The mainstream crowd has gotten way too greedy—which means we could be in the teeth of a stock-market selloff within weeks.

Most folks hear the word “selloff” and gasp. But not us contrarian dividend hounds! We know that volatility is our friend. It’s easy to see this just by looking at what the market’s done in the last five years. You’d have amped up your performance a lot just by buying the dips.

Buy and Hold? Nah. The Timing of Your Buys (and Sells) Matters

SPY-Price Gains

SPY-Price Gains

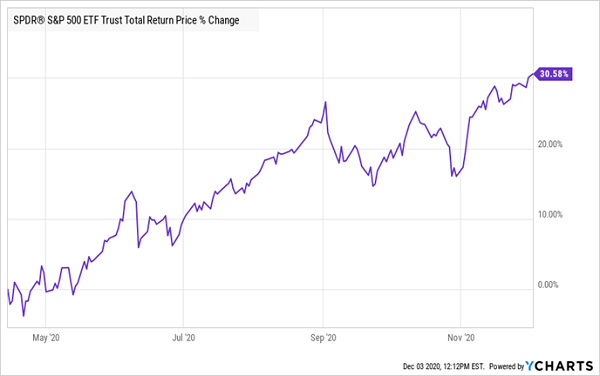

This year is a classic example. If you’d bought the typical S&P 500 stock on the first day of February, pretty much at the go-go peak of early 2020, you’d be sitting on a 15% total return now.

That’s not bad—especially in a nightmare year like this one!

But you’d have done a lot better by buying the dip. Heck, even if you waited till stocks were in full rebound mode in mid-April, your return would have been more than double what our February buyer has taken home—a solid 30%.

Buying the Dip: You Don’t Have to Be a Master Market Timer

SPY-2020 Dip-Buy

SPY-2020 Dip-Buy

This strategy is a lot like an approach many folks use, called dollar-cost averaging (DCA). You probably DCA’d your portfolio to its current level, dropping a fixed amount of cash into your stock holdings at regular intervals.

DCA-Graphic

DCA-Graphic

It’s my favorite way to “time” the market: your regular, fixed sum automatically buys more shares when they’re cheap and fewer when they’re pricey.

An “Active” DCA Strategy Is Your Best Play for 2021

We’re going to take this robotic process a step further by holding back some cash so we can actively bargain hunt when the first-level crowd’s greed turns to terror.

The beauty of this “active” DCA strategy is that it lets you hold on to your winners—and let them run—while enhancing your gains by injecting that extra cash on the dip and rebound.

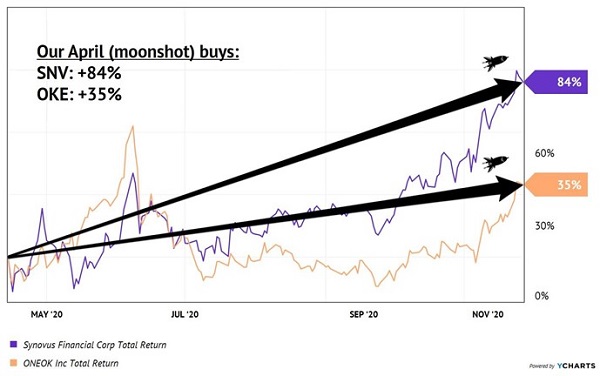

This is what I’m recommending that readers of my Contrarian Income Report service do now: let our winners run, including Synovus Financial (NYSE:SNV), which I urged CIR subscribers to buy in an April 14 Flash Alert, just as the rebound was finding its groove. SNV went on to hand us 84% in gains and dividends in just under eight months.

Or ONEOK (NYSE:OKE) a 9.7%-yielder I recommended in that same April Flash Alert. It’s handed us a 35% return, with a third of that in dividends. Both stocks have crushed the market, something that, as income investors, we don’t always expect—but we’ll happily take it when it happens!

“Active” DCA Strategy Delivers Big 2020 Gains and Dividends

OKE-SV April Buys

OKE-SV April Buys

But what if you have cash burning a hole in your pocket you want to invest today? While I do recommend holding off for a few weeks until a (likely, in my view) pullback, the good news about this strategy is you don’t have to wait, because there’s always an out-of-favor sector somewhere.

And these days, utility stocks are that sector.

I don’t usually write about utilities because, to be honest, they usually don’t yield enough. But in the mania of the last few months, investors have been doing what they love to do—speculating on volatile travel stocks, like American Airlines (NASDAQ:AAL), or shiny ponies like Tesla (NASDAQ:TSLA)—and dumping “boring” utilities.

That’s good news if you’re looking to deploy some cash, because it’s pushed many utilities’ prices down and their dividend yields up. Here are three to consider.

Undervalued Utility #1: Eversource Energy

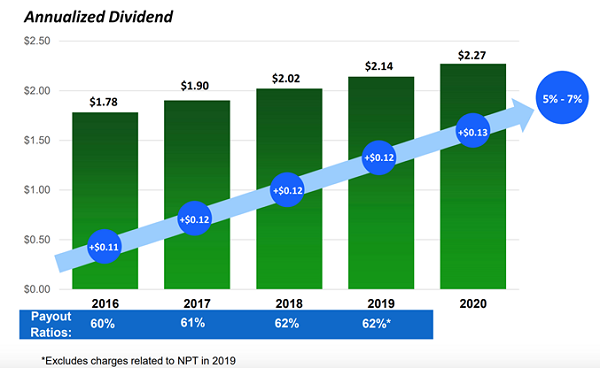

Eversource Energy (NYSE:ES)) isn’t the highest yielder out there, with a 2.6% payout, but dividend growth is the real story here: Eversource cranks out steady 5% to 7% annual payout increases, backed by a historically safe payout ratio, with the dividend accounting for around 60% of earnings per share (EPS):

ES-Steady Growth Chart

ES-Steady Growth Chart

This steadily rising dividend makes New England-based power, water and gas provider a good stock to tuck away: consider that Eversource has hiked its payout, year in and year out, for 20 years now. Its cumulative hikes mean you’d be pulling in a nice 10% yield on a buy made back then.

A risk of running a New England–based utility is location: Eversource is constantly barraged by Atlantic storms, but management deftly manages that risk: despite an active storm season in 2020 (not to mention the pandemic), Eversource kept a tight lid on costs, with expenses related to operations and maintenance edging up just 1% in the first nine months of 2020 from a year earlier.

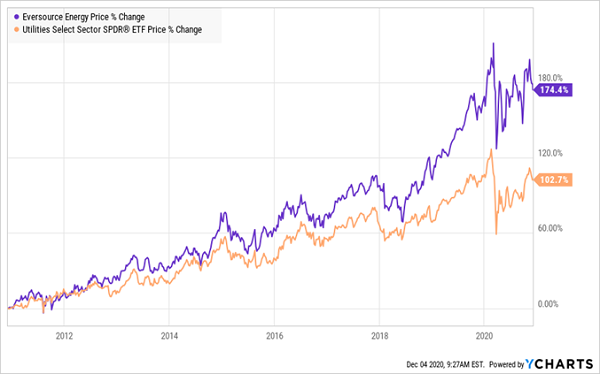

Eversource’s growing dividend and history of profit growth—analysts are calling for earnings per share (EPS) of $3.64 in 2020 and $3.89 in 2021, up from $3.39 in 2019—are why the shares have been playing in a different league than the benchmark utility ETF:

Eversource Powers Past the Field

ES-XLU Total Returns

ES-XLU Total Returns

Despite this outperformance, Eversource shares are still 12% off their March highs. That’s given us a nice entry point to deploy some “active DCA” cash now.

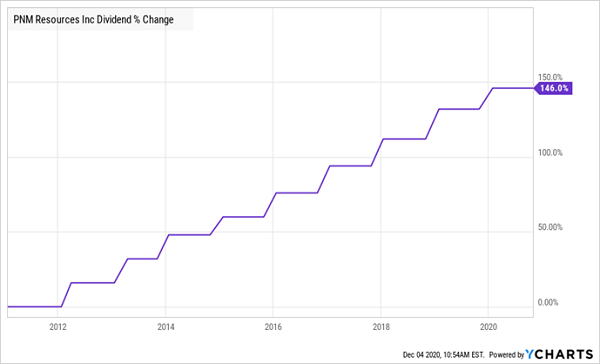

Undervalued Utility #2: PNM Resources

Unless you live in New Mexico or Texas, you’ve likely never heard of PNM Resources Inc (NYSE:PNM). It’s a smaller utility, providing electricity to 530,000 customers in New Mexico and 256,000 in the Lone Star State, and sporting a market cap of just $4 billion.

Like Eversource, it also sports a relatively low dividend yield, at 2.5%. But it’s growing its payout a lot faster, more than doubling it in the last decade. That means folks who bought back just 10 years ago have built themselves a nearly 10% income stream (a 9.7% yield, to be exact)—and they’ve done it 10 years faster than Eversource investors have:

PNM’s Potent Payout Growth

PNM-Dividend Growth

PNM-Dividend Growth

There’s no safer way to build a retirement-ready cash stream than this. And with PNM’s safe payout ratio of 49% of EPS and forecasts for higher EPS in both 2020 and 2021, we can expect its dividend to keep rising higher.

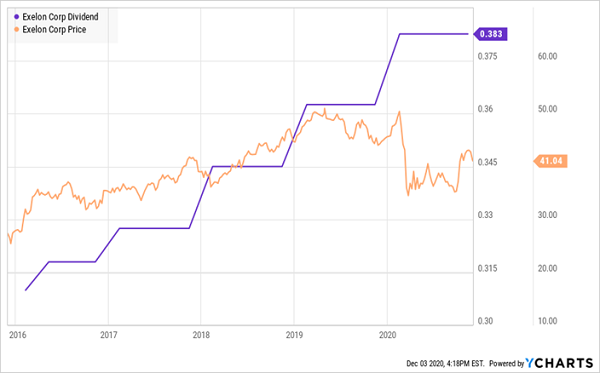

Undervalued Utility #3: Exelon

Exelon (NASDAQ:EXC) has electricity and gas businesses serving 10 million customers, mostly in the Northeast.

The big story here is that Exelon is considering spinning off its power-generation business. If the split goes ahead, it would follow a trend in the sector: DTE Energy (NYSE:DTE), for example, will spin off its pipeline and storage business in mid-2021.

Spinoffs are generally win-wins for investors—a 2012 Credit Suisse)study showed that the new firm and its parent tend to outperform the market in the 12 months following the split. It’s rare that we income-seekers get to participate in one!

Speaking of income, Exelon shifted from paying a static payout four years ago to delivering steady payout growth. Its rising payout has, in turn, prompted investors to bid up the stock—until mid-2020, when they sold it off. As you can see below, Exelon’s share price still trails its dividend-growth rate and is well off its 2020 high.

Exelon’s Dividend Outruns Its Stock (for Now)

EXC-Price Dividend Chart

EXC-Price Dividend Chart

The company’s sturdy payout growth, relatively high 3.7% yield and depressed (for now) share price make it another target for our “active DCA” strategy.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."

Leave a comment