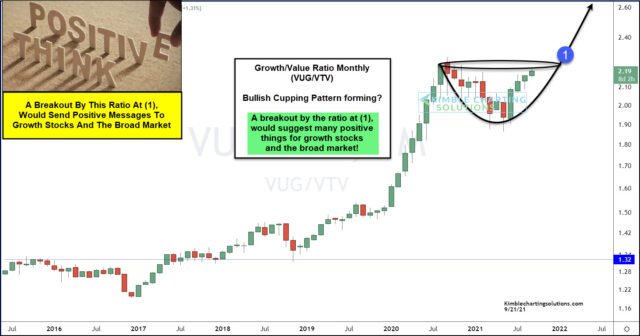

Monthly VUG-VTV Ratio Chart.

Equity investors like it when the markets are in “risk-on” mode.

What does that mean?

Well, it signals investors are more willing to take risks. When this happens, the stock market heads higher – and with a stronger trend.

A few areas that indicate “risk-on” are small- and micro-cap stocks, junk bonds and growth stocks (among others). Today, we look at growth stocks and compare them to the counterpart value stocks.

Above is a monthly ratio performance chart of the Vanguard Growth Index Fund ETF Shares (NYSE:)) to Vanguard Value Index Fund ETF Shares (NYSE:)). You can see where (in time) growth stocks have outperformed value stocks. The steepest move higher came over eight months in 2020, as the stock market raged back from the coronavirus crash. Since then, the growth/value stocks ratio has consolidated in a potentially bullish “cup” formation.

A breakout by this ratio at (1) would send a positive message to the broad market. Stay tuned.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.