Market Indexes: It was a volatile week, with big swings, but all 4 indexes eked out small gains.

“Stocks slid Monday, with major indices tumbling by over 2% during the worst points of the afternoon session, as investors nervously eyed the potential ripple effects of the default of a major Chinese real estate company, as well as ongoing debates over the debt limit in Washington. The , or VIX, jumped by more than 30% to its highest since May, as a confluence of risks roiled markets.

“Fears mounted that Evergrande (OTC:), the Chinese real estate juggernaut would collapse under a major debt burden, impacting shareholders, bondholders and potentially triggering turmoil elsewhere across global markets. Meanwhile, heated debates in Washington over increasing the government’s borrowing limit built on the risk-off tone in markets.” (YahooFinance)

Reuters reported:

“World stock markets rallied on Thursday and the U.S. dollar retreated from one-month highs as worries faded about contagion from China Evergrande and as investors digested the Federal Reserve’s plans for reining in U.S. stimulus. Norway’s central bank raised its benchmark and said it expects to hike again in December, joining a growing list of nations moving away from emergency-level borrowing costs. Norway’s crown strengthened versus the euro to its highest since mid-June.”

Volatility: The VIX was down 14.7% this week, ending the week at $17.75.

High Dividend Stocks: These high dividend stocks go ex-dividend this week: Prospect Capital (NASDAQ:), Main Street Capital (NYSE:), AGNC Investment (NASDAQ:), America First Tax Exempt Investors (NASDAQ:), Apollo Commercial Real Estate Finance (NYSE:), Ares Commercial Real Estate (NYSE:), B&G Foods (NYSE:), Broadmark Realty Capital (NYSE:), Chimera Investment (NYSE:), Crescent Capital BDC (NASDAQ:), Goldman Sachs BDC Closed End Fund (NYSE:), Ladder Capital Corp Class A (NYSE:), Owl Rock Capital (NYSE:), Starwood Property Trust (NYSE:), Stellus Capital Investment (NYSE:), TCG BDC (NASDAQ:), and British American Tobacco (NYSE:).

Market Breadth: 14 out of 30 stocks rose this past week, vs. 9 the week before last. 56% of the rose, vs. 41% the previous week.

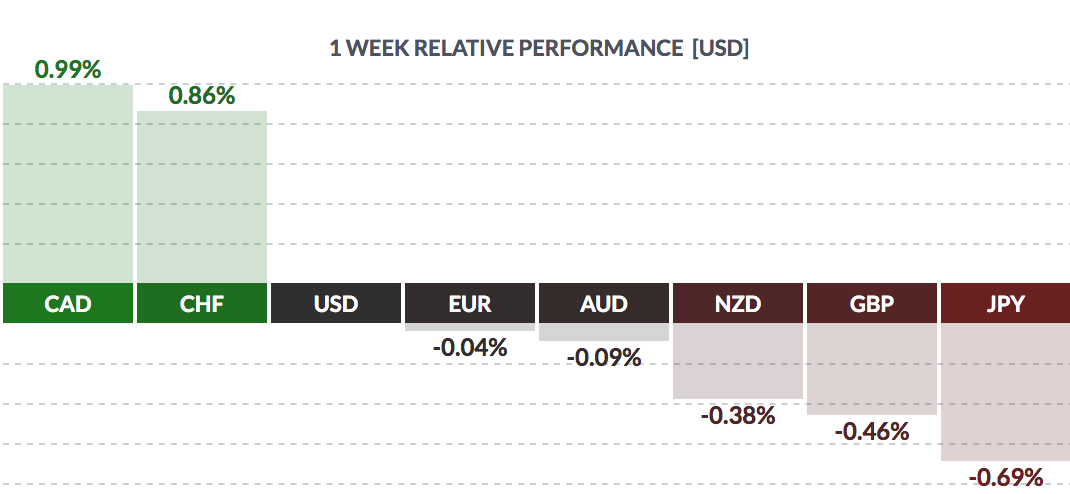

FOREX: The US fell vs. the and the , and rose vs. other major currencies this past week.

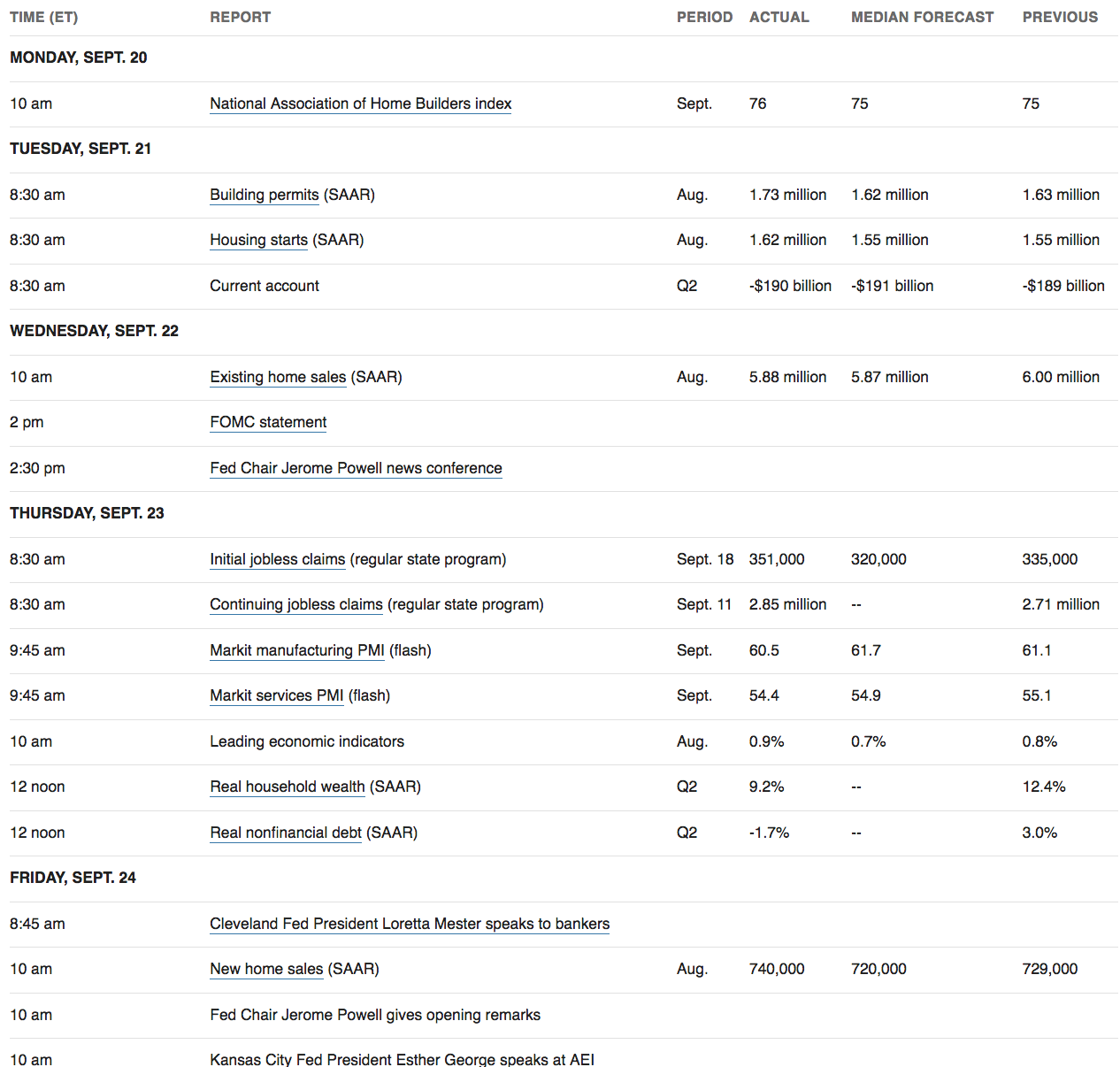

Economic News

From the NY Times:

“The Federal Reserve said it could soon slow its large-scale purchases of government-backed debt and indicated it might raise interest rates in 2022. Federal Reserve officials indicated on Wednesday that they expect to soon slow the asset purchases they have been using to support the economy and predicted they may raise interest rates next year, sending a clear signal that policymakers are preparing to pivot away from full-blast monetary help as the business environment snaps back from the pandemic shock.

“If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted,” the policy-setting Federal Open Market Committee said in its . The new phrasing eliminated wording that had promised to assess progress over “coming meetings,” suggesting that a formal announcement of the slowdown could come as early as the central bank’s next gathering in November.

“Fed officials confront a complicated backdrop nearly 20 months after the coronavirus pandemic first shook the American economy. Business has rebounded as consumers spend strongly, helped along by repeated government stimulus checks and other benefits. But the virus persists and many adults remain unvaccinated, preventing a full return to normal.

“The Fed has been holding interest rates at rock bottom since March 2020 and is buying $120 billion in government-backed bonds each month, policies that work together to keep many types of borrowing cheap. That has fueled lending and spending and boosted economic growth.

“My own view would be that the substantial further progress test for employment is all but met,” Mr. Powell said. “I think if the economy continues to progress broadly in line with expectations, and also the overall situation is appropriate for this, I think we could easily move ahead at the next meeting—or not, depending on whether we think those tests are met.”

“Policymakers also discussed the pace of the slowdown in asset purchases, Mr. Powell said, with officials largely expecting the overall bond-buying program to conclude around the middle of next year.”

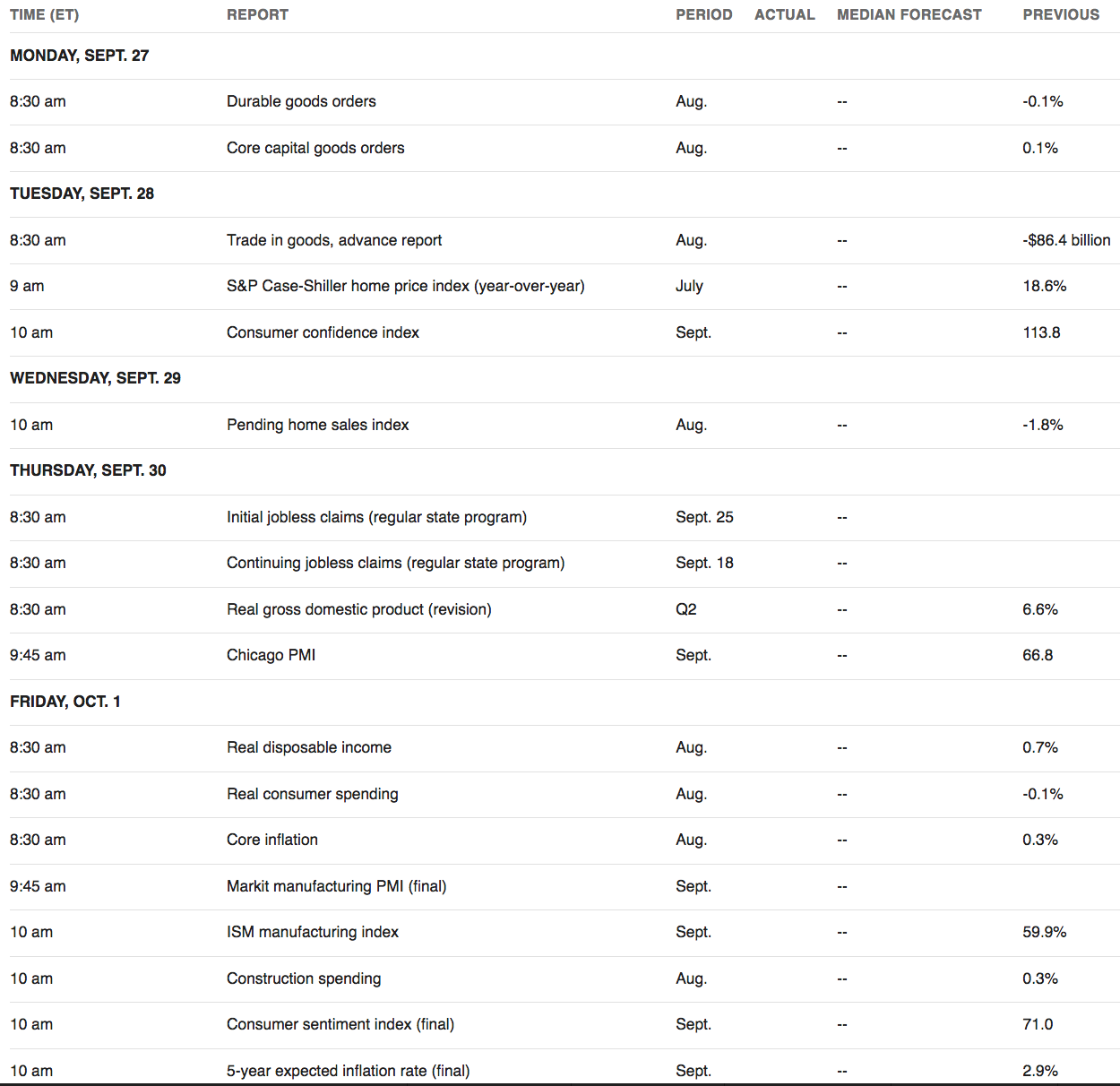

Week Ahead Highlights: It’ll be a heavy data week, with several Housing reports, the figure, and mfg. and goods reports due out.

Coming Week’s US Economic Reports

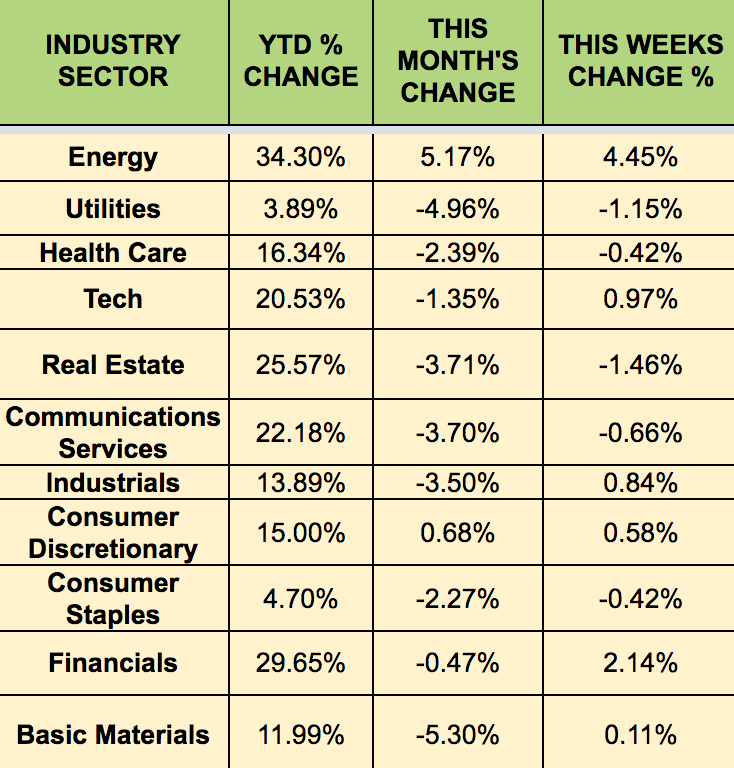

Sectors: and led by a wide margin last week, with falling the most again.

Futures: Crude rose 7%, ending at $73.95, its highest point since July.

“U.S. last week fell by 3.5M barrels to 414M barrels, the lowest since October 2018, the EIA reported Wed. The report was bullish overall, as crude supplies are “only going to get worse in the coming weeks” because inventories are “stretched and refiners are coming on back faster than supply of crude oil in the Gulf of Mexico.” (YahooFinance)