Executive Summary

-

Q2 earnings season is setting records in terms of EPS beat rates, but the future is uncertain regarding global regulatory risks and domestic infrastructure spending

-

We profile a large-cap Japanese firm facing operational challenges in the semiconductor market

-

Two U.S.-based small-cap stocks with recent bouts of share price volatility are featured with unusual earnings dates

Earnings Outliers

Two earnings outliers are highlighted this week. By using the Z-score, clients can gauge how statistically unusual a company’s earnings date is relative to normal. We analyze five years of earnings trends to develop a normal earnings date. Wall Street Horizon clients are alerted when a firm has an earnings date Z-score greater than 3.0.

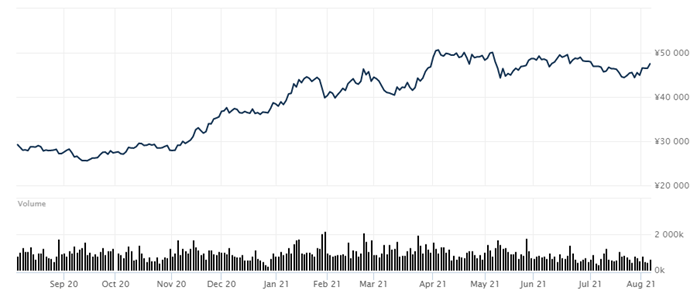

First up is a company in a tough industry at the moment. Tokyo Electron Ltd (OTC:) is a $66-billion large-cap technology firm based in Tokyo and listed on the . The stock also trades in the U.S. on the OTC market. Tokyo Electron develops, manufactures and sells semiconductor production equipment and industrial electronics for flat panel displays. While U.S.-listed semiconductor stocks are inching to new highs, TEL has been trading sideways much of this year.

Macro Issues Keeping A Lid On Growth

The persistent global squeeze on the supply of semiconductors is impacting TEL’s business. Another major issue for the firm right now is the regulatory situation in China— a major customer area. Given China’s recent crackdown on several industries, including technology, TEL’s stock price has wavered with volatility in the region. Shares peaked in early Q2 near ¥50,000 and then fell to near ¥45,000. The stock is little changed from its January high as supply issues and regulatory hurdles appear to be weighing on near-term growth. Still, profits for the Japanese large cap have bounced back from 2020’s decline, but are still below 2019’s peak as of the most recent fiscal year-end last March.

Figure 1: TEL Stock Price History (1-Year)

Outlier Analysis

- May 1 – Wall Street Horizon set an unconfirmed earnings date of July 27 based on TEL history of reporting Q1 results between July 25 and July 30.

- May 26 – TEL released an extensive list of “Personnel Changes for Executive Officers of Tokyo Electron Ltd. Effective on June 17th, 2021.”

- July 8 – TEL had not announced an earnings date; we pushed the estimated reporting date to Aug. 5.

- July 21 – Our analysts found that the firm’s website calendar noted an earnings date of Aug. 16, which is much later than normal.

The Aug. 16 earnings date resulted in a very high Z-score of 10.68. Traders should be prepared for unusual information to be disclosed within the earnings report next Monday and possible share price volatility.

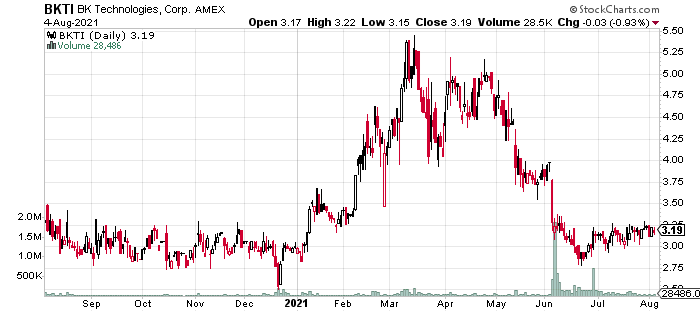

Next up is BK Technologies Inc (NYSE:); a $54-million micro cap technology company listed on the American Stock Exchange. Headquartered in Florida, the firm produces two-way radio communications equipment for first-responders, including firefighters, EMS, police and federal agencies. Business growth for this small company often depends on municipalities selecting BKTI for communications equipment. Its stock price has been an underperformer in the last several years with high volatility.

Stock Drops On Secondary Offering News

A particular corporate event type has hampered shares of BK Technologies in the last year—secondary offerings. On Dec. 11, 2020, Wall Street Horizon noted a secondary offering of shares. While there was little price reaction that day, the stock fell hard on high volume on a subsequent secondary in early June.

Figure 2: BKTI Stock Price History (1-Year)

Outlier Analysis

- Looking ahead, BKTI normally reports Q2 earnings between Aug. 1 and Aug. 6.

- May 14 – Wall Street Horizon set an unconfirmed earnings date of Aug. 4 based on BKTI normally reporting Q2 earnings between Aug. 1 and Aug. 6.

- July 15 – BKTI announced via press release that it would post results on Aug. 11.

- July 20 – BKTI announced the appointment of John Suzuki as the new CEO effective July 19.

Portfolio managers should keep this stock on their radar for potential volatility this Wednesday. The later than usual earnings date resulted in an elevated Z-score of 3.7.

Earnings Revisions

Two companies with earnings revisions caught our attention this week. Wall Street Horizon gathers and tracks firms from around the world that publicly declare an earnings date, but then publicly change it. By moving a reporting date, a firm indicates there might soon be unusual news that could draw stock price volatility.

First up is Perrigo Company PLC (NYSE:). Perrigo is a Dublin-based drug manufacturer in the health-care sector and is primarily known for its lines of affordable self-care products available at retail outlets. An ADR listed on the NYSE and an stock, PRGO has a market cap of $6.3 billion and an above-average dividend yield of 2.0%.

Figure 3: AIT Stock Price History (1-Year)

Revision Analysis

AIT has a history of reporting Q2 results between Aug. 10 and Aug. 12.

- July 22 – Wall Street Horizon updated the Q2 2021 earnings date to Aug. 11 before market per a company press release.

- July 27 – AIT issued an updated press release stating, “Applied Industrial Technologies today announced that it has changed the date of its previously announced earnings release and conference call due to a scheduling conflict.”

Wall Street Horizon reconfirmed the earnings date to Aug. 17 before the market opens. The later than usual earnings date resulted in a Z-score of 3.28.

Conclusion

Recent weeks have shown that macro issues like regulatory risks, supply shortages and uncertain spending bills can impact stocks significantly. What can be more impactful to small-cap stocks are corporate events and news that are not found on the front page of financial publications. At Wall Street Horizon, we provide the most accurate alerts to traders when important news impacts a single holding. Having this information at your fingertips is critical to managing risk.