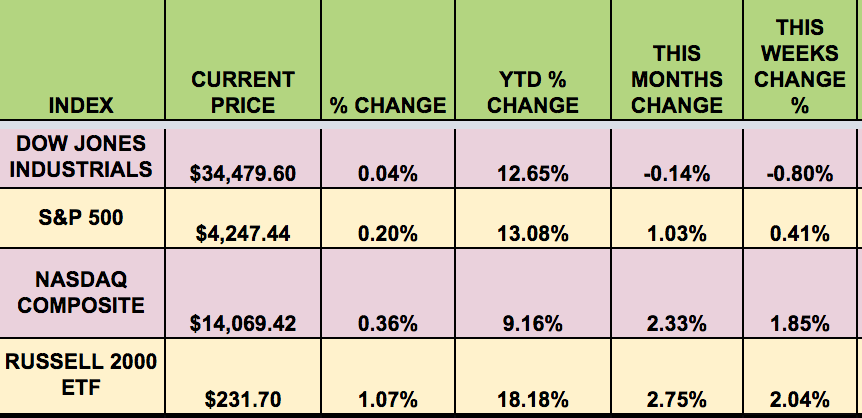

Market Indexes

The indexes had mixed results again last week, with the declining, but the , , and the rising.

The and NASDAQ led by a wide margin. Investors were buoyed by falling inflation fears.

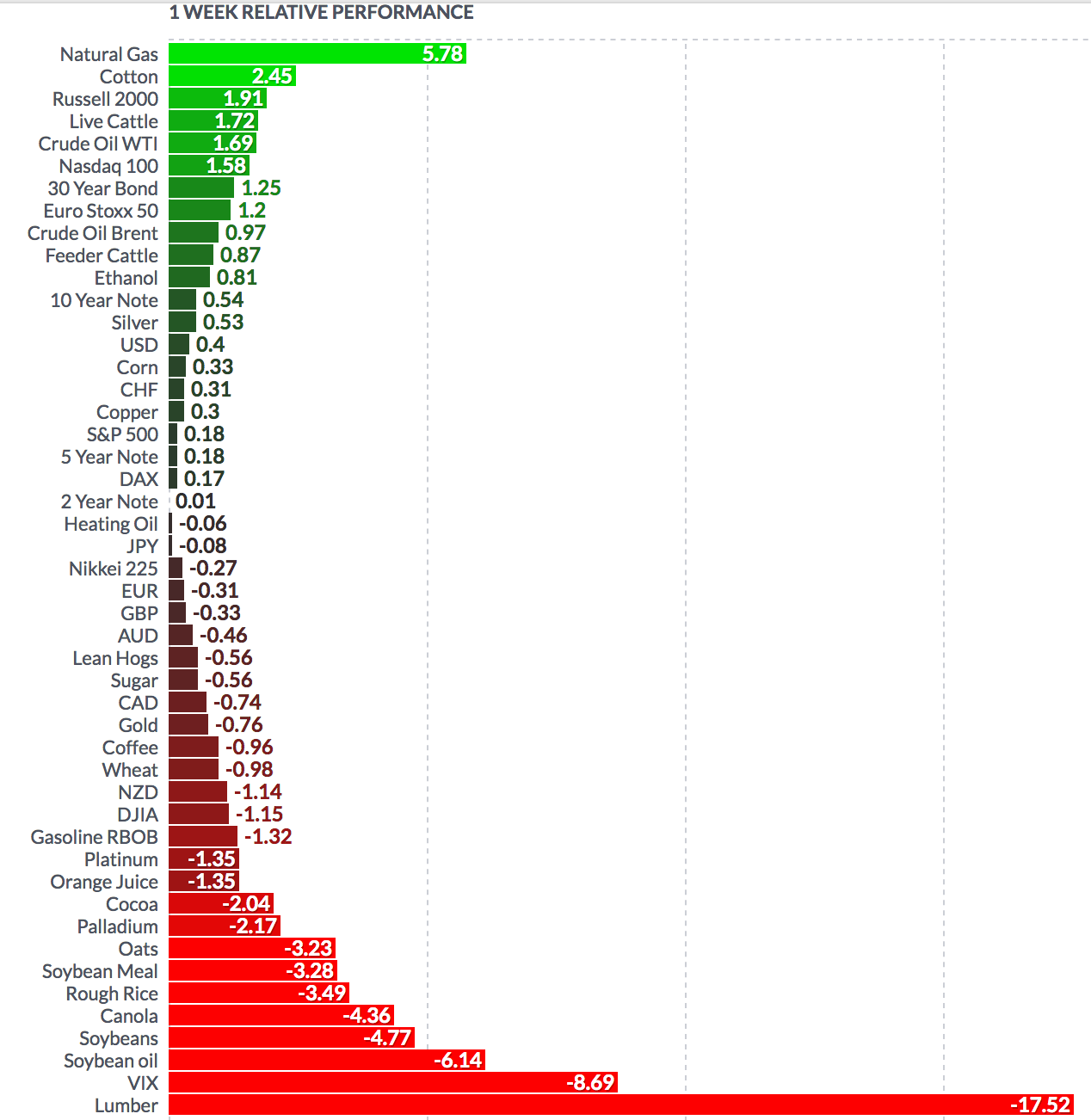

Volatility: The fell 4.2% last week, ending the week at $15.65.

High Dividend Stocks: These high dividend stocks go ex-dividend this week: Altria Group (NYSE:), Ares Capital Corporation (NASDAQ:), ARMOUR Residential REIT Inc (NYSE:), BCE (NYSE:), Capital Southwest Corporation (NASDAQ:), First Eagle Alternative Capital BDC Inc (NASDAQ:), Great Elm Capital Corp (NASDAQ:), Iron Mountain Incorporated (NYSE:), Newtek Business Services Corp (NASDAQ:), Oaktree Specialty Lending Corp (NASDAQ:), Preferred Apartment Communities Inc (NYSE:), Sixth Street Specialty Lending Inc (NYSE:), BlackRock TCP Capital Corp (NASDAQ:), New Mountain Finance Corporation (NASDAQ:), Oxford Lane Capital Corp (NASDAQ:), Apollo Investment Corp (NASDAQ:), Horizon Technology Finance (NASDAQ:), PennantPark Floating Rate Capital Ltd (NASDAQ:), PennantPark Investment Corporation (NASDAQ:), Gladstone Capital Corporation (NASDAQ:), Gladstone Commercial Corporation (NASDAQ:), and Gladstone Investment Corporation (NASDAQ:).

Market Breadth: 13 out of 30 DOW stocks rose last week, vs. 19 the previous week. 46% of the S&P 500 rose, vs. 60% the previous week.

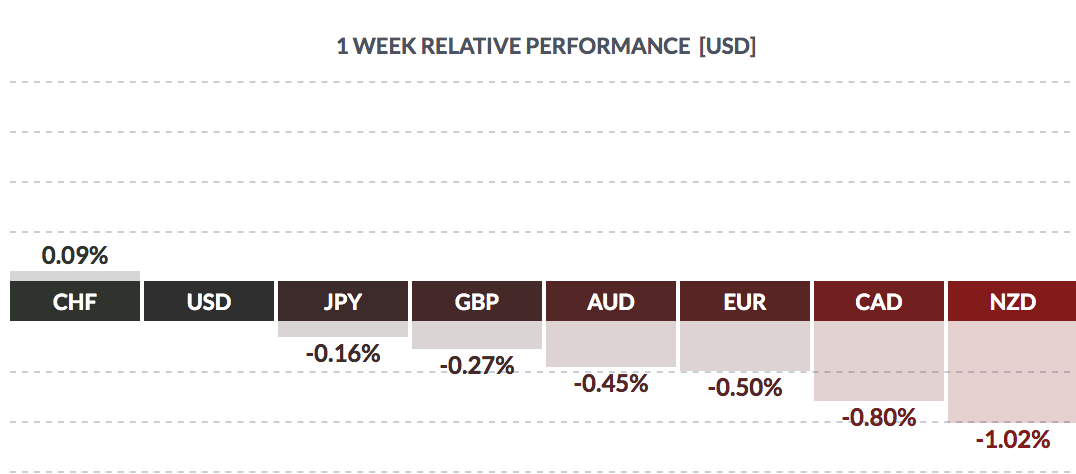

Forex: The rose vs. most foreign currencies last week.

Economic News

The core personal consumption expenditures price index increased 3.1% in April from a year earlier. Federal Reserve officials consider the to be the best gauge of inflation. Personal income dropped sharply as the effects faded from March’s government stimulus checks.

The index captures price movements across a variety of goods and services and is generally considered a wider-ranging measure for inflation as it captures changes in consumer behavior and has a broader scope than the Labor Department’s consumer price index. The CPI accelerated 4.2% in April.

In other economic news, “the came in at a higher than expected 75.2, its highest level since November 1973.” (CNBC)

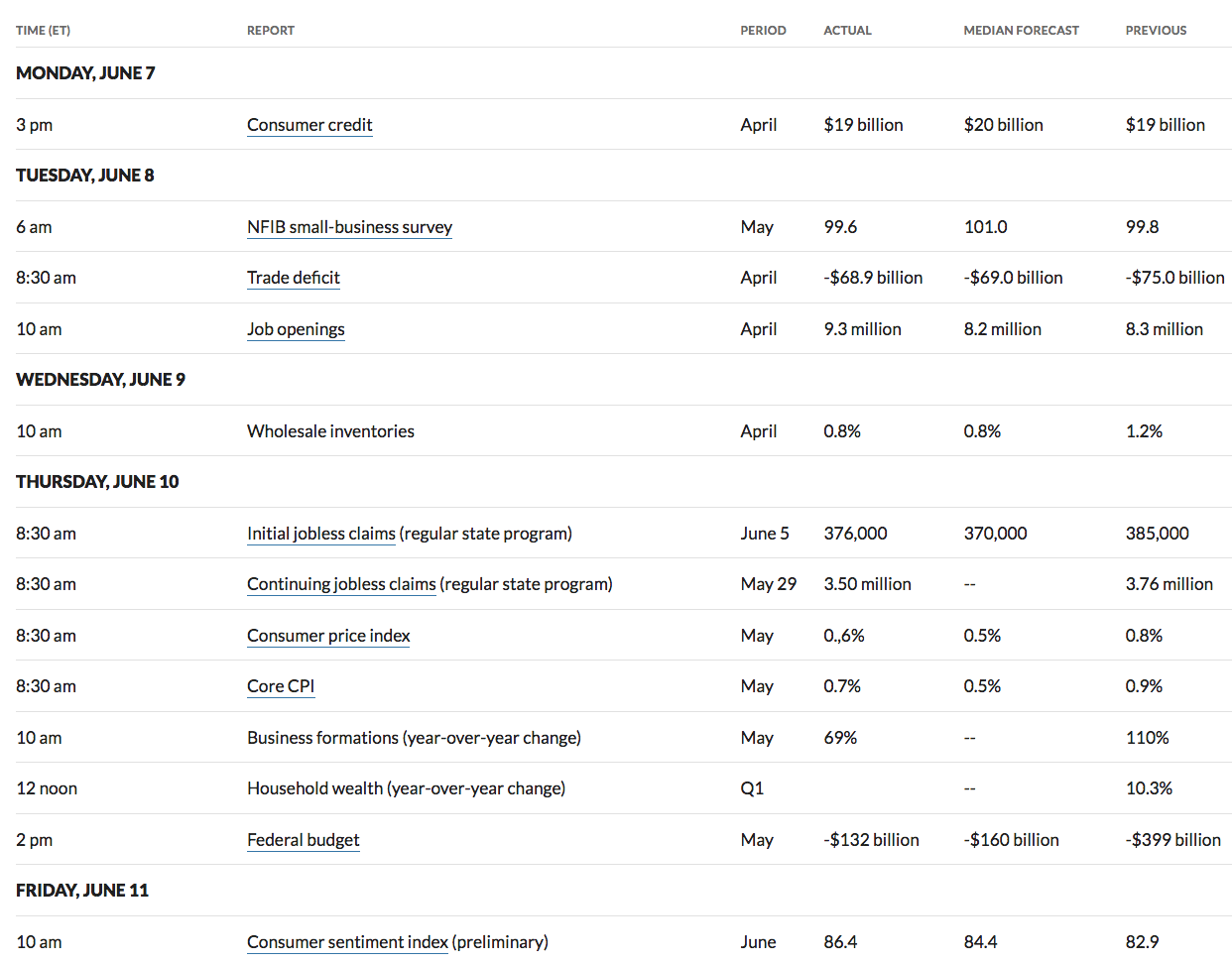

“U.S. consumer sentiment rebounded in early June as inflation fears subsided and households grew more optimistic about future economic growth and employment, a survey showed on Friday.

“The University of Michigan said its preliminary consumer sentiment index increased to 86.4 in the first half of this month from a final reading of 82.9 in May. Economists polled by Reuters had forecast the index rising to 84.” (Reuters)

Also from Reuters:

“U.S. Internal Revenue Service Commissioner Charles Rettig said on Tuesday that Congress needs to provide clear statutory authority for the tax agency to collect information on cryptocurrency transfers valued at over $10,000 that largely go unreported.”

“He said cryptocurrency market capitalization is over $2 trillion, with more than 8,600 exchanges worldwide, ‘and by design, most crypto virtual currencies are designed to stay off the radar screen. Rettig has said that massive profits from the run-up in crypto asset valuations are escaping the IRS, contributing to a “tax gap” that he estimates at some $1 trillion a year—the difference between taxes legally owed and those collected.

“The administration’s fiscal 2022 revenue proposals here include a new requirement that cryptocurrency transfers of $10,000 or more be reported to the IRS in much the same way that banks report cash transfers of that amount and brokers report securities transactions to the IRS. The proposed change would start in 2023.”

Week Ahead Highlights

All eyes will be on the Fed this week, as it holds its two-day policy . Investors will be parsing Fed comments for possible hints at raising rates, in the face of continued higher inflation reports.

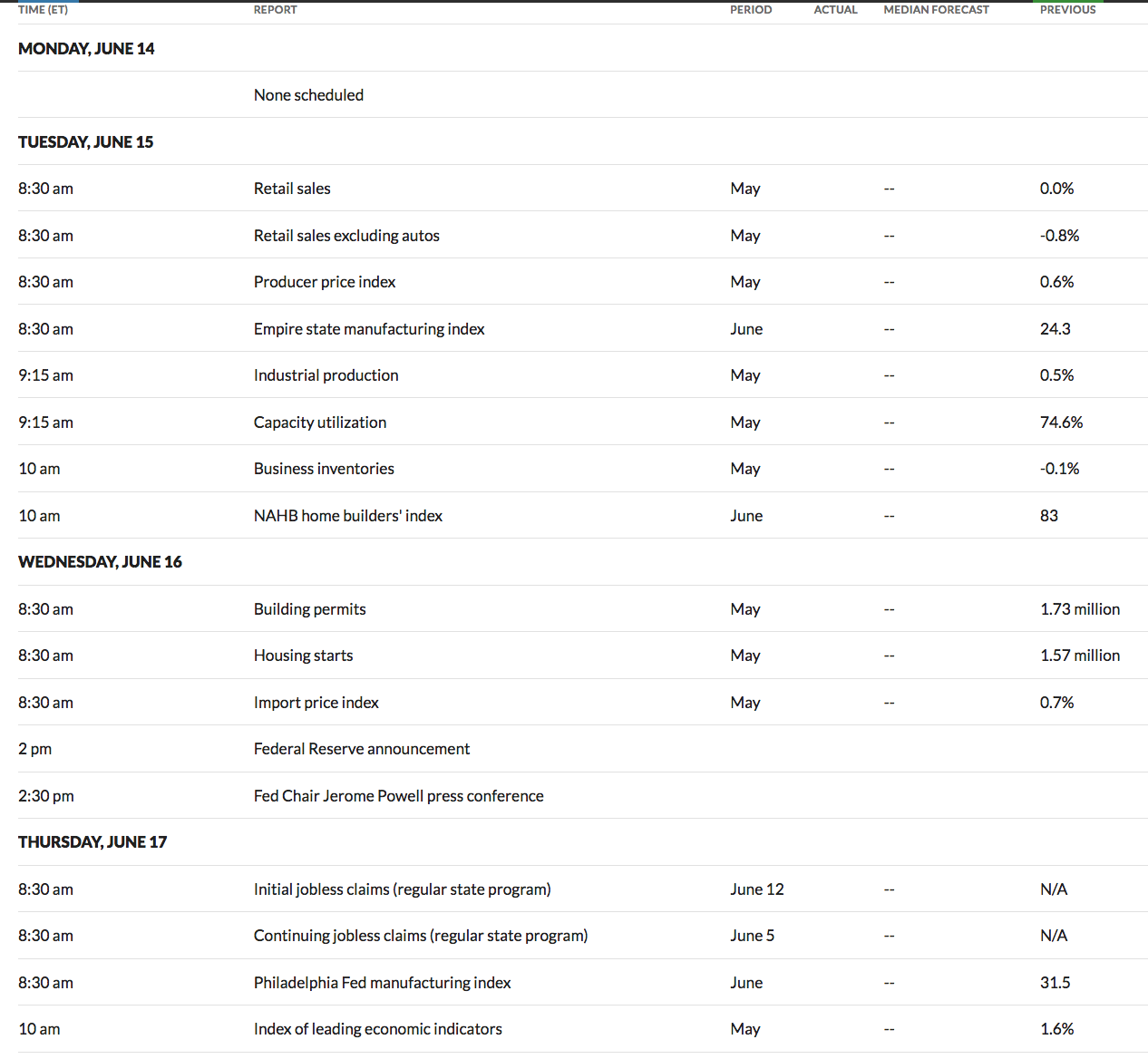

US Economic Reports

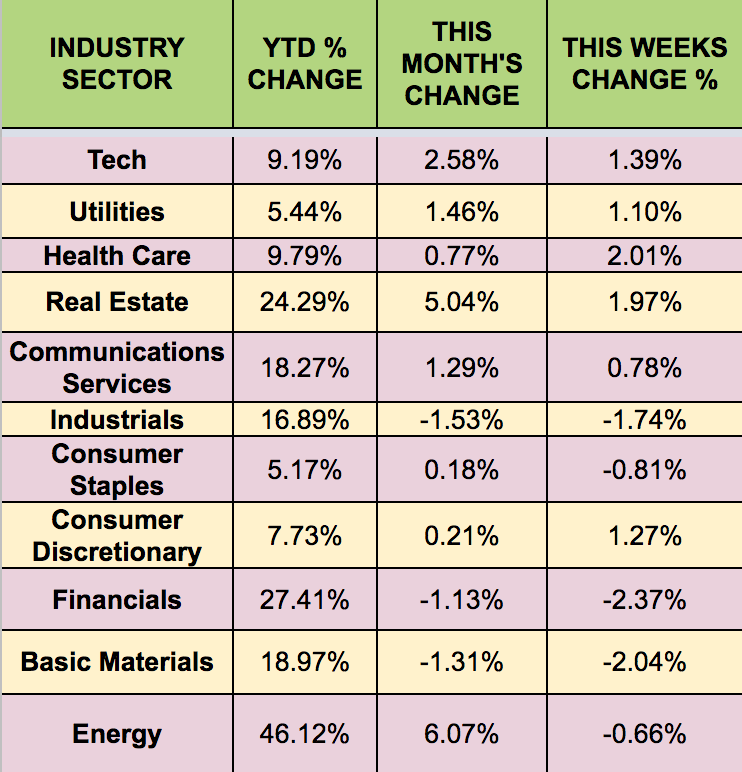

Sectors

The

The sector led last week, while the sector lagged.

Futures

crude rose 1.69%, ending at $70.78, its highest since October 2018.

From MarketWatch:

“Oil futures climbed on Tuesday, with U.S. prices settling above $70 a barrel for the first time since October 2018. Prices extended their gains after the Energy Information Administration in its monthly raised its 2021 West Texas Intermediate crude price to $61.85 a barrel, up 5% from the May forecast.

“Analysts polled by S&P Global Platts, on average, expect the EIA’s weekly report Wednesday to show a decline of 4.1 million barrels in U.S. crude inventories for the week ended June 4. That would make a third-straight weekly decline. West Texas Intermediate oil for July delivery.”