surprised, however, if there’s some profit taking in the near future. Nothing goes straight up forever, and it’s been a long time since the market had a 5% to 10% pullback. In fact, the Index has made new highs in 10 consecutive months. It’s hard to imagine that continuing endlessly, at least not based on history.

The bifurcation that we saw last week hasn’t gone away to start the new week. There’s mixed messages on COVID, reopening trends, inflation, and the Fed. While the major indices kept inching up last week and making new all-time highs, volume has been low, perhaps in part due to people being on summer vacations and kids still being out of school. Some of the kids go back this week, but for others it might not be until after Labor Day. By then, investors might have a better sense of Fed policy, because the central bank’s Jackson Hole symposium is next week.

The wild card is the Delta variant, which appears to be causing some people to rethink travel plans and dented crowds at restaurants in some states, media reports said. Anecdotally, a report in the Chicago Tribune last Friday said hotels in the city are starting to see Delta-related cancellations of business travel. That would be bad news for airlines, too, if it’s widespread. The airlines sounded a bit of an alarm about that same issue last week.

Maybe some of this contributed to a surprisingly weak Michigan sentiment print early Friday. It was the lowest since 2011 and a dramatic drop from the last reading. The bond market went bonkers on this one, as the 10-year yield fell about 9 basis points from its Thursday high to go back below 1.3%. There’s a cautious feeling about how quickly the economy can grow as Delta tightens its grip. The sudden weakness in yields isn’t good for financial stocks, either.

Watching Crude For Clues

One barometer of reopening is , which finished the old week on a soft note and continued to slide Monday. Though front-month futures did recover from three-month lows near $65 hit a week ago, they failed to test $70 a barrel and were below $68 early today. It looks like crude is finding a trading range between $65 and $70, which is relatively strong but a bit below the spring highs near $75. Looking at the charts, it seems pretty clear that crude’s ride higher got stopped in part by the emergence of Delta.

If you’re looking for catalysts, maybe Delta could be one of them. Obviously it could be a downside catalyst if more states and cities start announcing restrictions. But one possible upside on the Delta front would be if the U.S. Food and Drug Administration (FDA) approves vaccines for children or gives the vaccines official FDA approval (they’ve been available under emergency-use authorization), two things that haven’t happened yet.

Both Moderna (NASDAQ:) and Pfizer (NYSE:) shares rose last week when the FDA authorized a third shot for the vulnerable. Right now, one of the main things that could be causing people to be cautious about getting back out or to work or traveling is the fear of spreading the virus to their unvaccinated kids. Also, some people who are hesitant to get vaccinated have said lack of official FDA approval is a factor. Having said that, there’s no timetable on when the FDA might do either of those things.

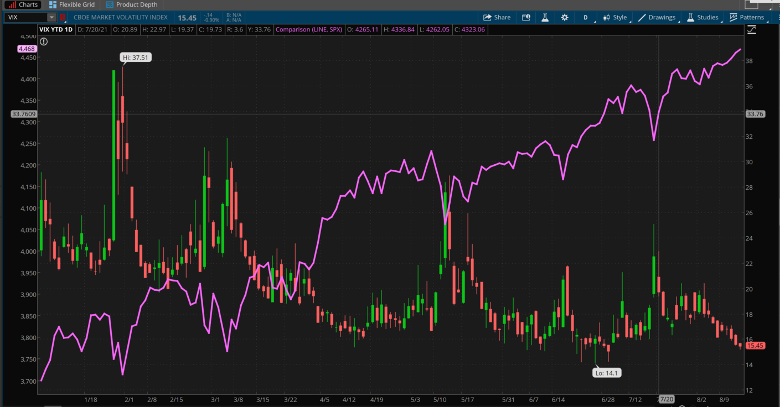

CHART OF THE DAY: SUNDAY MORNING EASY. The Cboe Volatility Index (VIX—candlestick) finished last week just above 15. That’s not far from its post-COVID low of 14.1 hit earlier this summer. A slow grind higher in the S&P 500 Index (SPX—purple line) with no major pullbacks in about a month probably helps explain the current low volatility, but remember that soft can sometimes be a contrarian indicator. Data sources: Cboe Global Markets (NYSE:), S&P Dow Jones Indices. Chart source: The thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

Higher Yields? No Prob! One interesting development lately is seeing both Apple and Microsoft gain a little ground despite the worse than expected producer price index (PPI) that came out last week. Back at the start of the year, both AAPL and MSFT fell sharply as worries about rising yields (which often accompany inflation) sapped their strength.

At the time, we pointed out that while yield gains can be tough for less mature Tech companies that still need to borrow their way to success, it’s not necessarily such a burden for the big bruisers that have decades of experience and piles of cash. It feels like investors may be starting to realize that. Of course, the 10-year yield dropped pretty sharply Friday after weak consumer sentiment data, but AAPL and MSFT mostly held the prior day’s gains. It almost feels like, “heads I win, tails you lose” for these two in recent months.

Tomorrow’s Shopping Trip: Consumers come back into focus this week not only due to WMT and TGT earnings, but also thanks to July retail sales due first thing tomorrow. After some wild swings earlier this year, retail sales the last few months have settled down a bit but still haven’t shown much of a trend one way or another. The 0.6% rise in June compared with a 1.7% decline in May and a slight gain in April.

One thing worth thinking about when you see retail sales is to look beyond the headline number, which includes the very expensive automobile category that can skew the overall view. For instance, June was a very soft month for auto sales, and that arguably kept the headline figure artificially low. With autos excluded, retail sales in June would have been up 1.3%. Some leading categories in June included electronics and appliance store sales, along with “miscellaneous store retail sales.” That’s a category that lumps a lot of smaller stores together, including florists, used merchandise stores, and pet supply stores as well as other store retailers, the Bureau of Labor Statistics says. Tomorrow we’ll see if the trend lasted into July.

VIX in Hibernation—For Now: Maybe it’s the summer dog days taking hold, but volatility quickly sank last week to near its lowest levels of the year. The dropped to near 15 (see chart above), which was the lowest level since early July and close to the lightest amount of volatility since COVID struck 18 months ago. The low for the year is 14.1, perhaps a level to keep an eye on this week. As we’ve noted before, sometimes a low VIX in and of itself can be a contrary signal, pointing to possible turbulence ahead.

That may sound counter-intuitive, but volatility can be like a sleeping bear. It looks peaceful, but if you wake it up, things can get ugly in a hurry. Seasonally, volatility tends to pick up in the fall, and the futures complex reflects that. By mid-September, the Cboe futures market looks for a VIX of just below 20, rising to 21 by November. Those aren’t historically high levels of volatility, but typically VIX hasn’t gone above 20 lately except in times when the water got pretty rough for stocks, like that mid-July selloff after the Fed meeting. If there’s a possible near-term trigger for increased volatility, look no further than the Fed’s Jackson Hole symposium next week. VIX popped up above 17 this morning.

Disclaimer: TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.