Now that has had his scheduled moment in the sun, the markets have had a chance to react. I’ve got to tell you, things are starting to look interesting.

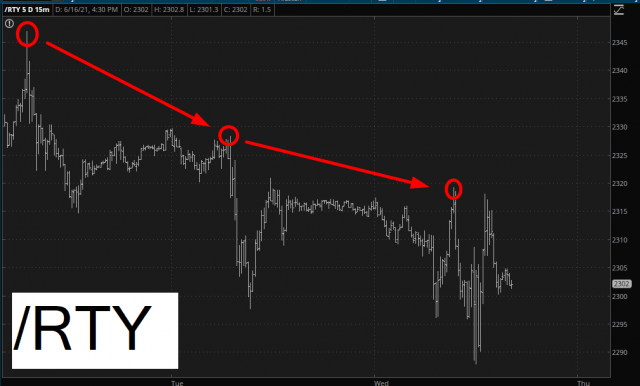

In recent days, have been carving out lower lows and lower highs:

RTY Chart

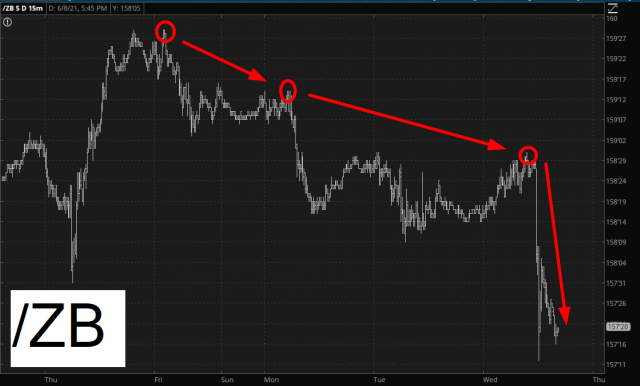

have been doing the same, with a particularly strong drop yesterday (which means, of course, higher interest rates, which is bad for just about everyone in our debt-choked economy):

ZB Chart

And poor old , which looked like it was trying—trying so hard—to mount a recovery, just got its shiny little spheres kicked again:

GC Chart

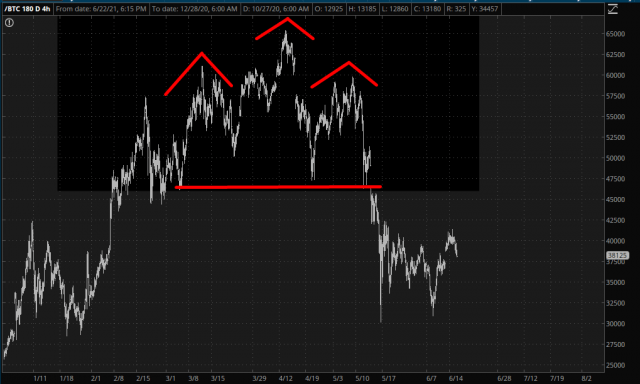

It sounds lunatic, I realize, but I’m still bullish crypto. My positions remain profitable, although the well-formed H&S on is a bit worrisome.

BTC Chart

All the same, my little champs—, , and —are profitable to a man. It’s as simple as can be: they need to conquer that red horizontal. Do it, and it’s rock & roll time.

ATOM Chart

As for equities, the is ever so slowly painting out what could be a reversal top.

COMP Chart

The remains sky high, but it, too, has the makings of a potential top, although if that’s true, it’s only about 80% done right now.

SOX Chart

As I mentioned, have stumbled badly in the face of rising rates (and a strengthening dollar) so the saucer pattern is looking badly damaged on the gold bugs index.

XAU Chart

Besides my fondness for crypto longs, my other favorite trade right now retains energy shorts, encapsulated neatly by the and index.

XOI Chart

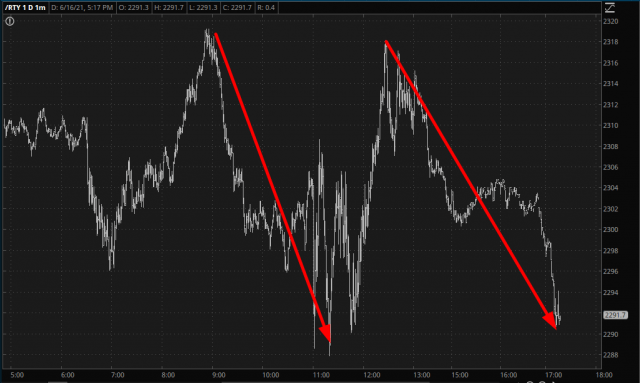

In the time it took me to compose this post, the / (small cap futures) have already lurched down hard. In fact, it’s lower than this chart represents since, ya know, the market does in fact keep moving while I’m typing. Like I said, things are starting to look interesting again.

RTY Chart