Combined EEM And S&P 500 Monthly Chart.

The emerging markets were the place to be for investors in the early 2000s. BRIC (Brazil, Russia, India, China) was all the rage, and investors desire to include exposure to these countries lead to a strong performance for emerging markets.

That is, until the 2008 financial crisis. At that point, things turned messy. And the iShares MSCI Emerging Markets ETF (NYSE:) spent more than a decade underperforming the .

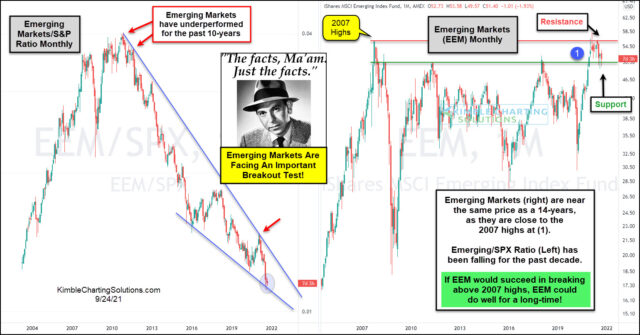

Today’s chart highlights this and more. Above are monthly charts highlighting the Emerging Markets ETF (EEM) performance on the right, along with its relative performance versus the S&P 500 on the left.

As you can see, EEM’s performance versus the S&P 500 has been in decline for the past 10 years. And EEM finally tested its 2007 high earlier this year at (1), meaning its near the same price as it was at 14 years ago.

But not all is lost. EEM is facing important breakout test.

If the EEM can succeed in breaking out above the 2007 highs, it woll likely get back on track and begin to win over investors once more.

So keep an eye on those 2007 highs. And stay tuned.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.