One of my Twitter (NYSE:) followers asked a question about benchmarking in relation to Tesla (NASDAQ:). I thought this would make an interesting post, as it gives me the opportunity to consider the stock’s daily and weekly charts, and highlight some interesting lessons from a volume-price analysis perspective.

The broad context of the question concerned the issue of benchmarking, which is a key component of the volume-price analysis methodology. So what is benchmarking?

In using volume as a key element in the volume-price analysis methodology, the first issue we must recognize is that volume is, of course, subjective. What we might consider being high, medium or low volume, or indeed extreme is subjective This is one aspect.

The second is price, and the context of the relationship between the two when looking to judge whether the volume and price we are seeing at the leading edge are in agreement or disagreement. To do this we search out our benchmarks to help provide us with the answer.

Across the chart, we identify up candles and down candles, preferably with small or no wicks. These give us an idea of what ‘the norm’ for the instrument is in a particular timeframe. Once we have established ‘the norm’ we can then judge the current price and volume against our benchmark candles. This will then confirm if we are witnessing an anomaly. If the answer is yes, then we can expect a reversal to follow. If not, then all is well. This also applies to candles like hammers and shooting stars.

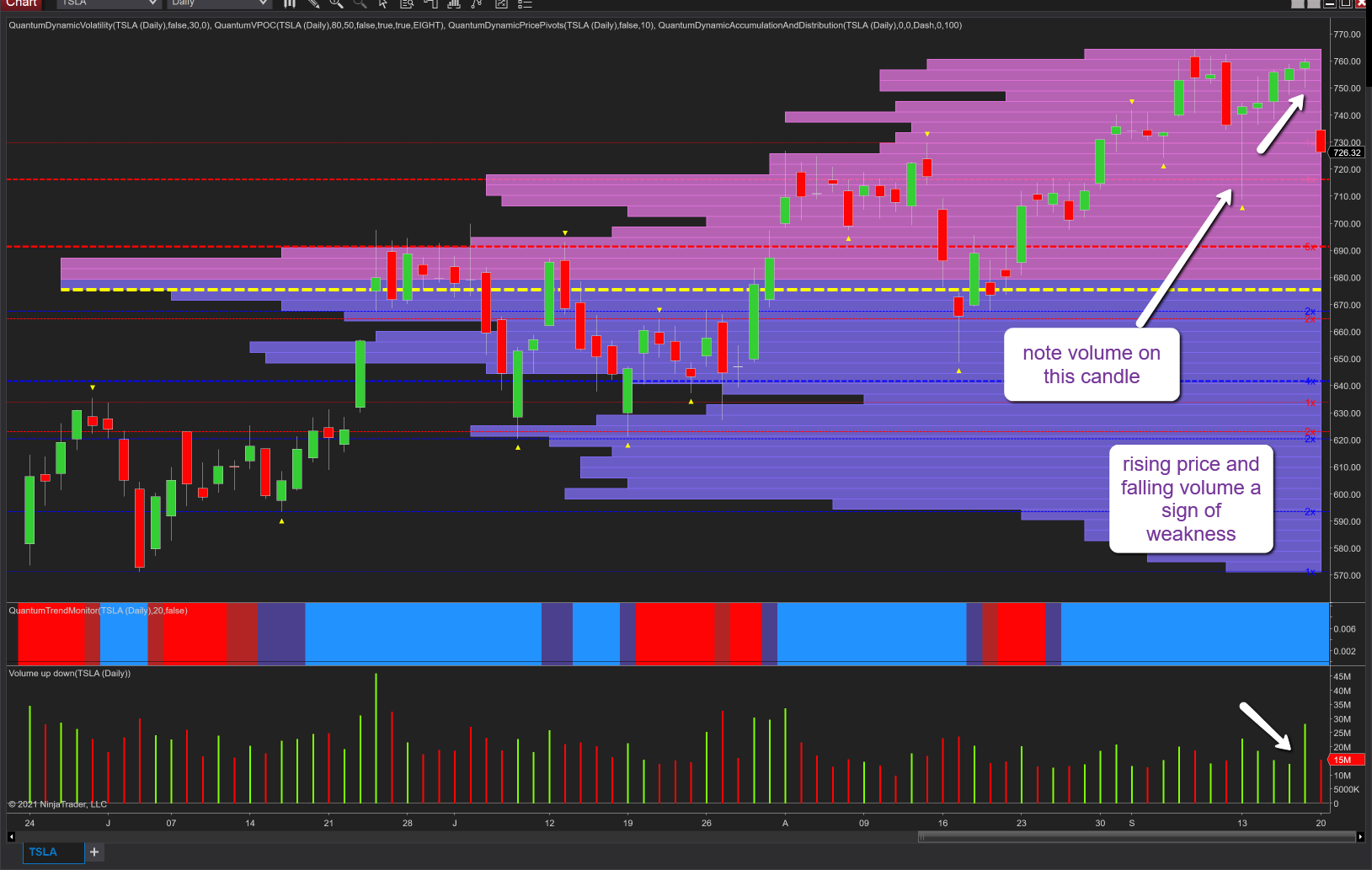

So, if we start with the daily chart for TSLA and last week’s price action. Note Monday’s volatile price action. It showed a sharp move lower and recovery. Yet, the volume was modest and hardly indicative of sustained buying by the market makers. This was confirmed over the following days, with the price rising on falling volume.

Look at Wednesday’s price action. It showed a nice wide spread candle. But consider the volume, and compare it to a benchmark candle. It looks lightweight.

Finally, to today’s price action. With the U.S. indices selling off sharply, it’s no surprise to see the stock has fallen. In fact, it gapped down. But the volume looks light. After all, we are seeing dramatic price action, and while the session is not yet over (at the time of writing), the volume thus far looks to be average at best and hardly indicative of major selling by the market makers. The volume on the day would need to be substantially higher if this is a genuine move.

Moving to the weekly chart, one anomaly that jumps off the chart is the widespread up candle of January 2021. Look at the associated volume. It is the same as candles of half this spread. Against any benchmark, this looks like a trap, which was indeed the case.

As an aside, notice how the up volume candles of 2021 are generally falling when compared to the volume from September 2020 through to the end of the year. So this is another reason the stock is struggling to regain last year’s highs.

Finally, I would always suggest looking at more than one timeframe when considering anomalies and benchmarking, as a slower timeframe can give further context to the price action, thereby providing a complete picture.