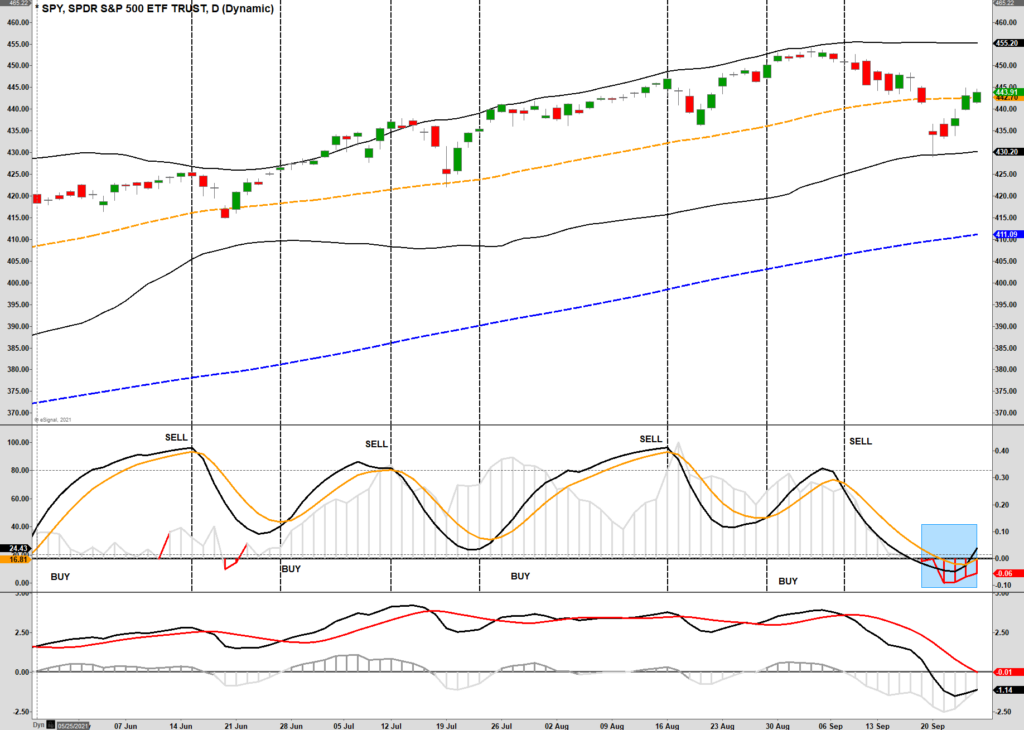

As , retail investors didn’t step in right away to buy the dip at the 50-dma. However, they did show up on Monday afternoon and continued to buy through the rest of the week.

“With the market very oversold, a counter-trend bounce next week will not be a surprise. However, if the market fails to hold the 50-dma, the risk of a more substantial correction is likely.”

Notably, two essential things occurred this week. The market regained its 50-dma and triggered our subscriber “buy” signal. Both suggest that bulls have regained control, and we could see some follow-through buying next week.

Over the past several weeks, in various forms, we discussed our reduction in risk by rebalancing equities, raising cash, and extending our duration in our bond portfolio. To wit:

“With volatility currently at the lows of its recent range, a pick-up in volatility would not be surprising. Over the last 6-months, corrections remain range-bound to the 50-dma which is currently 3% lower than closing levels. While such a decline is well within the norms of a correction in any given market year, the low levels of volatility will make it ‘feel’ worse than it is.

With money flows continuing to weaken and technical indicators setting up to produce sell signals, we reduced exposure a bit more this week by increasing cash and reducing our financial holdings. “ – August 13th.

With the now deeply oversold on a short-term basis, we deployed some of our cash throughout the week to rebalance the portfolio toward normal allocation levels.

We don’t expect a tremendous amount of upside, given the ongoing weakness of market internals, but a retest of previous highs is not out of the question. Particularly since the Fed “threaded the needle.”

The Fed Threads The Needle On Taper

For weeks now, the Fed has been prepping the market for “taper talk.” Stocks sold off a bit in anticipation of the announcement, effectively “pricing in” a mildly hawkish stance. Jerome Powell did not fail to deliver during his press conference by announcing taper with no timeline.

- With respect to progress towards taper, Powell commented, “In my own thinking, the test is all but met.”

- “I think if the economy continues to progress broadly in line with expectations and the overall situation is appropriate for this, we could easily move ahead [with taper] by next meeting, or not…”

- Again, with respect to a decision for November taper, “I don’t need to see a good employment report next month; I just need to see a decent employment report”. Powell is clearly signaling that Fed is likely to announce taper in November barring an unexpected deterioration in economic conditions.

- Powell commented that it may be appropriate for taper to conclude by mid-2022.

- As expected, Powell left a back door open in case taper doesn’t go over well. “If necessary, we can accelerate or decelerate the taper.”

As we noted in our Daily Market Commentary (here):

“The Fed has done a decent job of telegraphing when tapering is likely to begin (most market participants believe the announcement will come this year), but more importantly it’s because the asset purchase reductions are likely to be trivial when seen in the context of how large the fixed income markets are today, and how overwhelming the demand for income has become.” – Rick Rieder, BlackRock’s CIO of Global Fixed Income

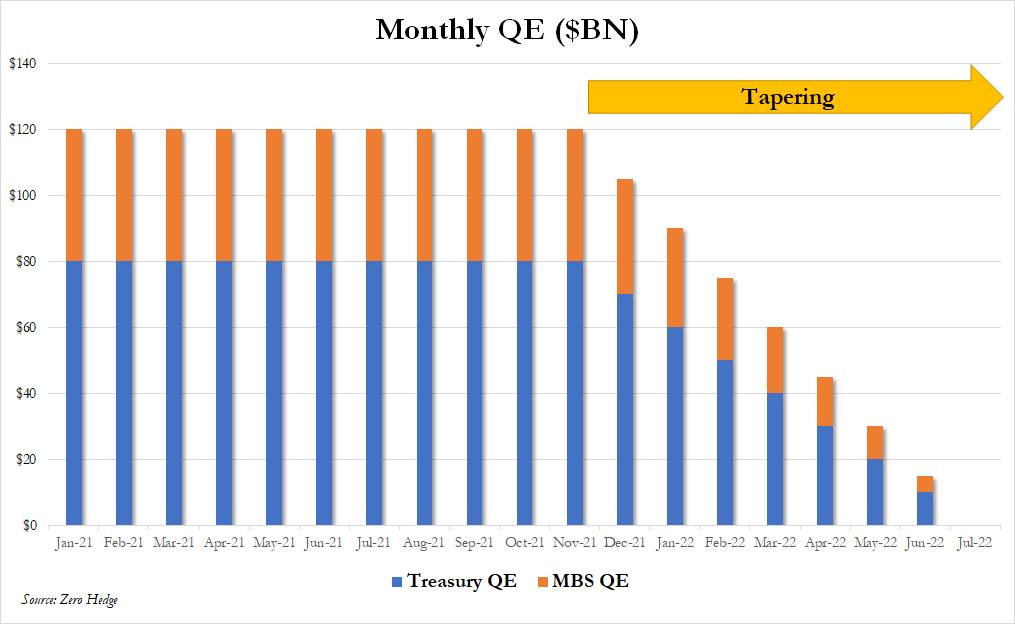

From the market’s perspective, a $15 billion reduction in purchases says the Fed isn’t removing the “punch bowl.” However, as shown in the table below, taper becomes an issue in 2022.

3 Signs Of The Next Bear Market

I previously warned that during the subsequent 5% correction, it would “feel” much worse than it was. However, gauging by the number of emails asking about the “crash,” why we weren’t heavily short the market, and we were crazy for “buying” the recent lows, it is clear sentiment has gotten extremely negative.

The question I received the most was, “Is this the beginning of a bear market?”

The answer is “no.”

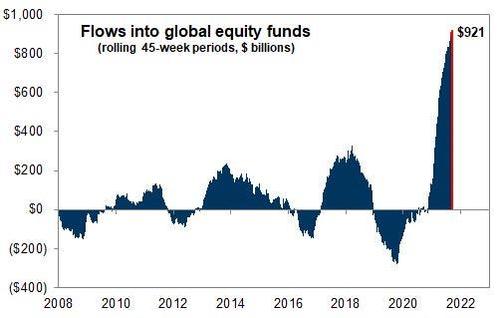

Currently, bullish sentiment remains high, global liquidity flows are strong, and stock buybacks are at a record.

Global Equity Inflows

While those issues are supportive of stocks currently, they are also dependent on rising asset prices.

So, for investors, there are 3-signs that will signal the next bear market or recession is approaching, requiring a more defensive investment posture.

In Case You Missed It: Yield Curve Inversion (Not Yet)

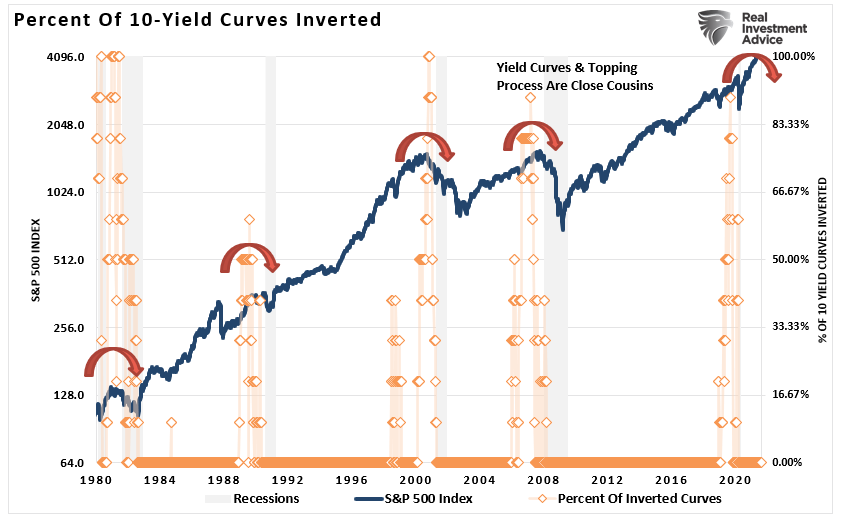

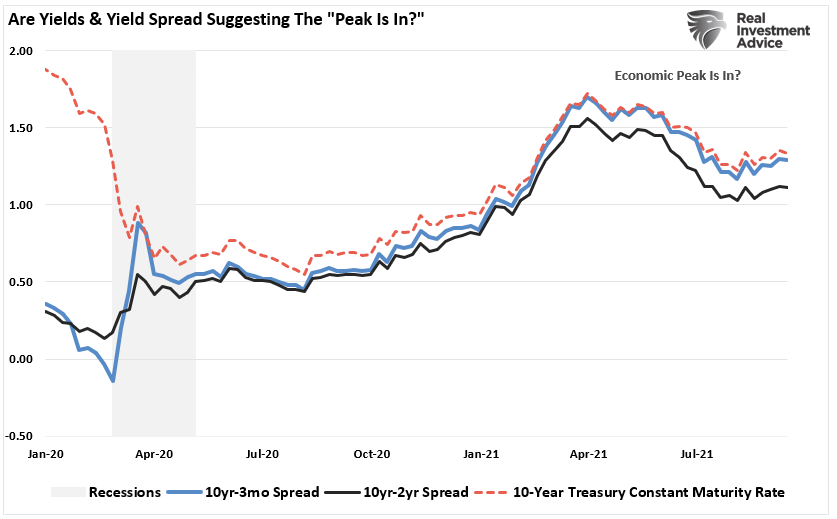

The yield curve is one of the most important indicators for determining when a recession, and a subsequent bear market, approaches. The chart below shows the percentage of yield curves that invert out of 10-possible combinations.

At the moment, given there are no inversions, there is no immediate risk of a recession or “bear market.“

Historically speaking, from the time yield curves begin to invert, the span to the next recession runs roughly 9-months. However, note that yield curves are currently , suggesting economic growth will weaken. If this trend continues, another “inversion” would not be a surprise.

Given the strong track record of predicting recessions historically, when the subsequent inversion occurs, the media will quickly dismiss it just as they did in 2019.

Such would not be a wise thing to do.

Fed Taper (Coming)

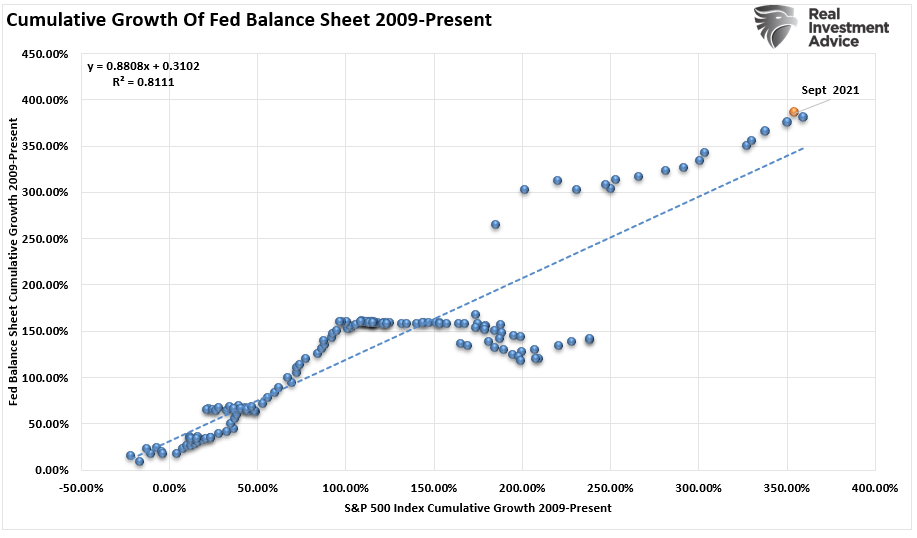

The issue of “tapering” is not as much about the Fed’s actual reduction of bond purchases as it is about psychology.

“The key to navigating Quantitative Easing and Fed policy in general is to recognize that their effect on the stock market relies almost entirely on speculative investor psychology. As long as investors get inclined to speculate, they treat zero-interest money as an inferior asset, and they will chase any asset with a yield above zero (or a past record of positive returns). Valuation doesn’t matter because investors psychologically rule out the possibility of price declines in the first place.” – John Hussman

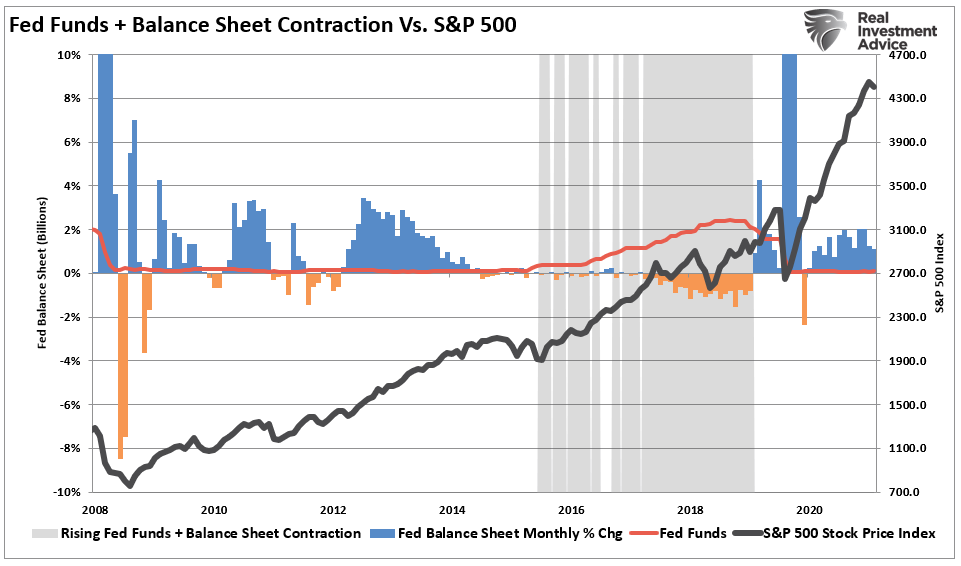

In other words, “QE” is a mental formation. Therefore, the only thing that alters the effectiveness of the Fed’s monetary policy is investor psychology itself. As shown, there is a very high correlation between the expansion of the Fed’s balance sheet and asset price increases.

Whether the correlation is due to liquidity moving into assets through leverage or just the “psychology” of the “Fed Put,” the result is the same.

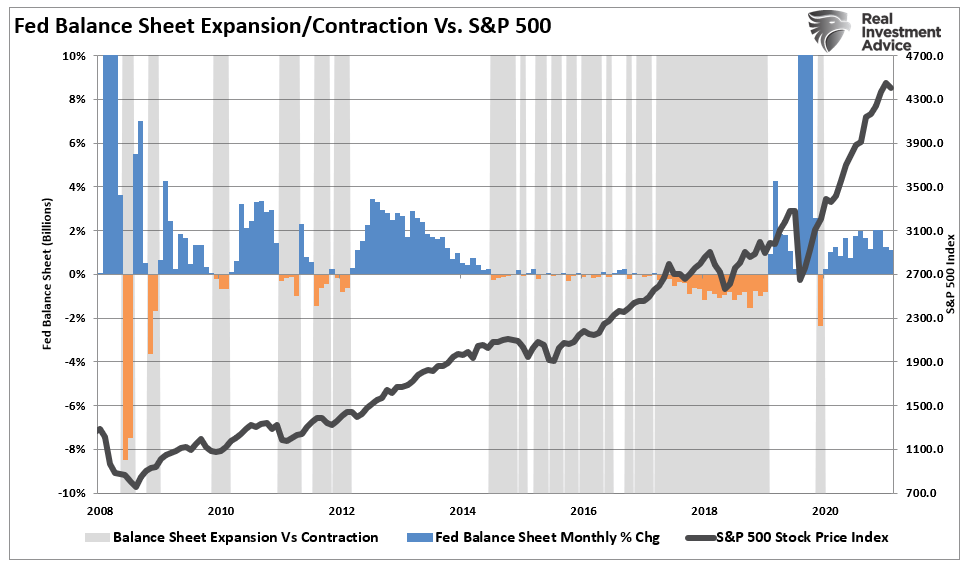

Therefore, it should also not be surprising that when the Fed starts “tapering” their bond purchases, the market tends to witness increased volatility. The grey shaded bars in the chart below show when the balance sheet is either flat or contracting.

Notably, the period from the initial tapering of assets and a market correction is almost immediate.

So far, the Fed is only TALKING about taper. November, however, could be a different story.

Fed Rate Hikes (Not Yet)

The risk of a market correction rises further when the Fed is tapering its balance sheet and increasing the overnight lending rate. Currently, there is no expectation for rate hikes until late 2022.

What we now know, after more than a decade of experience, is that when the Fed starts to slow or drain its monetary liquidity, the clock starts ticking to the next corrective cycle.

Once the Fed begins to hike interest rates, market corrections occur quickly, generally within 2-4 quarters. However, recessions and bear markets typically take longer and have been extended due to ongoing interventions. Recent history has moved the median time frame between the first rate hike and the onset of a recession to somewhere between 24 and 36 months.

Investors have several primary indicators to follow to navigate market risk and potential bear markets. While there is currently no indication of a recession or bear market, the Fed starting to “taper” its asset purchases will increase volatility.

Once the Fed begins to hike rates or yield curves start to invert, the time to become much more defensive will become evident.

However, such could all change quickly with the introduction of an exogenous event.

In the meantime, remain invested but don’t be lulled into complacency.

Changes in markets always happen slowly, then all at once.

Portfolio Update

As noted above, we discussed taking profits, increasing duration in our bond portfolios, and holding extra cash during the last several weeks. Such was to reduce our portfolio risk in advance of a market decline.

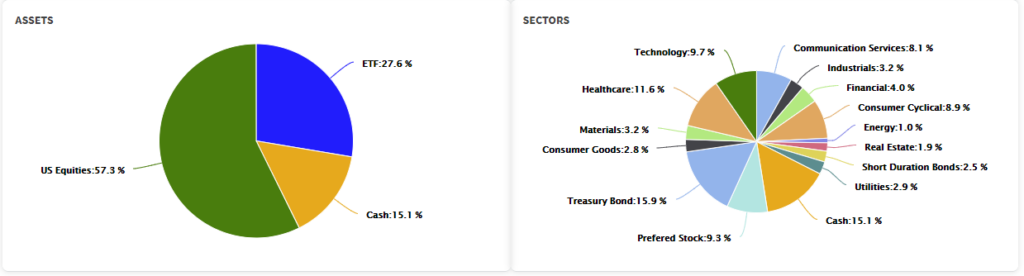

With that short-term correction now complete, we began putting some of that extra cash to work, increasing our equity exposure from 52% to 57%. As shown below, we increased our weight to , , , and .

Do we still think there is a longer-term risk to the markets? Absolutely.

However, as discussed many times, our job is to take advantage of markets when a reasonable risk/reward opportunity presents itself. Therefore, we can take advantage of those short-term opportunities without sacrificing our risk management strategies.

Our clients need us to create returns opportunistically to attain their financial goals. As discussed in “:”

“Our job is to participate in the markets with a bias toward capital preservation. As noted, the destruction of capital during market declines has the most significant impact on long-term portfolio performance.”

There is little denying we are in a strongly trending bull market, driven by massive amounts of exuberance and liquidity. As such, we have to keep managing our portfolios for “what is” rather than “what we think it should be.”

I do understand there is a significant risk. Or, as Seth Klarman from Baupost Capital once stated:

“Can we say when it will end? No. Can we say that it will end? Yes. And when it ends and the trend reverses, here is what we can say for sure. Few will be ready. Few will be prepared.”

We are not in the “prediction business.”

We are in the “risk management business.”

Have a great weekend.