Earnings Outliers

S&P 500 firms have easily beaten analyst earnings expectations four quarters in a row—the drive for five is on! We feature two earnings outliers this week as the second quarter reporting season begins.

Rexnord Corp (NYSE:) is a $6-billion market cap Industrials company. The Wisconsin-based multi-industry firm primarily engages in the manufacturing of engineered power transmission, aerospace and other precision motion technology products. This is a firm that may benefit from increased capital spending by private industries and infrastructure investment by the federal government. More imminently, however, there has been a significant reporting change which we will detail later.

A Sector Leader

RXN has been a hot industrials play this year. It is among the top stocks in its industry, care of multiple expansion, despite recent underperformance to the . The current trailing 12-month P/E ratio is 48.7, according to the Wall Street Journal. When a stock sees its P/E ratio increase, it is often a sign of bullish earnings expectations in the near future. What could be driving such a fervor?

A Capital Investment Play

As 2021 wears on, firms are seeing higher cash flow given the robust economic recovery happening in the United States. Domestic industrials stocks are seen as beneficiaries of higher capital spending from companies and public initiatives.

Recently, U.S. President Joe Biden and a group of Senators agreed to a roughly $1-trillion infrastructure plan. The package includes funding for roads, bridges, transit, airports and broadband. RXN could be in a strong position to benefit from higher spending through its Industrial Internet of Things solutions and water construction offerings.

Figure 1: RXN Stock Price History (1-Year)

Fiscal Year Change And Outlier Analysis

RXN recently changed the end of its fiscal year from March 31 to Dec. 31. Associated with that change, the upcoming Q2 earnings announcement of July 20 was confirmed on July 6 via press release.

Previous to the fiscal year change, this is when RXN would report its Q1 results. RXN has historically reported between July 28 and Aug. 2 with a Tuesday trend. The earlier than usual July 20 announcement date caused a very high Z-score of -5.59. Investors should be on the lookout for possible organizational changes given the fiscal year shift. RXN will hold a conference call and webcast at 7:00 a.m. Central Time on July 21 which will include a general business update and investor Q&A.

RXN Corporate Action

Taking a step back, in February, RXN announced a tax-free spin-off of its Process & Motion Control segment as part of a Reverse Morris Trust. While we won’t parse through the details, the point is there has been a significant change going on at RXN. With the upcoming earnings outlier, traders should be on guard for more unexpected news and potential stock price volatility.

Conagra Brands, Inc. (NYSE:) is a “Peter Lynch” stock. The famed portfolio manager always said “buy what you know”—most consumers and investors know Conagra. The $17-billion market cap consumer staples stock headquartered in Chicago is a leading packaged food manufacturer. The firm boasts brands of Banquet, Chef Boyardee, Healthy Choice, Bird’s Eye, and Duncan Hines. A much later than usual earnings date crossed our radar.

COVID’s Industry Impact

COVID-19 changed so many of our daily routines. Commuting to the office was replaced with stepping into the kitchen, sending the kids to the school bus was replaced with setting them up with a laptop in the living room, and dining out was replaced with grocery spending. While the world returns to normal, not everything is reverting to the mean.

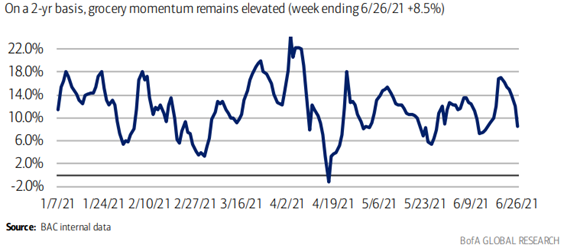

Both online and in-store grocery consumption surged in Q2 2020, and Bank of America’s internal card data shows that momentum for the category remains strong on a two-year basis (+8.5%). Despite an uptick in dining out, we are still buying those brands we know best—many of them are Conagra’s.

Figure 2: Grocery Daily 2-Year Change of 7-Day Moving Average Spending (BofA Aggregated Card Data)

Staples Out Of Favor

The consumer staples sector has not been the darling of Wall Street in 2021. It is the second-worst performing group among the 11 sectors with just a 5% total return YTD (as of July 7). That narrative is true for CAG as shown in the stock price chart below.

Defensive equities outperformed the S&P 500 during the COVID-crash in March 2020, but it has been a struggle for safety plays amid the risk-on environment in the last 16 months. While sales have been strong during and following the pandemic, traders are seeking a new catalyst amid new risks.

Figure 3: CAG Stock Price History (1-Year)

Inflation Watch

What could be driving investor pessimism of late? Inflation risks. Gauging inflation’s impact on a food company is tricky—it’s all about how well the firm can effectively pass along higher costs to consumers.

One measure CAG took earlier this year was to invest $15 million in its transportation operations to improve efficiencies. Portfolio managers holding CAG stock should pay close attention to what executives say regarding inflation on this week’s earnings call.

Outlier Analysis

CAG has historically reported Q4 results between June 29 and 30 with a Tuesday or Thursday trend. On April 9, Wall Street Horizon set an inferred earnings date of June 30 before market. On June 8, however, CAG confirmed its Q4 results would be published on July 13 before market. This later than usual announcement date resulted in a very high Z-score of 7.54. The company will host a webcast and conference call to review its Q4 2021 results at 9:30 a.m. ET on Tuesday following the 7:30 a.m. ET news release.

Conclusion

A global earnings recovery has been under way over the last year. Firms have handily beaten revenue and EPS expectations in each of the previous four quarters, but can that continue amid an economy pressured by supply chain disruptions and labor shortages? We will know a lot more a month from now.

In the meantime, traders and portfolio managers must pay attention to the tone of company executives and any unusual corporate news as reporting season kicks off. In addition to the earnings season, the happenings in Washington D.C. are important too—how will the massive infrastructure plan evolve? Firms in the Industrials sector will certainly be paying close attention to those developments.