Today we’re going to discuss the secret to double-digit annual returns every year, forever, with secure dividend stocks. It’s simple but not easy. Here’s the hint. We must seek out hefty recurring payouts from stocks with dependable recurring revenue! It’s one of the oldest business models there is, and it’s hands-down the best setup for us dividend investors: customers pay every week, month, year or whatever, giving a company predictable—and ideally growing—profits. They then send those profits our way as predictable—and growing—payouts! Plus, many of these firms buy back their own shares too. Which, in turn, makes each share we own more valuable on a “per share” basis.

(In the latest Hidden Yields advisory on dividend-growth service, I look at a company that was recently spun off from another firm and is adapting this model to heating and cooling equipment, of all things. This firm also recently boosted its payout by 50%! More on that below.)

If this sounds straightforward, it is. The devil is in the details of this nuanced dividend strategy. We’ll lock in our forever cash flows with three “must haves” (besides a top-quality product that customers can’t live without, of course):

- A growing dividend, which, as we’ll see below, tends to pull a company’s share price higher.

- Rising profits (and better yet free cash flow, which can’t be manipulated) to back that rising payout and, in turn, our upside.

- A safe payout ratio: I demand that “regular” stocks (i.e., those outside the real estate investment trust, or REIT, market) pay no more than 50% of free cash flow as dividends.

You can give yourself an extra upside kicker when you buy recurring-revenue stocks just as they’re being forged, as we’ll see next.

Buy During This Rare 'Window' for Big Upside

For management, switching to subscriptions is a classic case of short-term pain for long-term gain: their revenue will drop as they “break out” a sale over 12 months instead of getting it in one transaction. And if you buy during this transition, before the mainstream crowd realizes what’s going on, you can set yourself up for some very nice gains indeed.

For example, at some point in the last few years, you’ve probably read about Adobe (NASDAQ:ADBE) (NASDAQ:{{6373|ADBE}})’sswitch to subscriptions.

In 2011, when it launched its Creative Cloud service (or its graphic design software by subscription), less than 20% of its revenue was recurring, according to research firm McKinsey, so most of its users were still buying one-off software packages. Fast-forward to late 2020, and recurring revenue was 91% of the total.

The stock tracked the shift, treading water at first, then soaring to a 1,900%+ gain.

Adobe’s Course Change Ignites Its Stock

ADOBE-Price Chart

ADOBE-Price Chart

I can’t recommend Adobe today, trading as it does at 44-times forward earnings (and paying no dividend!). So we’ll tip our hats to our lucky Adobe buyers and look to other “sticky” businesses instead.

The 'Holy Grail': A Sticky Business Model and a Growing Dividend

You can also position yourself for strong gains by combining a recurring-revenue model with a fast-growing dividend.

To see what I mean, consider Ecolab (NYSE:ECL) which I recommended in my Hidden Yields advisory in April 2018.

The company works directly with government and corporate clients to help them better manage water and treat harmful chemicals. It also sells cleaning products to businesses—and those products always need replenishing.

Ecolab only paid a 1% yield when I recommended it (which is roughly what it yields today), but its payout was powering higher, with management tripling the dividend in the preceding 10 years. That created a winning setup I’ve seen happen again and again with dividend growers—the soaring payout took the price along for the ride!

A Profit Pattern You Can Set Your Watch To

ECOLAB-Price Dividend Chart

ECOLAB-Price Dividend Chart

The company also ticked our other boxes: per-share earnings were up 84% in the preceding five years, and its dividend accounted for a modest 37% of free cash flow.

So we bought in—and booked 31% gain when we sold Ecolab a little over a year and a half later, easily crushing the S&P 500’s performance in that time:

Recurring-Revenue Play Catches Fire

ECOLAB-SPY Total Returns

ECOLAB-SPY Total Returns

Now let’s look forward, at a REIT with a sticky business model that’s worth keeping an eye on now.

An 'Essential' REIT with Triple-Digit Payout Growth

REITs are a great place to look for recurring-revenue buys, so long as you avoid dying corners of the market. (I’m looking at you, mall landlords).

A solid example of a REIT with recurring revenue is lab owner Alexandria Real Estate Equities (NYSE:ARE), whose properties are in high demand. You can tell that from the fact that the REIT collected 99.8% of its rent from Apr. 1, 2020, through Dec. 31, 2020, while other REIT landlords were banging down tenants’ doors. It also boasts high occupancy (94.6% of its operating North American properties were occupied as of the end of Q4). A high rate like that is the norm for Alexandria, which buys up offices and labs in what it calls “innovation clusters”—neighborhoods where companies and government agencies in a particular research area “cluster” together.

And once tenants get in, they don’t want to leave!

Right now, its tenants are all, to one degree or another, participating in the effort to suppress COVID-19, an effort that will likely continue long after we’re vaccinated. They include pharma giants like Pfizer (NYSE:PFE), Eli Lilly (NYSE:LLY) and Novartis (NYSE:NVS), as well as medical-device makers like Thermo Fisher Scientific (NYSE:TMO) and Abbott Laboratories (NYSE:ABT).

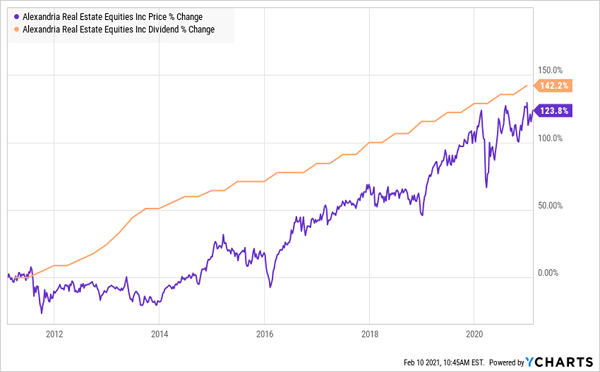

Rising demand (and rents) for labs should continue to spur Alexandria’s payout. As you can see below, the REIT regularly raises its dividend twice a year. You can also see its “dividend magnet” in action, with those reliable dividend hikes pulling the share price up almost point for point:

A 'Sticky' Stock With a Powerful Dividend Magnet

ALEXANDRIA-Price Dividend Chart

ALEXANDRIA-Price Dividend Chart

Alexandria paid 57% of per-share FFO as dividends in the last 12 months, which is conservative for a REIT (in this space, ratios up to 90% of per-share FFO can be sustainable). And continued payout growth seems even more likely, thanks to the company’s rising overall FFO, which jumped 21% in the fourth quarter.

My #1 Recurring-Revenue Play (for Big Gains and Dividend Growth)

Remember when I said I’d uncovered a company that was successfully applying a recurring-revenue model to the heating and cooling business? Well, that company is on the first page of the January Hidden Yields advisory. And because this company is a recent spinoff, most investors haven’t paid much attention to it, so we can still buy cheap—at just 15-times free cash flow.

These top-quality stocks are primed to return 15% a year, year in and year out as we transition to a new, more interconnected world dominated by e-commerce, electric vehicles and other technologies the pandemic has shifted into overdrive.

These 7 stout dividend growers should be fixtures in every investor’s portfolio to reap maximum gains (and maximum dividends!) from the tectonic shifts our society is undergoing.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."

Leave a comment