The word “bubble” gets thrown around a lot in the financial markets. The definition that investors use for a bubble is often pretty loose as people like to go for the shock value of calling something a bubble. I think it’s important to recognize the difference between overvalued and a bubble. Assets get overvalued all the time. It’s just a normal part of the trading environment. A bubble would be when something gets so excessively valued that it disconnects from the fundamentals of the asset.

The definition of a bubble, according to Investopedia, is as follows:

“Typically, a bubble is created by a surge in asset prices that is driven by exuberant market behavior. During a bubble, assets typically trade at a price, or within a price range, that greatly exceeds the asset’s intrinsic value (the price does not align with the fundamentals of the asset. Bubbles are usually only defined and studied in retrospect after a massive drop in prices occurs.”

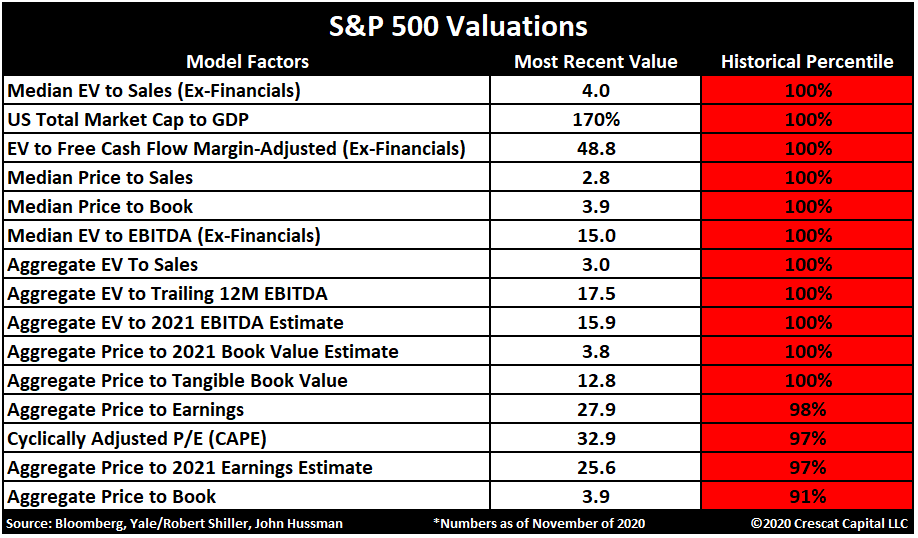

And that brings us to today’s topic: are the equity markets today in a bubble? They certainly qualify as overvalued, maybe even excessively valued if you’re measuring things by traditional fundamental metrics.

By almost any widely accepted metric, stocks are at the tip-top of their long-term historical range. Some will argue that the current ulta-low rate environment supports higher stock valuations. That notion has proven to be historically correct, but do current rates support this high of a valuation premium. Perhaps.

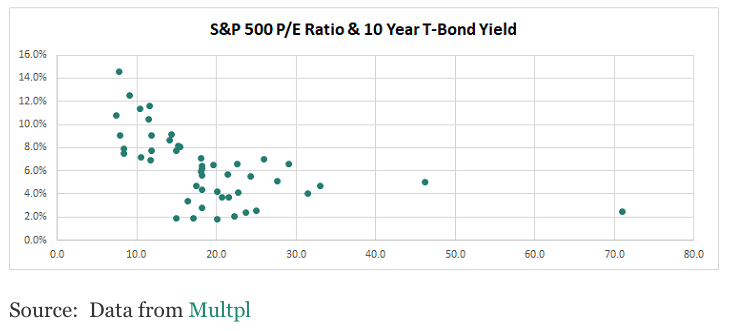

SPX P/E Ration and UST10Y Yield

SPX P/E Ration and UST10Y Yield

There’s a relatively limited dataset from where the P/E ratio on the S&P 500 gets above 25, but there is definitely an inverse correlation. There’s been no real precedent for when the 10-year yield gets all the way down to 1%, but I think we can draw some inferences.

When the P/E ratio begins hovering around the 30 area (we’ll exclude the two outliers for now), interest rates have been at or above 4%. Even when interest rates were down around 2%, P/E ratios of up to 25 have been recorded. If the S&P 500’s current P/E is 28 and the forward P/E is 25, is that completely out of line with what we’ve seen in the past? Maybe not. Does this qualify as a bubble even though valuations are way on the high end? I’d say probably not.

To be fair, there are some similarities to, say, the tech bubble crash in the early 2000s. Back then, the parabolic rise in equity prices was being fueled by speculation in companies with negative net incomes and little in the way of revenues. As long as its primary business was in tech or the internet, that was good enough. Of course, we know today that many of those businesses had little chance of long-term viability (Pets.com anyone?) and came crashing back to earth, often resulting in bankruptcy.

We’re some of that same speculation today. IPOs used to, in general, require some degree of success in order to go public. The IPO market is still red hot, but we’re seeing a record low percentage of those IPOs generating a positive net income. The SPAC market has exploded with the purpose of simply raising capital with no formal operations. Certain areas of the market are indeed trading at wild multiples and it’s easy to make the argument that they’re ready to come crashing back down.

Here’s the interesting thing though. We can’t agree if we’re in a bubble or not.

I did a Google search on the term “stock bubble” just today and it’s safe to say that opinions are all over the map.

For example…

Stock Bubble Prediction

Stock Bubble Prediction

Former hedge fund manager Jim Rogers believes we’re in a bubble right now, but not in all areas of the market. He notes bubble conditions in stocks, bonds and housing, but says there’s still room to run in commodities, such as gold.

Leave a comment