These days I hear from a lot of CEF investors who are struggling to dig up cheap dividends. If you’re one of these folks, I get it. In fact, I’m right there with you!

Even for those of us who spend our entire day looking for CEF bargains, this market’s been a grind, making it tougher than ever to find high, reasonably priced dividends to recommend to you in CEF Insider.

(But we’re not out of luck here. Today we’re going to look at three 10%+ yielders that would make good speculative plays now, beyond the 13 attractively priced buy recommendations in our CEF Insider portfolio, which I continue to recommend for the lion’s share of your CEF investments.)

From CEFs To Lumber—High Prices Are Everywhere

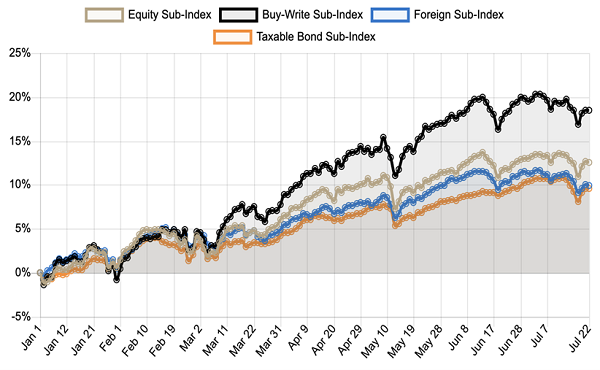

The reason for high prices in CEFs is the same as it is in stocks, real estate, lumber, bicycles, microchips—you name it: surging demand. Check out this list of the major CEF indexes we track in CEF Insider:

CEFs Take Off

CEFs-Soar-2021-Chart

Source: CEF Insider

As you can see, every single one of them is up by 10% or more, with the buy-write subindex (which tracks equity CEFs that generate extra income by selling options on their portfolios) up nearly 20%. Those are big moves for relatively stable income-producing investments like CEFs.

Discounts, Dividends Grind Lower—But Buys Are Still Out There

That fast swing up has slashed CEF discounts to net asset value (NAV, or the value of the stocks and bonds in their portfolios) to the lowest levels I’ve ever seen: just 1.8% as I write this.

CEFs’ swelling prices have also whittled away their yields. Over the decade I’ve been tracking CEFs, their yields have averaged between 6.8% to 7.2%. As of July 23, 2021, the average CEF was paying out 6.1%. That’s still high by the standard of stocks (which yield a pathetic 1.3% today) but it’s a low-water mark for CEFs.

For those of us who have been investing in CEFs for years, this is all great; we’re profiting from the Johnny-come-latelies, and will continue to do so.

And there are still opportunities out there. Which brings me back to those three more-speculative CEFs I mentioned off the top.

But These 10%+ Yielders Are Still Available

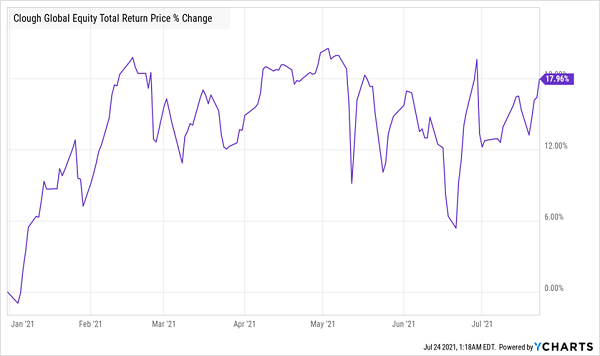

1. Clough Global EF

Let’s start with the Clough Global EF (NYSE:), which invests its $202 million in assets in a variety of stocks that are perfectly positioned for a reopening American economy, with Booking Holdings (NASDAQ:) as its largest position, followed by Royal Caribbean Group (NYSE:), Carnival Corporation (NYSE:) and First American Financial (NYSE:), which is already benefiting from heightened demand for single-family homes (FAF offers title insurance for homebuyers).

A broader shift into these stocks has driven GLQ higher this year, and they have room for further gains as more of the world gets vaccinated.

Strong Gains for 2021

GLQ-Total-Returns

GLQ delivers a large portion of its profits to investors as dividends, with a 10% yield that’s well ahead of the CEF average of 6.1%.

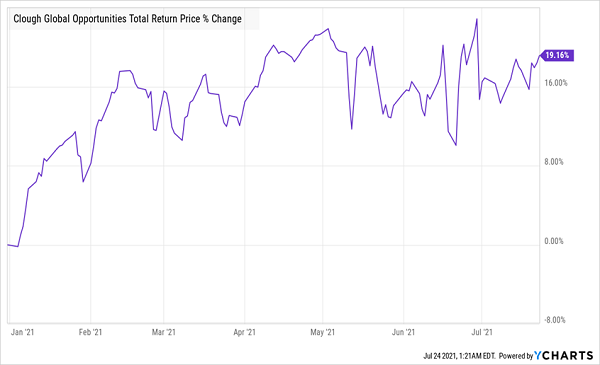

2. Clough Global Opportunities Fund

For another almost-10% yielder, let’s look to GLQ’s sister fund, the Clough Global Opportunities Fund (NYSE:). The two funds’ holdings are broadly similar, but with one key difference: GLO is more aggressive. While GLQ holds nearly 10% of its assets in cash and US government bonds to provide some liquidity in case of a crash, the 9.9%-yielding GLO goes all in on assets that can maximize returns. That’s driven its near-20% gains so far this year.

GLO’s Aggressive Approach Pays Off

GLO-Total-Returns

That means this $404-million fund is earning nearly twice its dividend, making payouts safe for now.

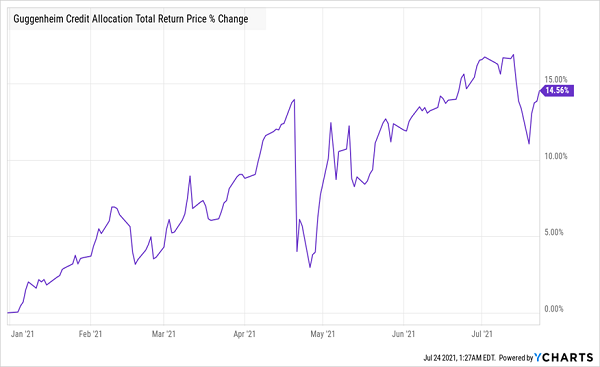

3. Guggenheim Credit Allocation Fund

Rounding out our double-digit-yielding portfolio is the pint-sized Guggenheim Credit Allocation Closed Fund (NYSE:), a $209-million CEF that uses its small size and institutional heft to invest strategically in places bigger funds can’t.

Here’s what I mean: GGM can lend money to small companies like Cengage (CNGO) when they want to issue debt, something bigger bond funds simply can’t do, since small firms’ bonds won’t move the needle for them. In addition, GGM’s management firm, Guggenheim, boasts $270 billion in assets under management, making it a big player in the markets, ideally positioned to find small opportunities it can then pass off to this fund.

That is how GGM affords to yield 10.3% and gets investors profits like this.

A Strong Showing

GGM-Total-Returns

That 15% year-to-date return more than covers GGM’s dividend for the year, and its small-fund-with-big-fund advantages position it to keep paying those big dividends for a long time to come.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”