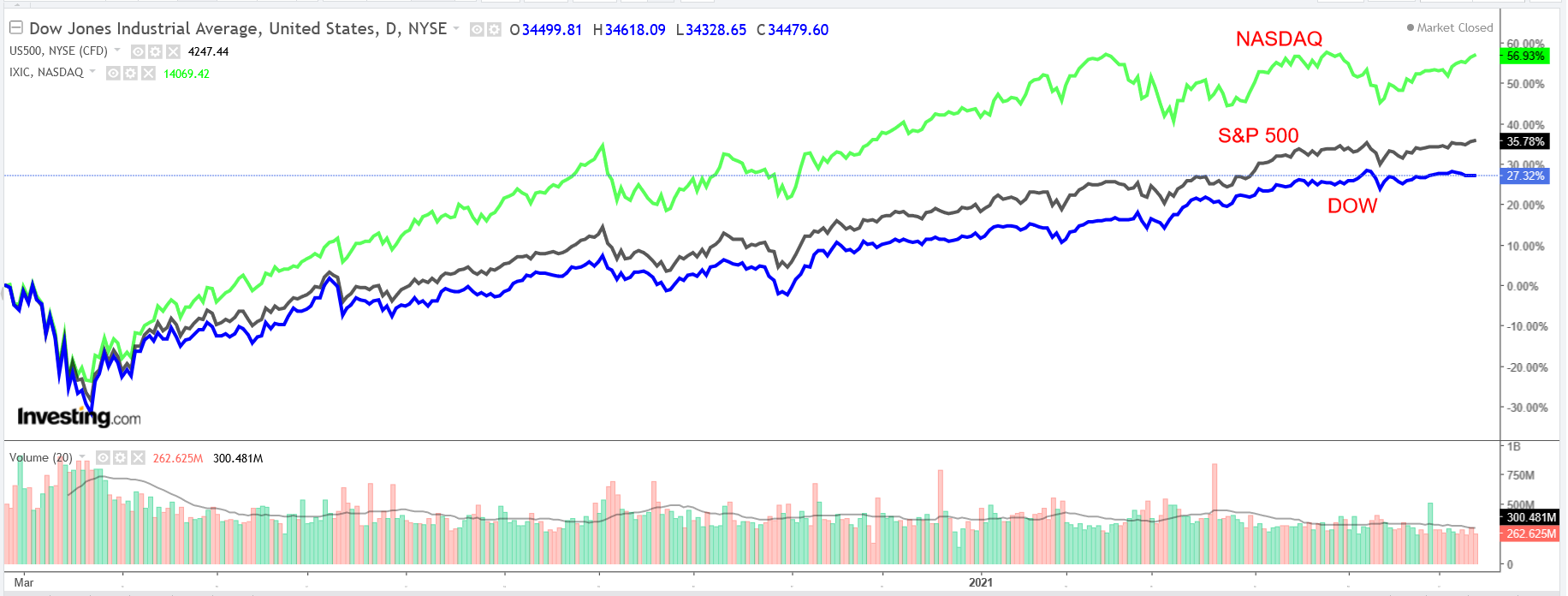

Stocks on Wall Street ended the week on a high note, with indexes looking past inflation worries as most major averages closing within sight of their recent records. The posted a weekly gain of 1.9% to record its fourth straight winning week, boosted by a rally in the mega-cap tech stocks.

The benchmark , meanwhile, tacked on 0.4% to mark its third winning week in a row. The blue-chip , however, underperformed, falling 0.8% over the same timeframe, as investors rotated out of value stocks.

Between the Federal Reserve’s key monetary policy , as well as more important economic data, including the latest report, the week ahead is expected to be a busy one on Wall Street.

Regardless of which direction the market takes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Jabil

Formerly known as Jabil Circuit (NYSE:), Jabil will be in focus this week, as investors await the latest financial results from one of the world’s leading electronic manufacturing services (EMS) providers.

The St. Petersburg, Florida-based company—best known for supplying components for iPhones and other Apple (NASDAQ:) devices—has thrived this year amid soaring demand for its products and services.

Year-to-date, Jabil, which operates 100 plants in 30 countries and has more than 260,000 employees worldwide, has seen its stock rise by 36%. It has nearly doubled over the past 12 months, gaining around 90% year-over-year.

After reaching a fresh 52-week high of $58.28 on Friday, JBL stock closed the session at $57.89, a level not seen since November 2000. At current levels, the manufacturing services company has a market cap of about $8.6 billion.

Jabil, which crushed expectations for earnings and revenue in the last , is scheduled to report fiscal third quarter numbers ahead of the U.S. market open on Thursday.

Consensus expectations call for earnings per share of $1.04, jumping a whopping 181% from EPS of $0.37 in the year-ago period. Meanwhile, revenue is expected to improve almost 10% year-over-year to $6.95 billion.

Beyond the top- and bottom-line figures, investors are hoping Jabil’s management will maintain its upbeat outlook for the remainder of the year, after boosting its guidance in the previous quarter, citing strong secular tailwinds and accelerated momentum in many of its end markets.

Jabil engages mostly in design engineering, manufacturing, and supply chain services for the EMS and consumer industries. It also provides materials technology services, such as plastics, metals, automation, and tooling.

The manufacturing contractor’s clients span numerous industries, including consumer products, computing, storage, networking and telecommunications, healthcare, defense, aerospace, automotive, as well as clean technology, and instrumentation.

Stock To Dump: Vertex Pharmaceuticals

Investors may want to stay away from shares of Vertex Pharmaceuticals (NASDAQ:) this week after the biotech firm said it would abandon any further development of an experimental drug designed to treat a rare genetic disease—AAT Deficiency (AATD)—which can lead to liver and lung disease.

The company said late last week that the Phase 2 trial of VX-864 met its primary endpoint, however the results are not likely to lead to substantial patient benefit.

The setback does not bode well for Vertex, which will now likely fall further behind rivals Arrowhead Pharmaceuticals (NASDAQ:), and Takeda Pharmaceutical (NYSE:) in the race to develop treatment for the rare genetic disorder.

Vertex’s next candidate for the treatment of AATD will likely not be tested on humans until 2022 at the earliest.

Vertex shares have cratered nearly 18% year-to-date, significantly underperforming the comparable returns of both the Dow and the S&P 500 over the same timeframe.

VRTX stock—which is now roughly 37% below its all-time high of $306.08 touched in July 2020—closed Friday’s session at a more than two-year low of $193.02, earning the Boston, Massachusetts-based biotech firm a valuation of about $50 billion.

From a technical standpoint, VRTX stock is now firmly below its 50-day, 100-day, and 200-day moving averages, which usually signals more selling pressure ahead.

Taking this into consideration, Vertex shares look set to remain on the backfoot in the coming days, with investors becoming increasingly concerned by the drug-maker’s as it struggles in its attempt to diversify its offerings beyond its core cystic fibrosis drugs.